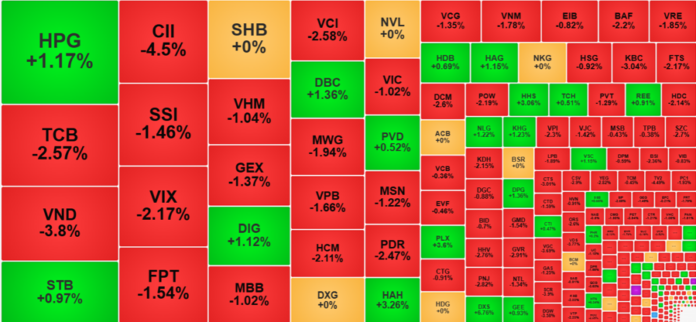

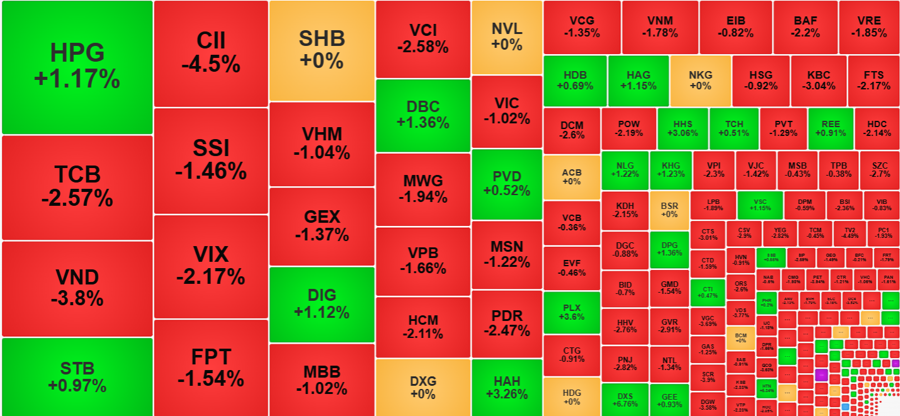

Selling pressure soared in the afternoon session, pushing the prices of many mid- and small-cap stocks deep into the red. While HoSE had 107 tickers falling by over 1% in the morning, the number rose to 160 by the closing bell. The decline in the VN-Index did not accurately reflect the losses in individual stocks.

The matched trading volume on HoSE in the afternoon also increased by 18.1% compared to the morning session, reaching 11 trillion dong, the highest in the last three sessions. The breadth didn’t change much, with 74 gainers and 231 losers (compared to 71 gainers and 215 losers in the morning), but the overall price level was significantly lower.

Of the 160 stocks that fell by more than 1% at the close, 77 fell by over 2%. While the market was also weak in the morning, only 30 stocks fell by more than 2%. The VN30 basket also performed poorly, with 16 stocks falling by more than 1% by the close, compared to just five in the morning.

The most dramatic move among the blue chips was GVR, which plummeted 2.91% from its reference price at the end of the morning session. While the trading volume for this ticker wasn’t particularly high, with a total matched volume of 83.6 trillion dong for the day and 51.6 trillion dong in the afternoon alone, the continuous price decline and severe lack of buying interest led to a significant drop in its price range. TCB is another story; it faced substantial selling pressure, with a trading volume of 472.6 trillion dong in the afternoon, causing its price to drop by an additional 1.3% from the morning session, closing down 2.57% from the reference price. TCB had the largest trading volume in the VN30 basket during the afternoon.

Statistics show that 24 out of 30 stocks in the blue-chip basket declined from their morning prices. Even strong tickers like STB felt the pressure. STB, which closed the morning session as one of the strongest stocks, up 2.3%, ended the day up only 0.97%. The selling pressure continuously pushed prices lower, resulting in a wide price range for many stocks during the day.

Once again, the blue-chip group proved to be the main obstacle preventing the VN-Index from breaking out. The three declining sessions at the end of this week were quite similar to the last two sessions of the previous week, when the VN-Index had briefly surpassed its peak before falling again. However, today’s situation was much worse than the previous week’s close, as a more significant number of stocks experienced sharp declines.

The mid-cap range of stocks, including VND, CII, VIX, GEX, VCI, HCM, PDR, and VCG, which all traded over 200 trillion dong in volume, faced extreme pressure. VND plunged 3.8%, CII fell 4.5%, VIX dropped 2.17%, VCI declined 2.58%, HCM lost 2.11%, and PDR decreased by 2.47%, resulting in significant losses. Lower-liquidity stocks fared even worse, with TDH, SBG, MHC, EVG, TV2, CCL, DLG, and CSM falling by over 4%.

The 160 stocks in the VN-Index that fell by more than 1% today accounted for 59.3% of the total trading value on the HoSE. While the exchange’s trading volume increased by 17.3% compared to yesterday, it was evidently influenced by active selling pressure.

On the upside, 74 stocks managed to stay in positive territory. Unsurprisingly, HPG remained impressive, despite weakening slightly in the afternoon, falling 0.76% from its morning close. HPG peaked at 11:00 am, gaining 2.91% from the reference price, but closed up only 1.17%. With a trading volume of 1,106.8 trillion dong, HPG led the market, but its afternoon volume was only 44% of the morning’s, indicating a poor inflow of capital.

Other stocks that received decent buying support and maintained their prices relatively well included DIG, up 1.12% with a volume of 441.2 trillion dong; DBC, up 1.36% with a volume of 382.9 trillion dong; HAH, up 3.26% with a volume of 235.1 trillion dong; HAG, up 1.15% with a volume of 175.7 trillion dong; HHS, up 3.06% with a volume of 120.8 trillion dong; and NLG, up 1.22% with a volume of 105.1 trillion dong. DSX, KHG, DPG, and VSC were also relatively active.

Overall, the intense selling pressure in the final session of the week reflected profit-taking by short-term speculative traders. If the market fails to explode, there is a high risk of a reversal, which could impact the profits of mid- and small-cap stocks.

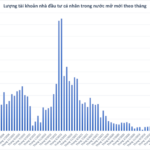

The New Stock Market Boom: Over 10 Million Trading Accounts Nationwide, Surpassing Government Targets

By the end of May, domestic individual investors held over 10 million accounts in total, equivalent to 10% of the population. This surpasses the initial target set for 2025, and the country is now aiming for 11 million accounts by 2030.