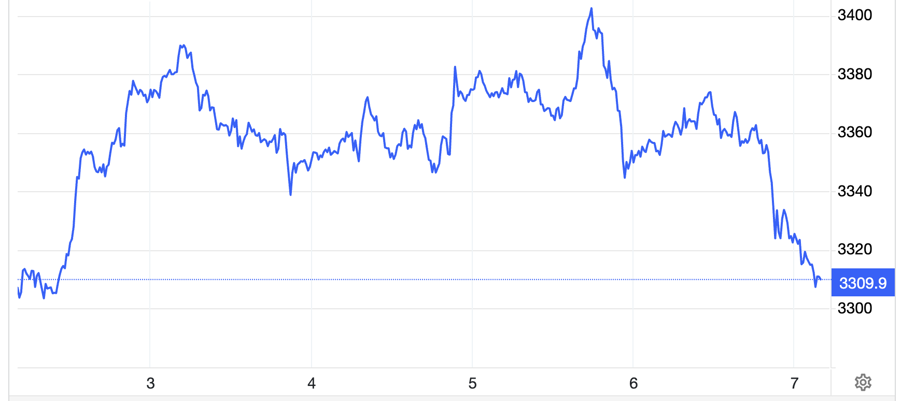

Gold prices dropped sharply on Friday (June 6th) as stronger-than-expected US jobs data lowered expectations for interest rate cuts among investors. However, high risk aversion and a weaker US dollar this week helped the precious metal post a weekly gain.

Spot gold on the Kitco exchange fell $43.7 or 1.3% to $3,311.7 an ounce at the New York close. At Vietcombank’s exchange rate, this price is equivalent to about 104.6 million VND per tael, down 1.8 million VND from yesterday morning.

According to Vietcombank, the bank’s USD buying and selling rates were 25,830 VND and 26,220 VND, respectively, up 20 VND from last week’s close.

Gold futures on COMEX fell 0.8% to close at $3,346.6 an ounce.

For the week, gold prices rose 0.6%, while gold prices in VND rose 700,000 VND per tael.

On Friday, gold prices fell as the US dollar strengthened after the US non-farm payrolls report from the Department of Labor.

The report showed that the US non-farm sector added 139,000 new jobs in May, higher than the forecast of 125,000 new jobs in a Dow Jones poll of economists, although lower than the April figure of 147,000 new jobs. The unemployment rate remained unchanged at 4.2%, in line with forecasts.

The optimism from the report pushed the US Dollar Index, which measures the greenback against a basket of six major currencies, up by nearly 0.5% to close at 99.2 on Friday. However, for the week, the index fell 0.13% according to MarketWatch data.

With a still-strong labor market, the US Federal Reserve (Fed) is unlikely to cut interest rates again this year, said Edward Meir, an analyst at Marex.

A higher interest rate environment and a stronger US dollar are both negative factors for gold, an asset that offers no yield and is denominated in the US currency.

According to data from the interest rate futures market, traders are betting on the possibility of a Fed rate cut in September, followed by another cut in December. Traders are also reducing bets on the Fed cutting rates three times this year.

The gold market closed on Friday before new developments in US-China trade negotiations. In the late afternoon, President Donald Trump announced on the Truth Social social network that US Treasury Secretary Scott Bessent and two other government officials would meet with their Chinese counterparts in London, UK on Monday (June 9th) for the next round of trade talks.

Some experts believe that this information could put downward pressure on gold prices when the market reopens next week. But “if the headlines on tariffs worsen, that will be a supportive factor for gold,” Meir added.

Gold prices continued to fluctuate within the range of 3,300-3,400 USD/oz this week, extending the sideways trend from May. Macroeconomic and geopolitical uncertainties are keeping gold prices elevated, but at the same time, some positive economic and trade negotiation news is putting downward pressure on gold. Analysts believe that the precious metal market needs a catalyst to find a clearer direction.

The world’s largest gold ETF, SPDR Gold Trust, sold 1.5 tons of gold on Friday, reducing its holdings to 934.2 tons. However, the fund bought a net 4 tons of gold this week, marking the second consecutive week of net purchases.