Gold prices dropped significantly during Thursday’s trading session (June 5th) following news of an upcoming trade negotiation between the US and China. This development caused investors to approach with caution ahead of the US non-farm payrolls report for May, which was due on Friday.

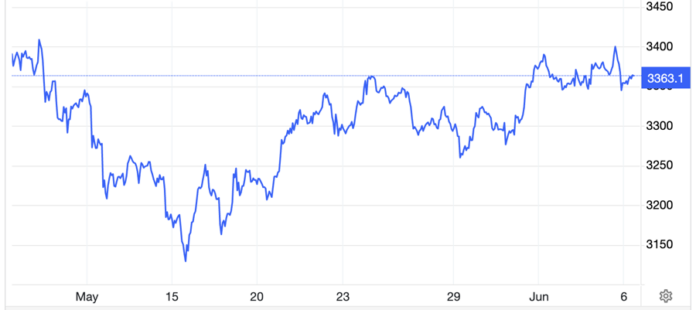

As of 9:15 am on Friday (June 6th), the spot gold price in the Asian market was trading at $3,364.82 per ounce, an increase of $11.42 per ounce compared to the previous night’s close in the US, according to Kitco exchange data. This equates to approximately 106.4 million VND per tael, a decrease of 700,000 VND per tael from the previous day’s rate when converted using Vietcombank’s USD selling rate.

At the same time, Vietcombank quoted the USD at 25,851 VND (buying rate) and 26,241 VND (selling rate), a decrease of 13 VND on both buying and selling rates compared to the previous day.

On Thursday, New York gold futures closed at $3,353.40 per ounce, a decrease of $21.30 per ounce from the previous session’s close, or more than a 0.6% drop.

Gold prices have been fluctuating this week, starting the week at around $3,300 per ounce, then rising to nearly $3,400 per ounce before falling again. Investor risk appetite remains significant due to uncertainties surrounding US tariff policies, and daily news continues to drive gold price volatility. Analysts believe that gold prices need a specific catalyst to establish a clear direction in the short term.

In a post on Truth Social following the June 5th phone call with Chinese President Xi Jinping, former US President Trump described it as a “very nice conversation” without elaborating on the outcome. He mentioned that high-level trade negotiators from both countries would soon meet. Meanwhile, a Chinese statement on the call stated that President Xi requested Trump to reduce trade sanctions and avoid actions that could escalate tensions over Taiwan.

According to Daniel Ghali, a strategist at TD Securities, the conversation between the US and Chinese leaders reduced the risk of escalating tensions between the two countries in the short term, thereby diminishing investors’ incentive to buy gold.

The trade war between the US and China has been a significant factor in the surge in gold prices this year. Since the beginning of the year, the price of this precious metal has increased by about 28%. Gold prices hit an all-time high of over $3,500 per ounce in April, not long after Trump announced his shocking tariff plans.

A report by Metal Focus predicts that central banks worldwide will net purchase 1,000 tons of gold in 2025, marking the fourth consecutive year of net purchases as they diversify their foreign exchange reserves away from USD-denominated assets. The net buying trend among central banks has also been a contributing factor to the upward movement in gold prices since 2024.

The US dollar weakened slightly during Thursday’s trading session, with the Dollar Index closing at 98.74, down from the previous session’s close of 98.79.

On Friday, investors’ attention turned to the US non-farm payrolls report for May, released by the US Department of Labor. Economists surveyed by Dow Jones predicted the report would show approximately 125,000 new jobs in May, 52,000 fewer than in April.

The job market situation could influence the Fed’s interest rate decisions in the near term. On Wednesday, former President Trump once again urged Fed Chairman Jerome Powell to cut interest rates.

“I believe a weakening US job market will increase bets on the Fed cutting rates sooner rather than later, which would benefit gold prices,” said senior analyst Ricardo Evangelista of ActivTrades, in an interview with Reuters.