I. VIETNAMESE STOCK MARKET WEEKLY REVIEW: JUNE 02-06, 2025

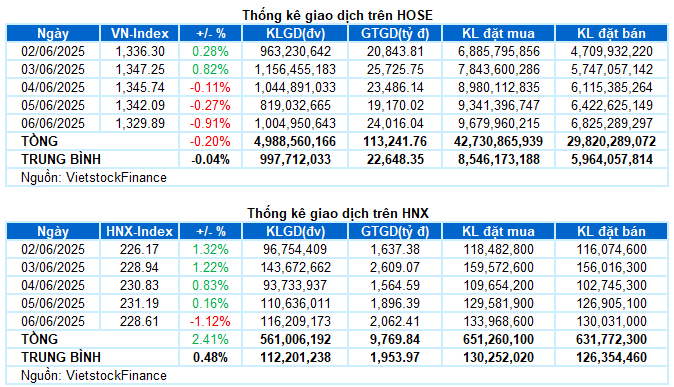

Trading: Major indices witnessed a sharp decline in the final trading session of the week. The VN-Index fell by 0.94% from the previous session, closing at 1,329.54 points. The HNX-Index also ended its previous gaining streak with a 1.24% drop, settling at 228.33 points. For the week, the VN-Index lost a total of 2.71 points (-0.2%), while the HNX-Index added 5.39 points (+2.41%).

The stock market kicked off June with a highly volatile trading week. After positive gains in the first two sessions, setting a new peak in over three years, the VN-Index reversed course and fell for the next three consecutive sessions with increasing intensity. The notable weakness among large-cap stocks, coupled with investor caution, made it challenging for the index to maintain its momentum. The VN-Index dropped by 12.55 points in the June 06 session, ending the week at 1,329.54 points.

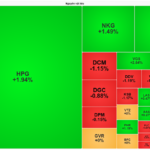

In terms of impact, TCB led on the negative side, taking away 1.3 points from the VN-Index. This was followed by VIC, GVR, and VHM, which collectively exerted pressure on the index, resulting in a loss of nearly 2.5 points. Conversely, HPG and PLX were the two most significant contributors on the positive side, helping the VN-Index retain almost 1 point.

The color red dominated most industry groups in the final trading session of the week. Energy and real estate were the two worst-performing sectors, with declines of over 1%. This was largely influenced by the downward trend of VGI (-1.54%), CMG (-1.98%); VIC (-1.02%), VHM (-1.04%), VRE (-1.85%), KDH (-2.15%), KBC (-3.04%), PDR (-2.47%), and CEO (-3.72%).

The financial group also weighed heavily on the overall index, with numerous stocks experiencing significant declines. TCB, VND, VCI, HCM, MBS, FTS, CTS, BSI, and others fell by more than 2%.

A few bright spots that went against the overall trend were scattered across various industry groups. Notable gainers with strong liquidity included HPG (+1.17%), STB (+0.97%), DIG (+1.12%), DBC (+1.36%), HAH (+3.26%), PLX (+3.6%), NLG (+1.15%), and DXS (+6.76%).

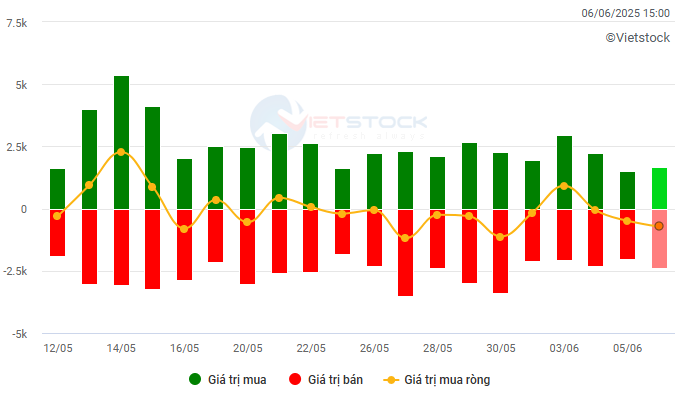

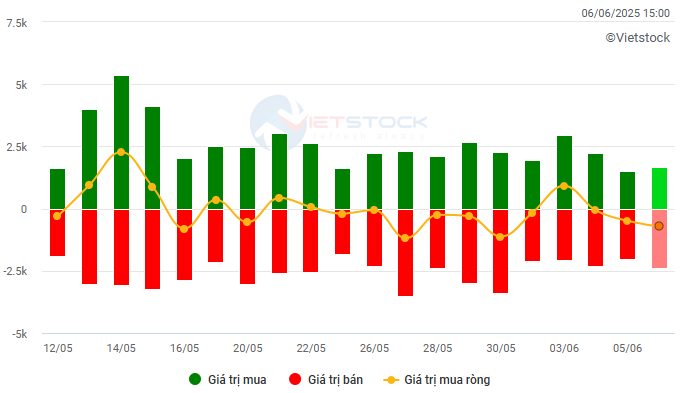

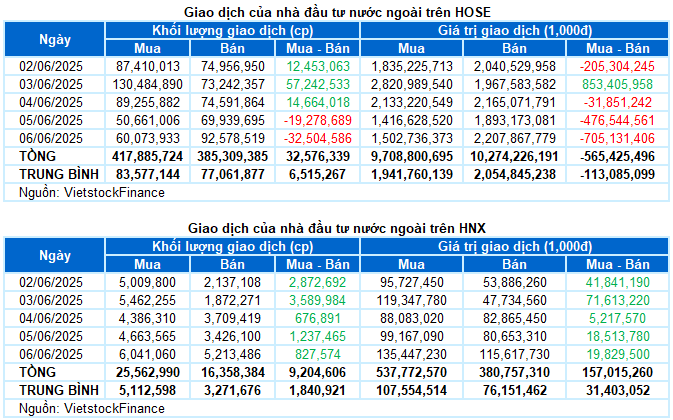

Foreign investors continued to offload stocks, with a net sell value of over 408 billion VND on both exchanges during the past week. Specifically, foreign investors net sold over 565 billion VND on the HOSE but net bought 157 billion VND on the HNX exchange.

Trading value of foreign investors on HOSE, HNX, and UPCOM by date. Unit: Billion VND

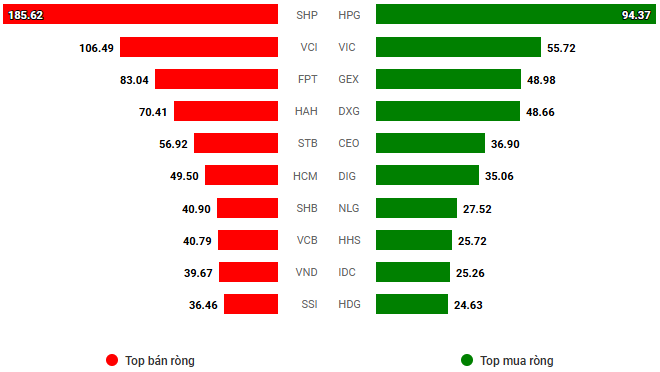

Net trading value by stock ticker. Unit: Billion VND

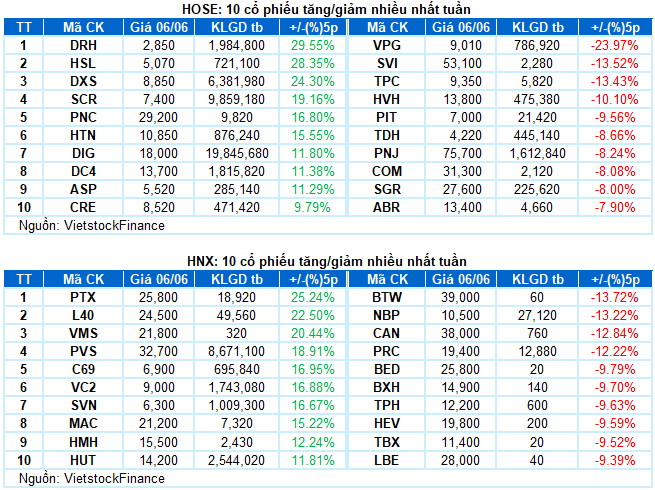

Stocks with notable gains during the week include DXS

DXS rose by 24.3%: DXS experienced a vibrant trading week, surging by 24.3%. The stock consistently climbed with the emergence of a Rising Window candlestick pattern. Moreover, trading volume remained high above the 20-session average in recent sessions, indicating robust participation from investors.

However, the Stochastic Oscillator indicator is venturing deep into overbought territory. Investors should exercise caution in the coming period if this indicator triggers a sell signal.

Stocks with significant declines during the week include PNJ

PNJ fell by 8.24%: The PNJ stock faced considerable selling pressure during the week after dropping below the Middle line of the Bollinger Bands. Additionally, trading volume remained below the 20-day average, reflecting a growing sense of investor caution.

At present, the Stochastic Oscillator indicator continues to trend downward after issuing a sell signal. The MACD indicator provides a similar signal and may even cross below the zero line. This suggests that the short-term downward trend could persist.

II. STOCK MARKET STATISTICS FOR THE PAST WEEK

Economy and Market Strategy Division, Vietstock Research

The Rise of Stock Market Enthusiasts in Vietnam: Over 10 Million Trading Accounts and Counting

As of May 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, with almost 10.1 million registered accounts, according to the Vietnam Securities Depository and Clearing Corporation (VSDC). This marks an increase of 190,852 accounts compared to the previous month, showcasing a vibrant and growing investment landscape in the country.

Which Stocks Tend to Rise in the Last Month of a Quarter?

The VN-Index rose by almost 9% in May, and investors are optimistic about its continued growth. However, a look at recent years reveals that declining stocks tend to dominate in June.

Market Pulse June 6: VN-Index Ends Week on a Sour Note, Energy Sector Stages a Comeback

The market closed with declines, as the VN-Index fell by 12.2 points (-0.91%) to 1,329.89, while the HNX-Index dropped 2.58 points (-1.12%) to 228.61. The market breadth inclined towards decliners, with 514 stocks decreasing against 246 advancing stocks. Moreover, within the VN30 basket, 22 stocks declined, 5 increased, and 3 remained unchanged, indicating a dominant red hue.

The US Economy Will Weaken This Year Due to Tariff Woes.

In the latest edition of ‘Gateway To Vietnam’, organized by SSI Securities on June 5th, experts delved into the intricacies of US tariff policies and their far-reaching implications. The discussion, titled “The Art Behind the Tariff Wave”, explored how these policies impact trade flows, investment patterns, and Vietnam’s economic growth prospects.