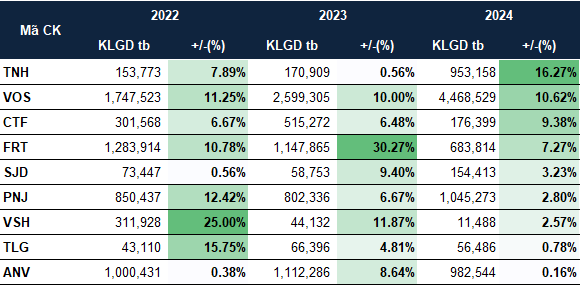

Specifically, according to statistics from VietstockFinance, there were only 9 stocks that consistently increased in the month of June over the past three years (2022-2024): TNH, VOS, CTF, FRT, SJD, PNJ, VSH, TLG, and ANV.

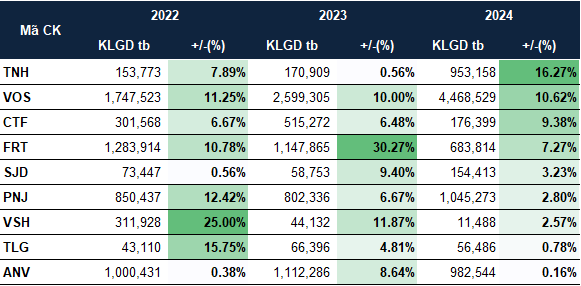

In contrast, 65 stocks experienced consistent declines, with prominent businesses spanning industries such as banking (BID), real estate (SCR, DXG, TCH, DIG), aviation (VJC), oil and gas (PLX), and construction (LCG, HTN, DPG).

|

Stocks on the HOSE that increased in price during June from 2022-2024

Source: VietstockFinance

|

|

Stocks on the HOSE that decreased in price during June from 2022-2024

Source: VietstockFinance

|

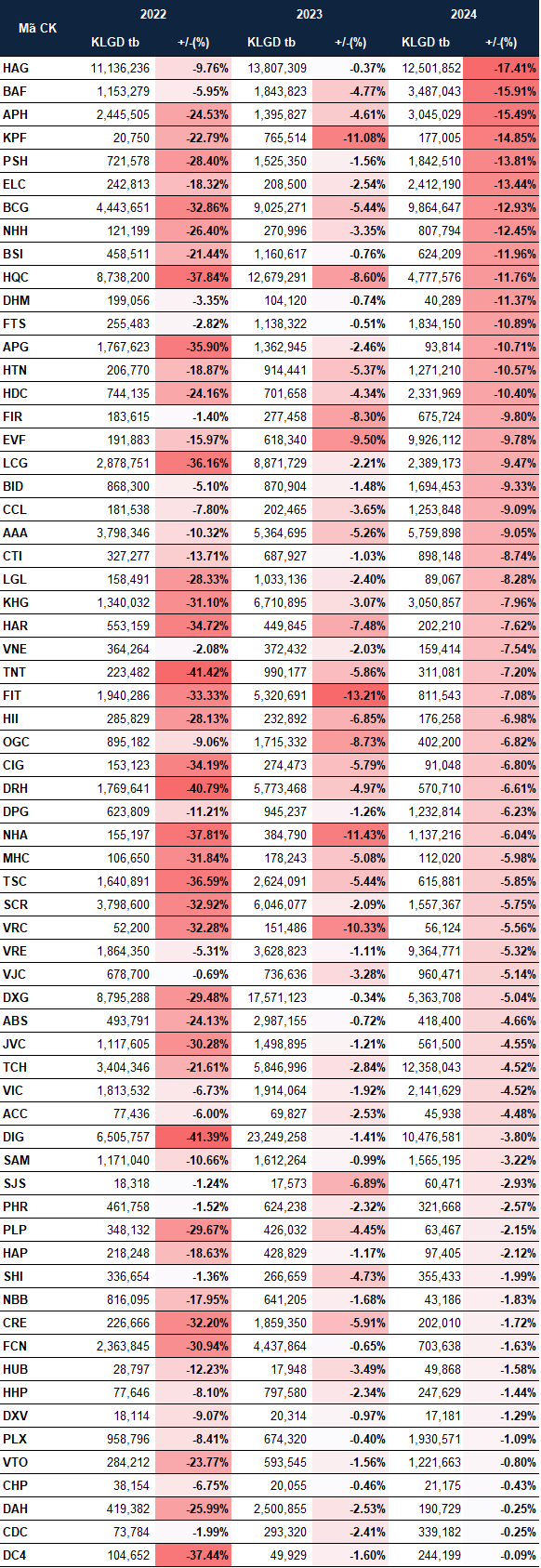

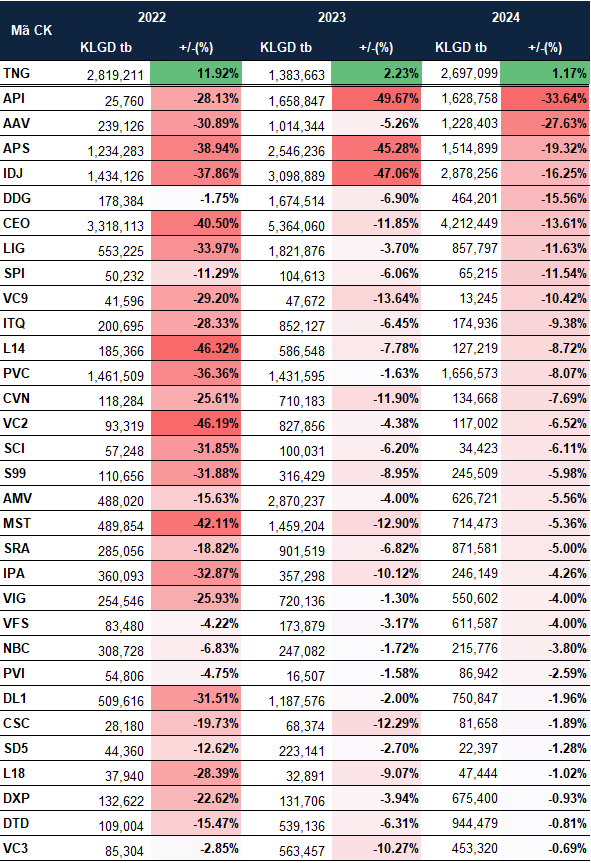

The situation on the HNX exchange followed a similar pattern, with only TNG witnessing consistent growth during June over the 2022-2024 period. Conversely, 31 stocks consistently declined, including notable names such as DDG, CEO, API, NBC, PVI, and VC3.

|

HNX stocks that increased/decreased in price during June from 2022-2024

Source: VietstockFinance

|

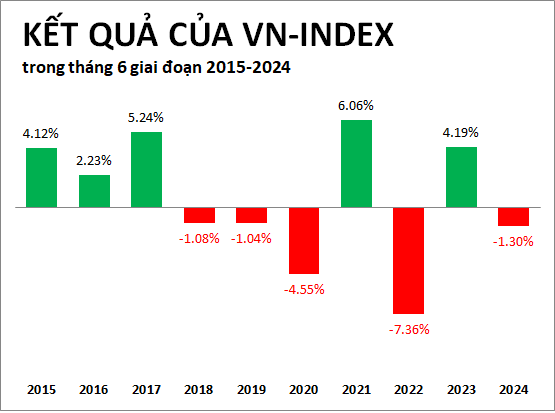

When considering the performance of the VN-Index, the index has exhibited 5 years of growth and 5 years of decline during the month of June over the past decade (2015-2024). Notably, in the last 5 years (2020-2024), the VN-Index alternated between increases and decreases annually, with a decrease recorded in the year 2024.

Source: VietstockFinance

|

Mr. Nguyen The Minh, Director of Research and Development at Yuanta Securities Vietnam, opined that regardless of the outcome of trade negotiations between the US and Vietnam, key export sectors such as seafood and especially textiles and garments will continue to be impacted. Therefore, investors should restructure their portfolios instead of relying on an expected recovery cycle.

On the other hand, investors can seek out sectors with growth potential, starting with banks. While bank stocks have risen, they have also exhibited differentiation. In the latter part of the year, banks’ NIMs could improve as credit flows into the real estate sector, which is currently receiving active support from the government to overcome challenges.

Secondly, the real estate sector, particularly commercial real estate, is expected to rebound from the third quarter onwards. Although the current performance has not shown improvement, stock prices have risen sharply and could be poised for another cycle of increases.

Thirdly, the technology sector is poised to drive long-term growth. Despite recent significant declines and subsequent weak recoveries, this sector continues to benefit from long-term growth trends. Mr. Minh also suggested that the current price levels are appropriate for re-entry into technology stocks.

The construction and building materials sectors are also anticipated to grow, propelled by public investment and real estate development. With input material prices currently low, profit margins are expected to improve.

Lastly, the food production sector could be another area of focus. While this sector hasn’t witnessed a specific wave of growth in the past 2-3 years, it holds potential for the current year. Given the goal of boosting GDP growth, domestic consumption will likely be a key driver. Resolution 68, which aims to boost the private economic sector, also serves as a catalyst to revive domestic consumption.

– 10:00 06/06/2025

Market Pulse June 6: VN-Index Ends Week on a Sour Note, Energy Sector Stages a Comeback

The market closed with declines, as the VN-Index fell by 12.2 points (-0.91%) to 1,329.89, while the HNX-Index dropped 2.58 points (-1.12%) to 228.61. The market breadth inclined towards decliners, with 514 stocks decreasing against 246 advancing stocks. Moreover, within the VN30 basket, 22 stocks declined, 5 increased, and 3 remained unchanged, indicating a dominant red hue.

The US Economy Will Weaken This Year Due to Tariff Woes.

In the latest edition of ‘Gateway To Vietnam’, organized by SSI Securities on June 5th, experts delved into the intricacies of US tariff policies and their far-reaching implications. The discussion, titled “The Art Behind the Tariff Wave”, explored how these policies impact trade flows, investment patterns, and Vietnam’s economic growth prospects.

The Stock Market Blues: Triple Trouble for Stocks as Selling Pressure Mounts and VN-Index Slips Below 1340 Points

The third consecutive session of decline witnessed a surge in liquidity, with an extremely negative breadth indicating that sellers are dominating the market. Most blue-chips are exhausted, while mid and small-cap speculative stocks are also facing heavy selling pressure.