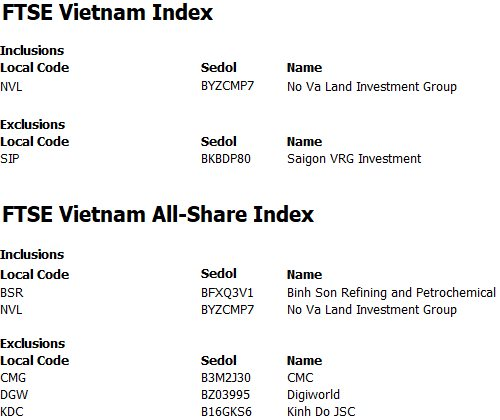

In the Q2 2025 review on June 6th, FTSE Russell added Novaland (NVL) to the FTSE Vietnam Index, while removing SIP from the index.

Additionally, three stocks, BSR, and NVL, were added to the FTSE Vietnam All-Share Index, while CMG, DGW, and KDC were removed.

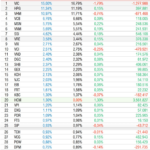

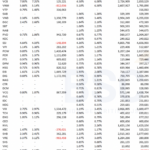

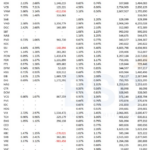

Following the Q2 2025 review, the FTSE Vietnam Index now comprises 32 stocks. The new portfolio will take effect after the market closes on Friday, June 20th, and trading will commence the following Monday, June 23rd.

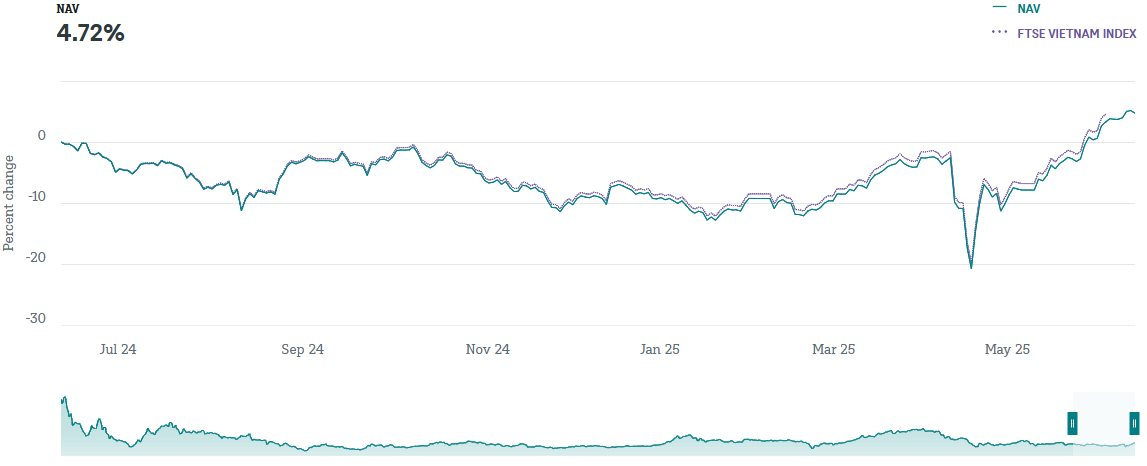

The FTSE Vietnam Index is the reference index for the FTSE Vietnam ETF. As of June 5th, the foreign fund had a total net asset value of approximately VND 7,000 billion. The investment performance of this ETF since the beginning of 2025 has been over 16%.

As of the end of March 2025, the FTSE ETF portfolio focused mainly on the financial, real estate, industrial, and consumer sectors. The most-held stocks included HPG, VIC, VCB, VHM, MSN, VNM, SSI, and VCI, among others.

In the early hours of June 13th, Vietnam time, MarketVector Indexes will announce the portfolio of the MarketVector Vietnam Local Index – the reference index for the VNM ETF.

“A Shake-Up in the FTSE Vietnam Index: NVL Makes the Cut, SIP Falls Short”

On June 6, 2025, FTSE Russell, a leading global index provider, announced the constituent stocks for the FTSE Vietnam Index and the FTSE Vietnam All-Share Index as part of its quarterly review for Q2 2025.

“VNM ETF and FTSE Review Forecast: Hotspot in Securities and Banking Stocks”

June 2025 is set to be a pivotal month for Vietnam’s stock market, with two large foreign ETFs gearing up for their periodic portfolio restructuring. This upcoming event has the potential to cause significant fluctuations in the market, making it a critical period for investors and market enthusiasts alike.

“The Stock Whisperer: Unveiling the Next FTSE Vietnam Index Contender”

The FTSE Vietnam Index is set for a potential shake-up, with SSI Research predicting the addition of HCM. This addition is anticipated as HCM satisfies all the requirements, and no stocks are expected to be removed.