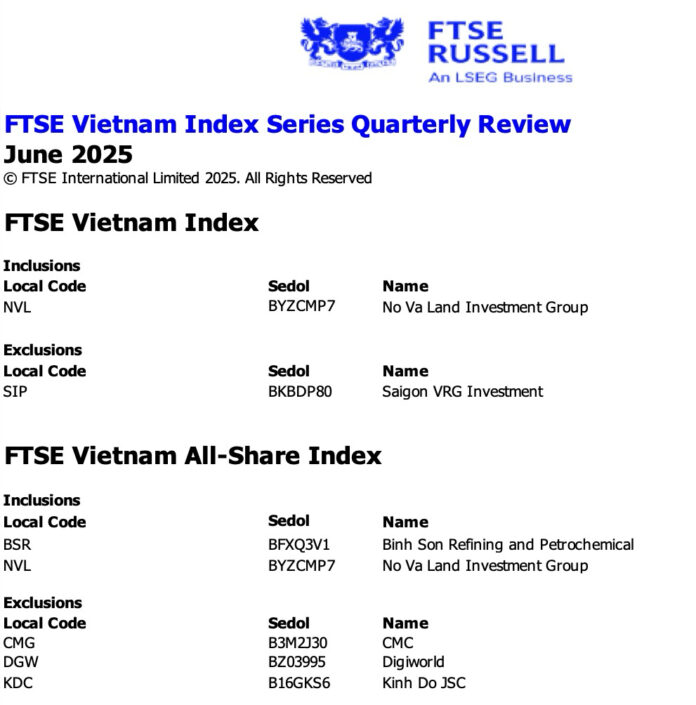

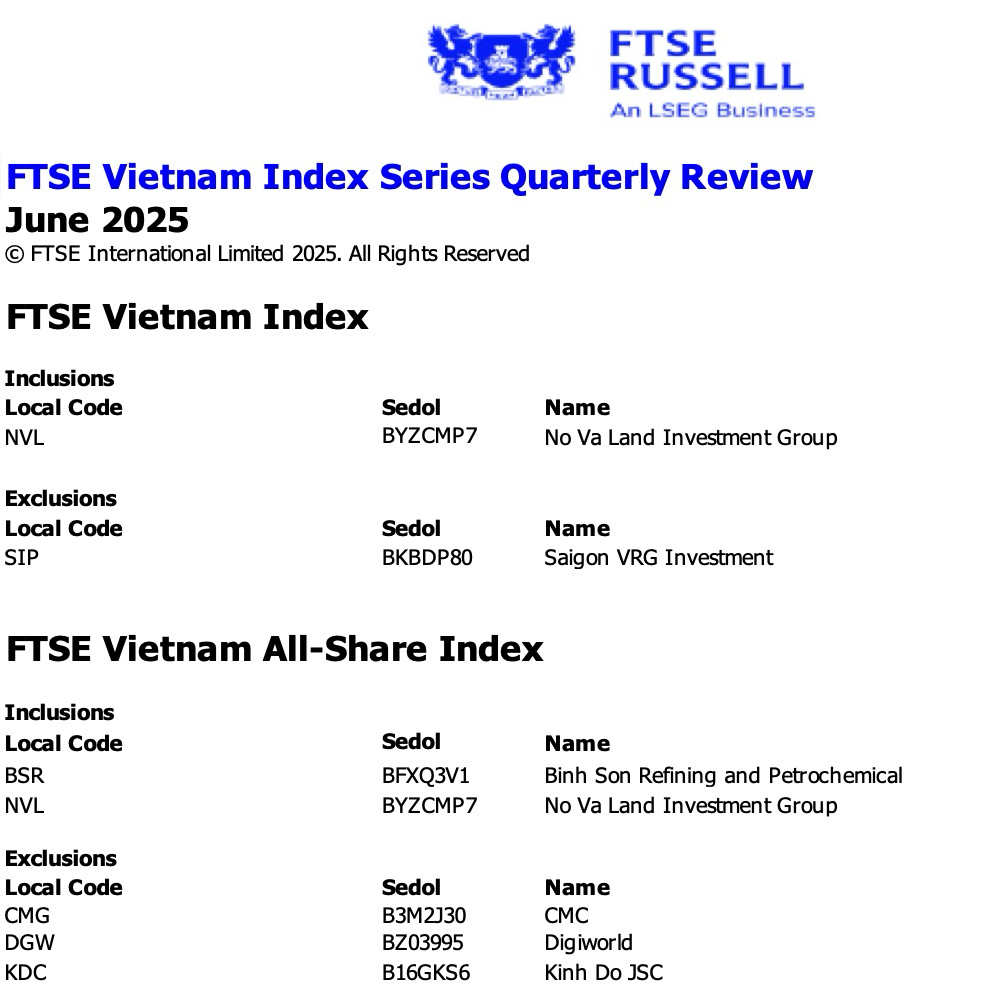

The latest review of the FTSE Vietnam Index and FTSE Vietnam All-Share Index has resulted in some notable changes. Novaland (NVL), a prominent real estate company, has been added to the FTSE Vietnam Index, while SIP (Sao Saigon Investment Group) was removed. Interestingly, SIP was only recently added to the index in the Q1 review, demonstrating the dynamic nature of these portfolios.

NVL is one of two new additions to the FTSE Vietnam All-Share Index, along with BSR. In contrast, CMG, DGW, and KDC have been removed from this index.

Source: FTSE

|

These changes will take effect after the market closes on Friday, June 20th, and the new portfolios will commence trading on the following Monday, June 23rd.

On Wednesday, June 14th, MarketVector will announce the constituents of the MarketVector Vietnam Local Index, which serves as a benchmark for the VNM ETF.

– 17:13 06/06/2025

“VNM ETF and FTSE Review Forecast: Hotspot in Securities and Banking Stocks”

June 2025 is set to be a pivotal month for Vietnam’s stock market, with two large foreign ETFs gearing up for their periodic portfolio restructuring. This upcoming event has the potential to cause significant fluctuations in the market, making it a critical period for investors and market enthusiasts alike.

“The Stock Whisperer: Unveiling the Next FTSE Vietnam Index Contender”

The FTSE Vietnam Index is set for a potential shake-up, with SSI Research predicting the addition of HCM. This addition is anticipated as HCM satisfies all the requirements, and no stocks are expected to be removed.