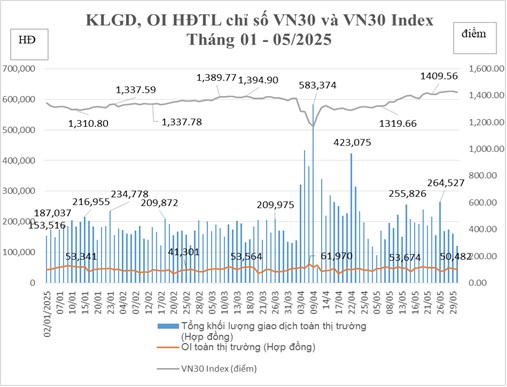

The trading session on May 26th witnessed the highest trading volume with 264,527 contracts.

Source: HNX

|

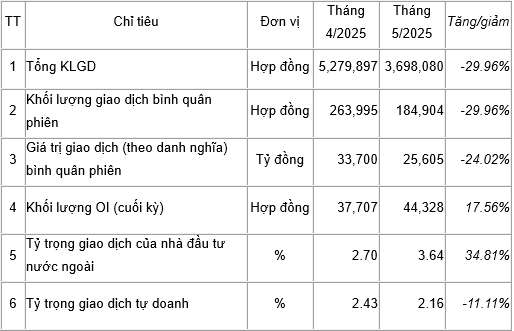

In terms of open interest (OI), the last trading day of the month saw 44,328 contracts, a 17.6% increase from the previous month. The highest OI of the month was recorded on May 7th, 2025, with 53,674 contracts.

According to investor composition, proprietary trading of securities derivatives by securities companies accounted for 2.2% of the total market, slightly down from 2.4% in April. Meanwhile, foreign investors’ trading volume increased, accounting for 3.6% of the total market.

|

Summary of VN30 Index futures contract transactions

Source: HNX

|

– 6:38 PM, June 6, 2025

Market Pulse June 6: VN-Index Ends Week on a Sour Note, Energy Sector Stages a Comeback

The market closed with declines, as the VN-Index fell by 12.2 points (-0.91%) to 1,329.89, while the HNX-Index dropped 2.58 points (-1.12%) to 228.61. The market breadth inclined towards decliners, with 514 stocks decreasing against 246 advancing stocks. Moreover, within the VN30 basket, 22 stocks declined, 5 increased, and 3 remained unchanged, indicating a dominant red hue.

Stock Market Blog: Unexpected Euphoria Returns, Don’t Miss the Boat by Selling Too Soon!

The market surged unexpectedly today, fueled by a rally in stock securities. Although unable to lead the score, this momentum positively influenced investors’ psychology. Those who took profits are now hesitant, feeling the psychological pressure of missing out on potential gains.