Sài Gòn VRG Investment Joint Stock Company (SIP on the HoSE stock exchange) has announced its plan to issue bonus shares for the year 2024 from retained earnings.

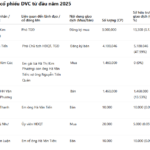

The company intends to issue approximately 31.6 million bonus shares to its shareholders at a ratio of 100:15, meaning that for every 100 shares owned, shareholders will receive 15 new shares.

The total value of the issuance, based on par value, exceeds VND 315.8 billion. This issuance will be funded by the company’s undistributed post-tax profits as of December 31, 2024, as per the audited 2024 financial statements.

The bonus shares are expected to be issued in the second and third quarters of 2025, with the record date for determining the allocation of rights anticipated to fall in July 2025.

Illustrative image

Prior to this announcement, on May 28, 2025, Sài Gòn VRG Investment disbursed nearly VND 147.4 billion in cash dividends for the second dividend payment of 2024, at a rate of 7% (VND 700 dividend per share).

In December 2024, the company had paid out over VND 210.5 billion in interim dividends for 2024, equivalent to a rate of 10%, or VND 1,000 dividend per share.

At the 2025 Annual General Meeting of Shareholders of Sài Gòn VRG Investment, held on April 25, 2025, the company’s shareholders approved a dividend payout ratio of 32% for 2024, amounting to over VND 673.7 billion. This includes 17% in cash dividends and 15% in stock dividends.

In terms of business performance, according to the consolidated financial statements for the first quarter of 2025, Sài Gòn VRG Investment recorded net revenue of nearly VND 1,941.2 billion, a 6.3% increase compared to the same period last year. Gross profit reached over VND 320.2 billion, marking a 17.5% rise.

During this period, the company’s financial income stood at nearly VND 233.5 billion, a 3.6-fold increase year-over-year. Meanwhile, financial expenses also rose by 163.6% to VND 43.5 billion. Selling expenses decreased by 46% to over VND 3.4 billion, while management expenses increased by 15.3% to over VND 21.8 billion.

After deducting taxes and expenses, the company reported a net profit of nearly VND 402.3 billion, representing a 56% surge compared to the previous year’s figure for the same period.

As of March 31, 2025, Sài Gòn VRG Investment’s total assets grew by 5.1% from the beginning of the year to over VND 26,325.9 billion. Short-term financial investments amounted to nearly VND 5,957 billion, a 13.6% increase, accounting for 22.6% of total assets. Long-term work-in-progress stood at over VND 2,285.1 billion, or 8.7% of total assets, while investment properties totaled nearly VND 6,047.2 billion, making up 23% of total assets.

On the liabilities side, total liabilities exceeded VND 21,027.4 billion, a slight increase of 4.2% from the beginning of the year. Borrowings and finance lease liabilities amounted to nearly VND 4,117.8 billion, representing 19.6% of total liabilities.

PV

A Sewing Brand is Unraveling: 50 Years of Threads Snipped and Over 2,500 Jobs at Risk.

With a robust financial standing, a generous dividend policy, and a nearly 50-year operational history, the 29/3 Garment and Textile Joint Stock Company, better known as Hachiba (UPCoM: HCB), stands apart from the myriad of companies that have delisted due to unforeseen circumstances or losses. Hachiba’s departure from the stock exchange is simply a consequence of its evolving shareholder structure, marking a shift towards a more closed-off business model.

“Leading Battery Brand Announces First Interim Dividend for 2025: A Generous 20% Payout”

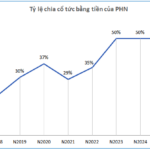

The Hanoi Battery Joint Stock Company (HNX: PHN), proud owners of the renowned Bunny Battery brand, is thrilled to announce an interim cash dividend for the first quarter of 2025, offering a generous 20% dividend payout ratio, equivalent to VND 2,000 per share. Shareholders will be delighted to know that the record date for this dividend is set for June 13th, with payments expected to be made by June 24th.