Vietnam Stock Market Update: VN-Index Down Slightly as Foreign Investors Sell-Off Continues

The Vietnamese stock market continued its lackluster performance, with the VN-Index closing slightly lower on June 5th. Investor caution prevailed in the absence of supportive news, resulting in a modest decline of 3.65 points to 1,342.09. Trading volume also dipped compared to the previous session, with a meager VND 17,315 billion in matched orders on the HoSE.

Foreign Investors’ Sell-Off Continues:

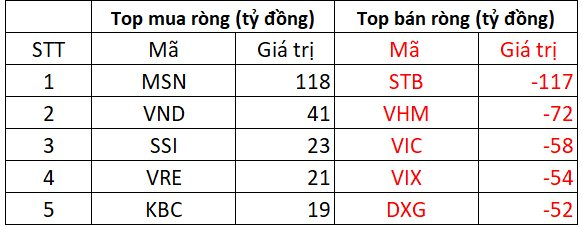

On the HoSE, foreign investors offloaded a net VND 475 billion, with STB bearing the brunt of the selling, witnessing a net sell-off of VND 117 billion. Vingroup’s stocks, VHM and VIC, also faced substantial outflows, with net selling of VND 58 billion and VND 72 billion, respectively. VIX and VNG experienced similar fortunes, with net selling exceeding VND 50 billion each.

Conversely, MSN emerged as the most sought-after stock, attracting net purchases of VND 118 billion. VND also witnessed robust buying interest, with net inflows of VND 41 billion. SSI, VRE, and KBC saw net buying in the range of VND 19-23 billion each.

HoSE: Foreign Investors’ Net Selling Intensifies

HNX and UPCOM Witness Mixed Fortunes:

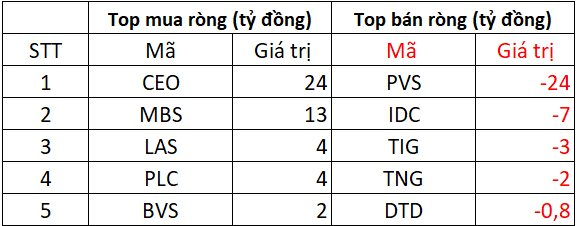

On the HNX, foreign investors turned net buyers, injecting a net VND 19 billion into the market. CEO and MBS led the pack, with net purchases of VND 24 billion and VND 13 billion, respectively. PLC, LAS, and BVS also witnessed net buying in the range of VND 2-4 billion each.

Conversely, PVS faced a net sell-off of approximately VND 24 billion. IDC, TIG, and TNG also experienced net outflows of a few billion dong each.

HNX: Foreign Investors Turn Net Buyers

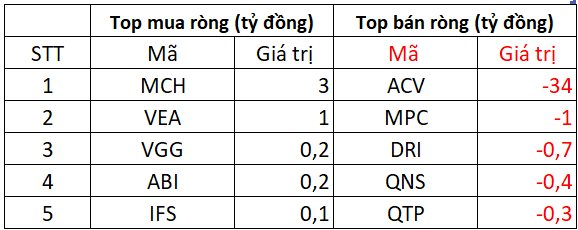

The UPCOM saw foreign investors offload a net VND 32 billion. MCH and VEA witnessed net buying of VND 1-3 billion each, while VGG, ABI, and IFS saw modest net purchases.

ACV faced the brunt of the selling pressure, with a net sell-off of VND 34 billion. MPC, DRI, QNS, and QTP also witnessed net outflows ranging from a few hundred million to one billion dong.

UPCOM: Foreign Investors’ Net Selling Continues

The Arrest of VPG’s Leadership Leaves Stock ‘Stranded’

The recent indictment of its leadership has sent shares of Viet Phat Import-Export Trading Investment Joint Stock Company, known as VPG, into a tailspin. Today’s session (June 4th) witnessed a frantic sell-off as investors offloaded their holdings at any price, yet they remained trapped with over 7.6 million VPG shares still on offer at the floor price.

Stock Market Outlook for Tomorrow, June 5-6: The Tug-of-War Continues

The Vietnamese stock market witnessed a volatile session on June 4th, with stocks fluctuating within a narrow range.

“Stock Market Outlook: VN-Index Faces Adjustment Pressures for the Week of June 2-6, 2025”

The VN-Index witnessed a significant decline during the week’s final session, bringing an end to its four-week streak of consecutive gains. The index’s repeated tests of the old March 2025 peak (equivalent to the 1,320-1,340 range) indicate a crucial resistance level that the VN-Index must surpass to sustain its upward trajectory. Erratic trading volume fluctuations around the 20-day average reflect investors’ unstable sentiment. Moreover, consistent selling pressure from foreign investors has further intensified the burden on the VN-Index. Should this trend persist, the likelihood of a corrective phase looms large.

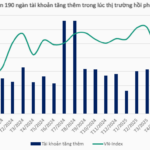

The Rise of Stock Market Enthusiasts in Vietnam: Over 10 Million Trading Accounts and Counting

As of May 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, with almost 10.1 million registered accounts, according to the Vietnam Securities Depository and Clearing Corporation (VSDC). This marks an increase of 190,852 accounts compared to the previous month, showcasing a vibrant and growing investment landscape in the country.

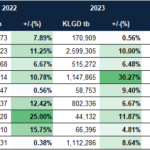

Which Stocks Tend to Rise in the Last Month of a Quarter?

The VN-Index rose by almost 9% in May, and investors are optimistic about its continued growth. However, a look at recent years reveals that declining stocks tend to dominate in June.