The Gateway to Vietnam 2025 panel featured, from left to right: Mr. Thomas Nguyen, Foreign Markets Director at SSI; Mr. Pham Luu Hung, Chief Economist and Head of Investment Advisory at SSI; Mr. Derek Hamilton, Economist at Macquarie Asset Management; and Mr. Andy Rothman, Founder and CEO of Sinology LLC.

|

American businesses and consumers bear the brunt of tariffs.

Mr. Derek Hamilton, Economist at Macquarie Asset Management, opined that tariffs are not just “noise” from the US but have short- and long-term implications for the US and global economies. Government policies are dominating everything in the US at the moment, with trade and tariffs topping the list of concerns.

Before the tariffs took effect, there was a surge in imports into the US as companies tried to build up inventory ahead of the tariff implementation, as tariffs essentially increase costs or act as a tax. However, this surge in imports reduces a country’s GDP because the goods are not domestically produced.

Mr. Hamilton predicts that this trend will reverse, with imports returning to normal levels, consumer spending slowing, and underlying domestic demand weakening throughout the year. The short-term consequence is weaker economic growth. He forecasts that the US economy will weaken this year due to the impact of tariffs, which increase costs, reduce companies’ profit margins, and affect economic growth.

In the tariff battle, American companies and consumers pay most of the tariffs, not foreign governments. About half of US imports are intermediate goods from China, and increasing tariffs on these will raise production costs for American factories.

However, many of the temporary tax cuts from the first Trump administration will expire at the end of this year. Congress is working to extend and even add to these tax cuts for both consumers and businesses. If this legislation passes, it will provide economic stimulus for the next few years, with the highest stimulus expected in 2026. This could help the US economy rebound next year.

Service sectors will be better shielded from the impact of tariffs, whereas goods sectors, especially those importing from China, will be hit harder. Mr. Hamilton cites Walmart’s announcement of price increases on many items, a situation that could spread.

Another important point to note is that companies serving lower-income consumers will be more affected. Lower-income individuals are more impacted by price increases than higher-income ones. So, when companies raise prices due to tariffs, lower-income consumers bear the brunt.

Globally, as imports into the US decline, many countries around the world, especially those dependent on trade and Southeast Asian nations such as Vietnam, which saw strong export growth to the US in Q1, may experience slower economic activity.

China holds more cards than the US.

Mr. Andy Rothman, Founder and CEO of Sinology LLC, believes China holds more cards than the US. China is not an export-dependent economy. In the five years before COVID (2015-2019), net exports contributed only 1% on average to China’s GDP growth. Although in Q1 this year, net exports contributed 30% to China’s GDP growth, it was due to weak domestic demand rather than an export-led strategy.

Mr. Rothman argues that the pressure from the Trump administration is making it clear that China’s next phase of growth cannot rely on foreign consumers but must depend on its 1.4 billion domestic consumers. Additionally, China processes almost all of the world’s rare earth elements, which are critical for many industries and have no immediate substitutes.

VN-Index has the potential to reach 1,600.

Mr. Pham Luu Hung, Chief Economist and Head of Research at SSI, assessed Vietnam’s economic outlook, stating that the country should “wait and see” as trade negotiations with the US are ongoing and showing positive developments. Domestic factors remain positive, with large public investment disbursements (over $30 billion for infrastructure this year, with almost 40% disbursed in May). FDI registration continues to surge (nearly doubling in May). GDP growth is expected to be at least 7.5% or even 8% in Q2, following a strong 7% in Q1.

The government is focusing on reviving the real estate market, benefiting the real estate and banking sectors, which are also boosted by new regulations. Vietnam’s population remains in its “golden” phase for at least another decade, providing opportunities for the real estate sector to flourish before facing aging issues like China.

The government is also orienting its policies toward developing the private sector. Resolution 68 on private sector development is key to Vietnam achieving 8-10% GDP growth in the next decade.

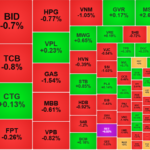

The VN-Index has recovered from the drop after the “Tariff Liberation Day” and is approaching 1,400 points. SSI sets a target of 1,450 points for the index this year. SSI analysts believe that the current valuation is quite cheap, and if it returns to its five-year historical average, the VN-Index could reach around 1,600 points.

Additionally, the exposure of listed companies to external factors is not high, with exports accounting for less than 20%. The main driver remains the domestic economy. In this phase, investors should prioritize the real estate, construction, and public investment-related sectors. Securities companies will also benefit as the market improves.

– 11:29 06/06/2025

“Kido’s Grand Vision: Forging Ahead with a 662% Profit Surge, Unveiling Prime Real Estate Ventures, and the Triumphal Return of the Vạn Hạnh Mall”

This time, KIDO is seeking shareholder approval regarding its shareholding in KDF and matters related to the KIDO brand and the Celano and Merino trademarks.

The Liquidity Crunch: Small-Cap Stocks Swimming Against the Tide

The VN-Index’s upward trajectory continued to falter after yesterday’s pause, this time primarily due to a decline in buying power. Of the 10 largest stocks by market capitalization that make up this index, 8 witnessed negative performance, with a 17% drop in the VN30 basket’s liquidity. However, trading remained vibrant among medium and small-cap stocks, with numerous stocks witnessing robust gains.

Bank Stocks in May: Rising from the Abyss

Amid the market’s rebound following the news of the U.S. delaying retaliatory tariffs on Vietnamese goods to pave the way for negotiations, the banking stock group has surged back after plunging to rock-bottom levels.