In previous disclosures, the role of Eastspring Vietnam’s representative was undertaken by CEO Ngo The Trieu, who has over 15 years of experience with the company.

According to Eastspring Vietnam’s website, Vice President Nguyen Quoc Dung and CEO Ngo The Trieu are the two members of the company’s management board. Mr. Dung is responsible for operations, business development, and strategy formulation.

|

Mr. Dung has over 24 years of experience in financial consulting, investment banking, and Vietnam’s stock market. Prior to joining Eastspring Vietnam in April 2025, he spent over 17 years with Vietcap Securities, mainly in the Investment Banking and Institutional Sales Trading divisions. He has also held senior roles in accounting and auditing at Gannon Group, Vietnam Brewery, KPMG Vietnam, and Arthur Andersen Vietnam.

Mr. Dung holds a Master of Business Administration from the French-Vietnamese program (CFVG) and a Bachelor of Corporate Finance from the University of Economics in Ho Chi Minh City. He also possesses a fund management practitioner certificate issued by the State Securities Commission.

In 2024, Eastspring Vietnam’s leadership underwent changes, with the dismissal of non-executive chairman Faizal Gaffoor on August 28, 2024, despite his appointment only a few months prior on April 28, 2023. Soon after, Terence Lim Ming Wan was appointed as his replacement on September 13, 2024.

Eastspring Investments Limited was established in 2005 with a chartered capital of VND 25 billion, fully contributed by Prudential Vietnam Assurance Private Ltd. – a 100% foreign-invested enterprise. The company was initially named Prudential Vietnam Fund Management Company Limited and was renamed on December 9, 2011.

Eastspring Vietnam is headquartered on the 23rd floor of the Saigon Trade Center, 37 Ton Duc Thang, Ben Nghe Ward, District 1, Ho Chi Minh City. The company’s main activities include establishing and managing securities investment funds, portfolio management, financial consulting, and securities investment consulting.

In the first quarter of 2025, the company generated over VND 92 billion in revenue, ranking third in the fund management industry. This marked a 13% increase compared to the same period last year.

Breakdown of the revenue structure: Investment portfolio management activities (including investment solutions and asset allocation services) contributed the most, generating nearly VND 80 billion, while the remaining came from securities investment fund management, operating bonus fees, and other activities.

Finally, the company posted a net profit of nearly VND 48 billion, ranking third in the industry, although this figure represented a 4% decrease compared to the previous year.

As of March 31, 2025, the company’s total assets amounted to nearly VND 586 billion, a 10% increase from the beginning of the year. Notably, the entrusted investment portfolio reached nearly VND 159,000 billion, ranking second in the industry, a slight increase of 2%, and 271 times the total assets.

In the entrusted investment portfolio, the company allocated over 59% to bonds, over 30% to long-term deposits, and more than 10% to stocks.

– 15:02 05/06/2025

How Profitable is This Enterprise, With State Budget Submissions of 12,300 Billion VND Over Five Months?

As one of the leading state-owned economic groups, we are proud to be at the forefront of ensuring energy security for our nation. With a strong foundation and a dedicated team, we strive to be the pillar of support for the country’s energy needs, now and in the future. Our commitment to excellence and innovation drives us to explore new horizons and secure a sustainable energy landscape for generations to come.

“Leading Battery Brand Announces First Interim Dividend for 2025: A Generous 20% Payout”

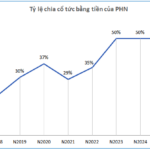

The Hanoi Battery Joint Stock Company (HNX: PHN), proud owners of the renowned Bunny Battery brand, is thrilled to announce an interim cash dividend for the first quarter of 2025, offering a generous 20% dividend payout ratio, equivalent to VND 2,000 per share. Shareholders will be delighted to know that the record date for this dividend is set for June 13th, with payments expected to be made by June 24th.

The Pen Is Mightier: Crafting a Compelling Headline

“Chairman of EIN Resigns: A Year of Leadership Cut Short.”

“Mr. Bui Tuan Anh has stepped down from his position as Chairman of the Board of Directors of Electricity Investment – Trading – Service Joint Stock Company (UPCoM: EIN), effective June 5th, citing personal reasons. This development comes ahead of EIN’s upcoming 2025 Annual General Meeting of Shareholders, scheduled for June 11th.”

Optimizing Tax Compliance: Targeting Over 25,000 Online Businesses

“The Ministry of Finance revealed that in the first five months of the year, tax authorities scrutinized nearly 165,000 e-commerce business taxpayers. Over 25,000 individuals and households were subject to additional tax collections, totaling more than VND 330 billion.”