The sellers’ aggressive price cuts during the weekend caused a sea of red on the stock screens. Although the VN-Index closed down only 0.91%, hundreds of stocks on the two exchanges lost more than 1% of their value. The blue-chip group was particularly disappointing, with only 5 green ticks left in the VN30 basket. Among the largest-cap stocks, HPG’s 1.17% gain was a lonely bright spot that couldn’t make up for the losses.

VIC fell 1.02%, VHM by 1.04%, TCB by 2.57%, FPT by 1.54%, GAS by 1.25%, MBB by 1.02%, and VPB by 1.66%—all among the market’s largest stocks. The weakness in these leading stocks was reminiscent of the previous week’s final three sessions when they also prevented the VN-Index from breaking through the old peak.

The same pattern played out over the last three sessions this week, with the VN-Index falling continuously after briefly surpassing the peak again and eventually losing the 1,330-point mark to settle at 1,329.89. A notable difference from last week was that the index’s weakness also dampened the overall market sentiment.

Speculative stocks turned south in droves. VND, CII, VIX, GEX, and PDR saw massive sell-offs, with transaction values reaching hundreds of billions of dong for each stock, resulting in significant price declines. These stocks had performed well recently, but their momentum fizzled out in the last three sessions.

This development indicates a resurgence of the “sell on news” mentality, as investors quickly dumped stocks that had surged in price. Such a reaction is not surprising, given that converting profits into cash is the ultimate goal. With the VN-Index meandering for ten sessions around the 1,340-point mark without a decisive breakthrough, the likelihood of a distribution phase emerging is high.

Foreign investors sold a net VND 2,273.3 billion, with a net sell of VND 519.5 billion in matched orders. Their net buy in matched orders was focused on the Real Estate and Basic Resources sectors. The top stocks they net bought were: HPG, VIC, GEX, DXG, DIG, NLG, HHS, HDG, NVL, and HDB.

On the sell side, they net sold Financial Services stocks in matched orders. The top stocks they net sold were: VCI, FPT, HAH, STB, HCM, VCB, VND, SSI, and EIB.

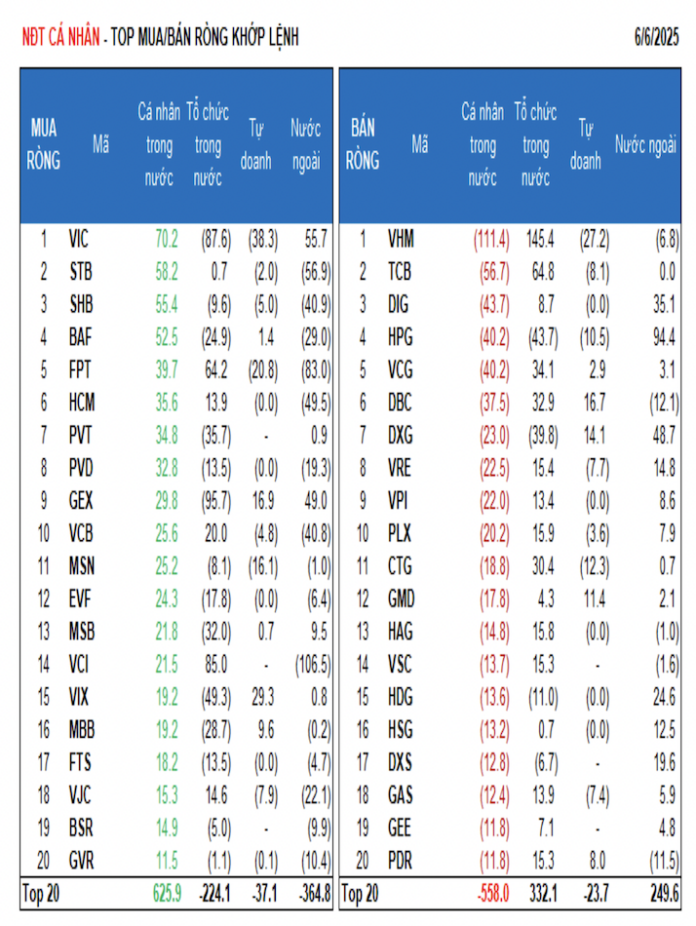

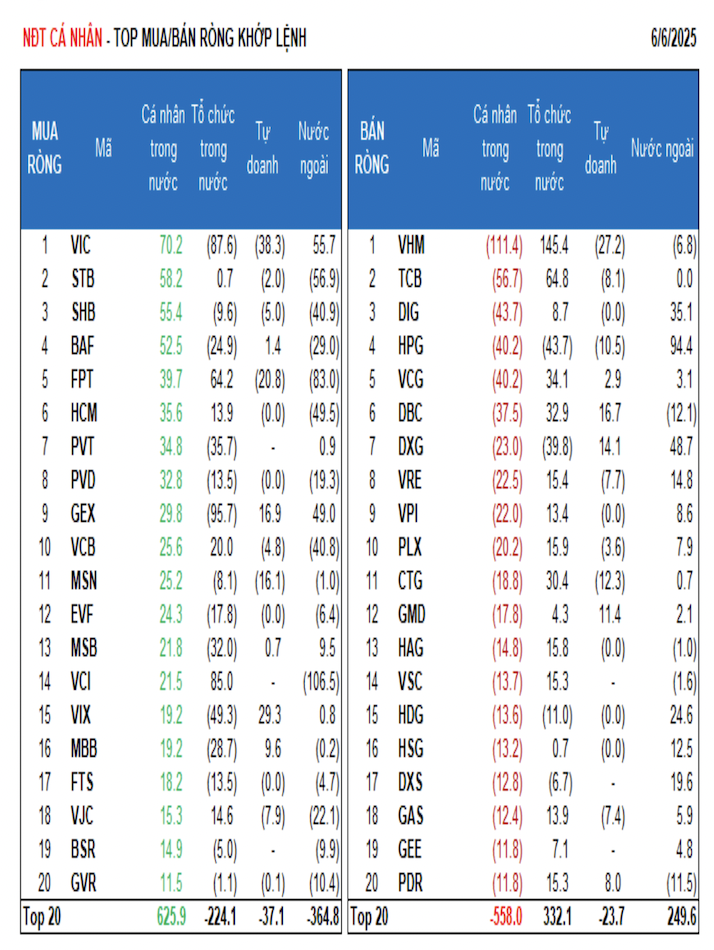

Individual investors net bought VND 1,667.0 billion, with a net buy of VND 156.2 billion in matched orders. In matched orders, they net bought 11 out of 18 sectors, mainly in the Financial Services sector. Their top net buys were: VIC, STB, SHB, BAF, FPT, HCM, PVT, PVD, GEX, and VCB.

On the sell side in matched orders, they net sold 7 out of 18 sectors, mainly Real Estate and Basic Resources stocks. Their top net sells were: VHM, TCB, DIG, HPG, VCG, DBC, VRE, VPI, and PLX.

Proprietary trading arms of securities firms net sold VND 142.7 billion, with a net sell of VND 77.8 billion in matched orders. In matched orders, they net bought 6 out of 18 sectors. Their biggest net buys were in the Financial Services and Industrial Goods & Services sectors. The top net buys by proprietary traders today were VIX, DCM, GEX, DBC, EIB, DXG, FUEVFVND, REE, GMD, and PC1. Their top net sells were in the Banking sector. The top stocks net sold were VIC, VHM, VPB, FPT, MSN, VNM, ACB, CTG, HDB, and MWG.

Domestic institutional investors net bought VND 735.0 billion, with a net buy of VND 441.1 billion in matched orders. In matched orders, they net sold 4 out of 18 sectors, with the largest net sell in the Basic Resources sector. Their top net sells were GEX, VIC, VIX, HPG, DXG, PVT, NVL, MSB, MBB, and BAF. Their largest net buys were in the Banking sector. Their top net buys were VHM, VCI, HAH, TCB, FPT, VNM, VPB, VCG, DBC, and CTG.

Proprietary trading arms of securities firms net sold VND 142.7 billion, with a net sell of VND 77.8 billion in matched orders. In matched orders, they net bought in 6 out of 18 sectors. Their biggest net buys were in the Financial Services and Industrial Goods & Services sectors. The top net buys by proprietary traders were VIX, DCM, GEX, DBC, EIB, DXG, FUEVFVND, REE, GMD, and PC1. Their top net sells were in the Banking sector.

The top stocks net sold were VIC, VHM, VPB, FPT, MSN, VNM, ACB, CTG, HDB, and MWG.

Domestic institutional investors net bought VND 735.0 billion, with a net buy of VND 441.1 billion in matched orders. In matched orders, they net sold 4 out of 18 sectors, with the largest net sell in the Basic Resources sector. Their top net sells were GEX, VIC, VIX, HPG, DXG, PVT, NVL, MSB, MBB, and BAF. Their largest net buys were in the Banking sector. Their top net buys were VHM, VCI, HAH, TCB, FPT, VNM, VPB, VCG, DBC, and CTG.

The money flow allocation increased in Banking, Securities, Steel, Agricultural & Seafood, Oil & Gas, and Software sectors, while it decreased in Real Estate, Construction, Chemicals, Food & Beverage, Warehousing & Logistics, Mining, Building Materials & Interiors, and Automotive Manufacturing.

In matched orders, the money flow allocation increased in the large-cap VN30 and mid-cap VNMID groups, while it decreased in the small-cap VNSML group.