Latest Updates

The annual general meeting of HAG always garners significant attention from the investment community. According to the Executive Board, as of 9:15 am, 505 shareholders were present and represented by proxy, accounting for 73% of the total shares with voting rights.

2025 Annual General Meeting in Ho Chi Minh City on May 6, 2025

|

HAG Plans to Distribute Dividends Only in Cash Going Forward

Regarding special incentives for key personnel, Mr. Duc shared that HAGL had endured an extremely challenging period since 2016. At its peak, the company faced a cumulative loss of nearly VND 7,000 billion and total debt of VND 32,000 billion. However, thanks to the unity and determination of all staff, especially those with long-term commitment, HAGL has overcome this dark period. Currently, the debt has been reduced to approximately VND 3,000-4,000 billion, a hard-earned achievement.

“Engaging in agriculture in Laos and Cambodia, there are areas where there is no phone signal or convenient transportation for days, and our staff had to be away from home for years. Yet, they persevered, sacrificing their personal interests to contribute to the maintenance of production activities and the development of strategic agricultural raw material regions,” Mr. Duc stated.

Therefore, HAG will issue 12 million ESOP shares to personnel with a minimum of 10 years of dedication. The issued shares will be subject to transfer restrictions in phases: after 3 years from the issuance date, 10% can be transferred; an additional 10% after 4 years, and full transferability after 5 years.

On the plan to issue 210 million shares to convert bond debt, Mr. Duc stated that HAG would immediately reduce debt by VND 4,000 billion, adding, “We are not issuing shares to beautify our financial statements. This is a well-calculated move aimed at long-term goals.”

At the same time, Mr. Duc pledged that after the issuance, HAGL would not distribute shares to avoid dilution as in the past. “From now on, we will only distribute cash dividends if there are profits. Additionally, when conditions permit, I will purchase treasury shares and proceed with cancellation to restore the share value to its rightful position, aiming for an initial capitalization of VND 9,200 billion.”

Mr. Doan Nguyen Duc speaking at the 2025 Annual General Meeting

|

Target to Maintain Profit of Thousands of Billions

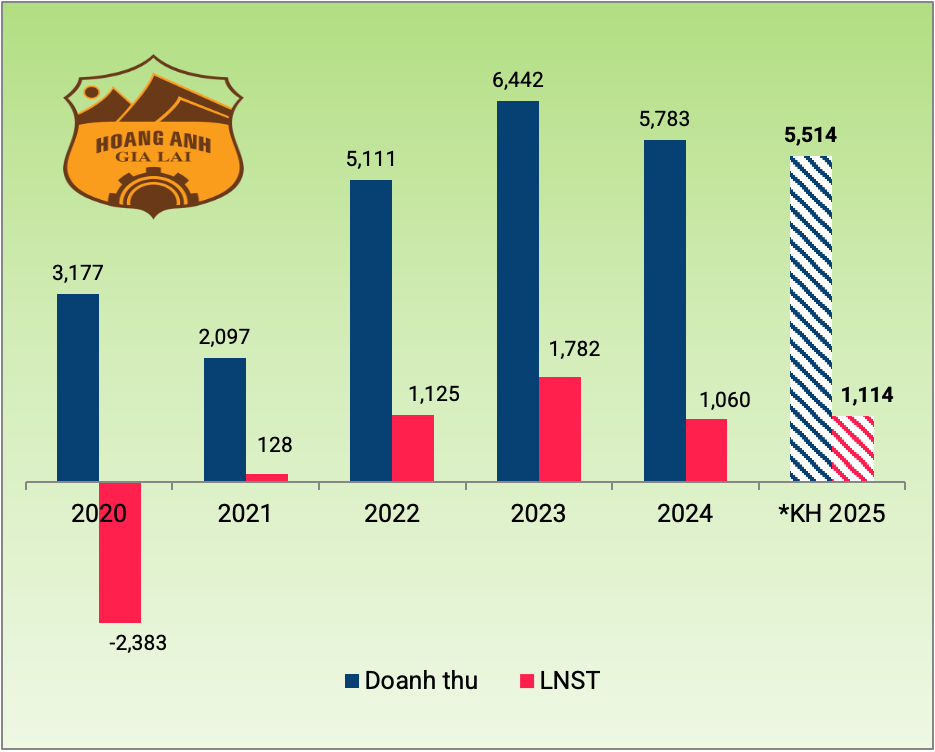

In 2024, HAG experienced a significant decline compared to the previous year, with revenue reaching VND 5.8 trillion (-10%) and net profit of over VND 1 trillion (-39%). Nonetheless, this was the third consecutive year that the company achieved net profits of over a thousand billion, a substantial increase compared to the previous period.

However, HAG is expected to not distribute dividends for 2025, likely due to the company’s cumulative loss of over VND 423 billion as of the end of 2024.

For 2025, HAG sets a revenue target of over VND 5.5 trillion, a decrease of about 5%. The largest proportion comes from the fruit segment (bananas and durians) at 76%. Revenue from pork is expected to account for 19%, with the remaining coming from other goods. The plan aims for an after-tax profit of over VND 1.1 trillion, a 5% increase, and it would be the fourth consecutive year of achieving profits above a thousand billion if successfully executed.

|

HAG’s Business Plan (in VND billion)

|

As of Q1/2025, HAG achieved nearly VND 1.38 trillion in net revenue, an 11% increase over the same period last year, mainly due to banana sales. Thanks to reduced expenses, net profit reached nearly VND 341 billion, a 59% increase year-on-year. Cumulative losses were significantly reduced to only VND 83 billion. Compared to the plan announced at the general meeting, HAG has accomplished over 25% of its revenue target.

HAG also stated that there are no new investment plans for 2025. Instead, the focus will be on maintaining the stability of the current garden area (bananas, durians, and macadamia) and improving the efficiency of the existing pig farming system.

Thaigroup Candidate Withdraws from the Nominee List

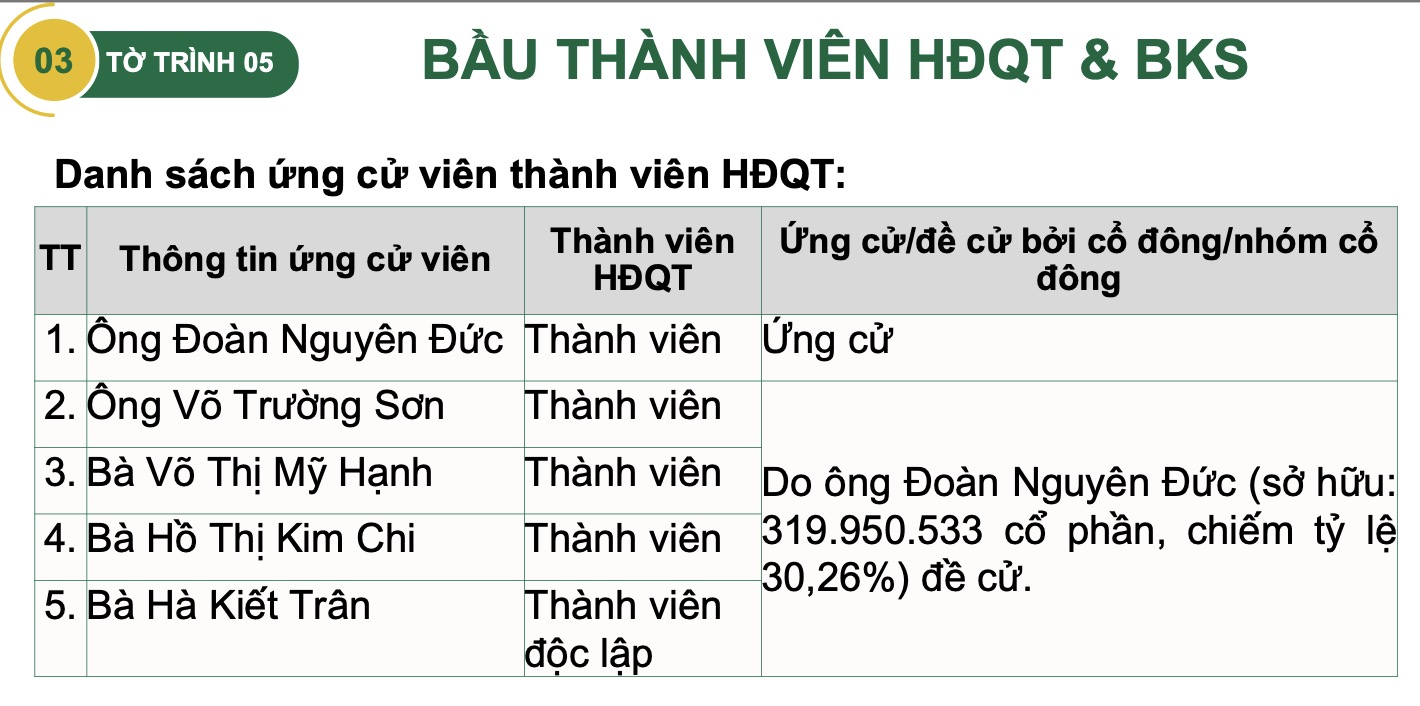

According to documents published on May 27, businessman Doan Nguyen Duc (Bầu Đức), as a major shareholder holding over 30.26% of HAG’s charter capital, submitted a list of nominees for the Board of Directors and Supervisory Board for the new term. Mr. Duc nominated himself to continue as Chairman of the Board of Directors and included current members Mr. Vo Truong Son (Member of the Board of Directors), Ms. Vo Thi My Hanh (Member of the Board of Directors and Deputy General Director), and Ms. Ho Thi Kim Chi (Member of the Board of Directors and Deputy General Director).

Notably, Mr. Tran Van Dai, a current member of the Board of Directors, was absent from the list, replaced by Ms. Ho Kiet Tran. Ms. Tran is currently the Investment Director at Huong Viet Investment Consulting Joint Stock Company and a member of the Supervisory Board of Century Yarn Joint Stock Company (HOSE: STK).

Interestingly, another large shareholder group has emerged, comprising Thaigroup Joint Stock Company (4.92%), LPBank Securities (LPBS, holding 4.73%), and an individual, Mr. Nguyen Phan Anh (1.82%). Together, this group holds 11.47% of HAG’s charter capital, equivalent to over 121 million shares.

According to the documents, the group nominated Ms. Vu Thanh Hue to the HAG Board of Directors for the new term. Ms. Hue previously served as Chairman of the Board of Directors of LPBS from August to December 2023 and is currently the Vice Chairman of LPBS and Chairman of the Board of Directors of Thaihomes Real Estate Joint Stock Company, a member of Thaigroup. Additionally, she is a member of the Board of Directors of Kim Lien Tourism Joint Stock Company.

However, Ms. Hue’s name was absent from the election list at the general meeting. According to updates, the candidate has been withdrawn from the list.

Source: HAG

|

Discussion:

Sericulture

Question: Why didn’t the company increase the banana area and rebuild the pig herd in 2024? What is the current status of the pig herd, and what is the plan for 2026-2030?

Bầu Đức: Initially, we planned to increase the banana area in 2024, but after careful consideration of resources and finances, and encountering difficulties in capital mobilization, we had to halt those plans.

Regarding pigs, we faced similar capital-related issues. As a result, pig sales were low despite favorable market prices. We are now in the process of rebuilding the herd, but it takes almost a year to see the results. Pig sales will begin to increase at the end of 2025 – early 2026.

Investing over VND 1,000 billion is risky. Having learned from past mistakes, we decided to pause those plans. However, I have discussed this with credit institutions, and they have agreed to provide financial support. In 2025, I will use retained earnings and credit support to invest in 2,000 hectares of mulberry. This is a new crop that HAG has been piloting since 2024. So far, both theoretical and practical indicators have been refined. We have also invested in a silk factory, which was completed four days ago.

Mulberry is more profitable than any other crop we have cultivated. This year, we will invest in 2,000 hectares of mulberry for sericulture and silk export. Additionally, we will invest in 2,000 hectares of Arabica coffee, as its price has reached USD 9,000 per ton, almost double that of regular coffee.

These are our two major programs. HAGL has a competitive advantage over other units, with thousands of agricultural engineers working in remote areas.

As part of our strategy to reach 30,000 hectares by 2030, I plan to allocate 2,000 hectares for sericulture and 4,000 hectares for Arabica coffee. In 2025, we will cultivate 2,000 hectares of mulberry and 2,000 hectares of coffee. In 2026, we will continue to plant an additional 2,000 hectares of coffee to complete the raw material region. If we stay on track, the coffee trees will start bearing fruit from 2027 onwards, providing a stable cash flow and high profits.

I share this not to boast, but to provide clarity to shareholders. I prefer to act first and speak later. However, today, I feel it is necessary to explain that HAGL is transforming, restructuring, and investing in strategic and valuable ventures, rather than following trends or impulses. I commit that everything I have mentioned today has been, is being, or will be done with the highest determination.

How will Donald Trump’s tariffs affect exports?

Bầu Đức: In reality, there has been no impact, and HAGL has even benefited. Firstly, this policy has led to an increase in the USD exchange rate, which is advantageous for us as we are exporters. Secondly, HAG sells to three main markets: China (70%), Japan, and Korea.

I remember the day Mr. Trump announced the tariffs; banana prices surged. Initially, we were concerned, but now we can confidently say there has been no negative impact. If tariffs were imposed on China, there might have been consequences, but that has not happened yet.

The Chinese market is actually quite open to Vietnamese products. We focus on fresh fruit agriculture as our mainstay, and the Chinese market is enormous and crucial for our industry. If this trend continues, I believe we will be just fine.

The idea of growing coffee actually came from China during a business trip there. Chinese consumers are shifting from tea to coffee, and the recent price increase is also due to Chinese demand. Our partners there shared that once Chinese consumers complete this shift from tea to coffee, coffee prices will remain stable.

Even the idea of sericulture came from China, as they are the largest market for silk in the world. Unless they close their borders, there won’t be any significant impact.

Aiming for a Profit of VND 5,000 Billion by 2028

Question: Regarding the proposal to issue 210 million shares to convert bond debt, why do you believe it will eliminate the entire VND 4,000 billion debt when the issuance will only raise over VND 2,000 billion?

Bầu Đức: I have negotiated with investors. If the conversion of 210 million shares is approved, the interest-bearing debt will be reduced. If not approved, we will still have a debt of VND 4,000 billion.

Moreover, if the conversion is approved, HAG will recognize this as profit because we have already made provisions for it. We have engaged a consulting firm for this matter. Once the SSC approves the conversion, we will resolve this “debt.”

Can the company consider distributing dividends, as many shareholders have held their stocks for a long time?

Bầu Đức: It has been challenging since 2016. I think shareholders should hold on for another year.

What is the exact roadmap?

Bầu Đức: Over the past 8-9 years, our primary goal has been to reduce debt as much as possible. In the past, I did not create a three-year plan, but now I have to develop a 3.5-year plan. I am setting a target to achieve a profit of VND 5,000 billion after tax by 2028.

This is a significant plan, so I want to introduce the ESOP of 12 million shares to “anchor” our key personnel who have been with the company for 15 years.

Will the monthly report be resumed?

Bầu Đức: Consolidating data from Laos, Cambodia, and Vietnam is challenging, so we ask for permission to provide quarterly reports only. Starting in 2025, I am willing to meet with shareholders every quarter.

What is the update on the sturgeon farming project?

Bầu Đức: The sturgeon farming project is located in Laos, and we have successfully bred 700,000 sturgeons, which are currently in the pilot stage. We plan to sell the first batch of fish in September-October. The final decision will likely be made by the end of the year.

Please elaborate on the future strategy, including the targeted percentage of sales for each product, such as durian, coffee, bananas, etc., to avoid concentrating risks in a single product.

Bầu Đức: Currently, HAGL follows the “two plants – one animal” model, which is also risky. So, I have added mulberry and coffee to create a “four plants – one animal” model. For example, if the Chinese market affects durian sales this year, we still have mulberry and coffee. At the moment, I cannot think of adding any other products.

Chau An