VTGS aims for 2.3X profit growth with a focus on margin lending, without competing for market share

In 2025, VTGS has set forth several business directions, notably focusing on margin lending and refraining from aggressive market share competition.

According to the set directions, the company targets robust loan growth, with new margin disbursements of VND 1,000-1,100 billion. It aims to maintain existing margin loans and disburse an additional VND 1,500 billion in the first half of 2026, bringing total outstanding loans to VND 2,500 billion by the end of Q2/2026.

As per VietstockFinance data, as of March 31, 2025, VTGS’s margin loan balance was less than VND 8.5 million, with no prior occurrences. The company only received approval from the State Securities Commission to provide securities advance payment and securities lending services since October 2022.

However, with the recent plan to issue shares to raise capital, VTGS is expected to have significant funds to support its margin business.

| VTGS’s margin lending business took off in Q1/2025 |

In 2025, the company will also introduce a unique commission policy, setting it apart from other securities companies, to create a competitive edge and boost sales motivation.

Additionally, with idle capital after the capital increase, VTGS will utilize it efficiently by prioritizing term deposits, certificates of deposit, or bonds. The actual capital structure will depend on market conditions at different times.

VTGS notes that while monetary easing can stimulate credit growth and asset price increases, including stock prices, it can also lead to increased money supply and lower interest rates across the board, including deposit rates, certificate of deposit rates, and bond coupon rates. Margin lending rates may also be impacted, but to a lesser extent.

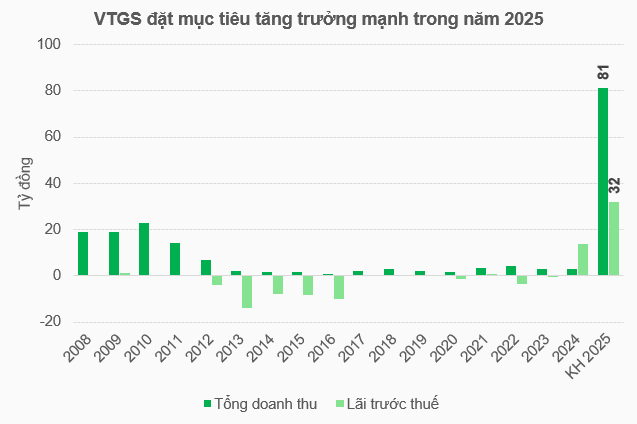

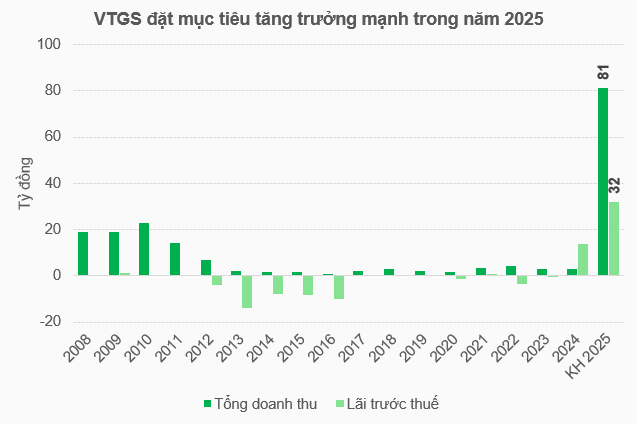

For 2025, VTGS aims to achieve over VND 81 billion in total revenue and VND 32 billion in pre-tax profit, representing nearly 26 times and more than 2.3 times the results of 2024, respectively, indicating the management’s high expectations.

Source: VietstockFinance

|

In 2025, VTGS plans to offer 289.8 million shares to existing shareholders, increasing its charter capital from VND 138 billion to VND 3,036 billion, a 22-fold increase.

On May 23, the Board of Directors of VTGS passed a resolution to approve the offering, with the record date for determining the list of existing shareholders set as June 2. The period for transferring and registering to buy shares is from June 3 to July 1, and the payment period is from July 2 to July 16.

At a price of VND 10,000 per share, VTGS is expected to raise VND 2,898 billion. The company will allocate most of this amount to securities-related businesses, including VND 2,386 billion for securities lending, VND 400 billion for advance payment against securities sale, and VND 100 billion for the purchase of certificates of deposit and/or term deposits for payment reserves. The expected utilization period is before June 30, 2026.

The remaining amount of approximately VND 12 billion will be used for investing in information technology system upgrades (including hardware supplements and software upgrades for trading, website, web trading software, and mobile app), as well as for purchasing work tools and office equipment. The expected utilization period for this portion is before December 31, 2027.

Appointing Additional BOD Member and Expanding Business Operations

Based on the planned business development in the coming time, to meet the requirements of governance, management, supervision, and compliance with current legal regulations, it is expected that at the AGM, the BOD of VTGS will propose to the shareholders the election of one additional BOD member, thereby increasing the number of BOD members from June 26 to five.

The BOD will also propose the content of commissions and business incentives for managers and related persons.

Furthermore, the BOD will propose to the shareholders to consider adding two additional business lines: proprietary trading and underwriting securities. Currently, the company has been granted licenses for brokerage and securities investment advisory services.

In fact, the 2024 AGM, held on June 26, 2024, had approved the addition of the proprietary trading and underwriting securities business lines. However, the company has not yet been able to implement them as it does not currently meet the regulatory capital requirements.

– 6:00 PM, June 6, 2025

The Ultimate Guide to FPT’s Capital Raising Venture: Unveiling the Plan to Issue Over 222 Million Shares

The FPT Board of Directors has approved a plan to issue over 222 million new shares to existing shareholders from equity capital.

Is the Mid and Small-Cap Stock Group Undervalued?

The notable observation here is that the P/E ratio of the Non-Financial sector, excluding Real Estate, has plummeted by a staggering -35% from its peak a year ago, which also marked a historical high for this group. This represents a significantly deeper discount compared to the broader market, with the overall market’s P/E declining by -14%, Banks by -10%, and Real Estate by -28%.