Real Estate Development JSC Van Phu (Van Phu Invest, code: VPI) has just announced a change in personnel.

Specifically, Van Phu Invest approved the dismissal of Mr. Trieu Huu Dai from the position of General Director according to his personal wishes, effective June 6.

According to Van Phu Invest, Mr. Trieu Huu Dai holds a Master’s degree in Business Administration and has over 20 years of experience in the construction investment industry, as well as over 15 years of management experience in organizations and enterprises in the field of construction and construction.

In June 2021, Mr. Dai was appointed as Deputy General Director and became the General Director of VPI two months later. At the 2022 Annual General Meeting of Shareholders, Mr. Dai was also elected as a member of the company’s Board of Directors.

Mr. Trieu Huu Dai (furthest left) at the 2024 Annual General Meeting of Van Phu Invest

On the other hand, Mr. Pham Hong Chau has been appointed as the new General Director of VPI since June 6, 2025.

Mr. Pham Hong Chau holds a Master’s degree in Accounting and has over 25 years of experience in the field of finance and investment. He has been a member of the Board of Directors and Deputy General Director of Van Phu Invest since 2017.

Previously, Van Phu Invest also appointed Ms. Phan Le My Hanh as Deputy General Director of the company for a term of 5 years from May 13.

In terms of business results, according to the consolidated financial statements for the first quarter of 2025, Van Phu recorded a revenue of over VND 248.7 billion, up 96.6% over the same period last year. After deducting taxes and fees, the company reported a net profit of over VND 142.2 billion, up 103.4%.

Thus, at the end of the first quarter of 2025, Van Phu has completed 10.2% of the revenue plan and 40.6% of the profit plan.

As of March 31, 2025, the company’s total assets increased by 13.6% compared to the beginning of the year, reaching over VND 12,654.7 billion. Inventories accounted for VND 3,511.7 billion, or 27.8% of total assets, while long-term assets under construction accounted for VND 3,450.2 billion, or 27.3% of total assets.

On the other side of the balance sheet, total liabilities were over VND 7,430.1 billion, up 22.5% from the beginning of the year. Of this, loans and finance leases accounted for VND 5,950.6 billion, or 80.1% of total debt.

The 2025 Annual General Meeting of Shareholders of Van Phu approved the 2025 business plan with financial targets including a total revenue of VND 2,450 billion and an estimated profit after tax of VND 350 billion.

“A New Era for Văn Phú Invest: Unveiling Our Dynamic Leadership Change”

“Van Phu Invest announces a change in leadership with the resignation of Mr. Trieu Huu Dai from his position as CEO. The company has appointed Mr. Pham Hong Chau as the new CEO. Mr. Chau brings a wealth of experience and a fresh perspective to Van Phu Invest, and we are confident in his ability to lead the company towards continued success.”

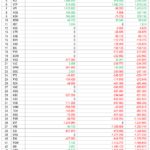

What Stocks Will Be Removed From the FTSE ETF and VNM ETF in the Q4 Review?

According to the latest report by SSI Research, the foreign ETF portfolio will undergo significant changes in the upcoming quarterly rebalance for Q4 2024. The upcoming rebalancing will introduce new potential stocks and adjust the weights of existing constituents, offering a refreshed landscape for investors.

The Ultimate Guide to Stock Market Success: Unveiling the Secrets of the Pros

“Revolutionizing Debt Management: VPI’s Strategic Move to Settle Bond Debt with a Twist”

“Van Phu – Invest Joint Stock Company is poised to issue 29.65 million shares to settle a VND 690 billion debt (excluding interest) in convertible bonds, with a conversion price set at approximately half of the current market price.”

Let me know if there are any other adjustments or refinements you would like to see!