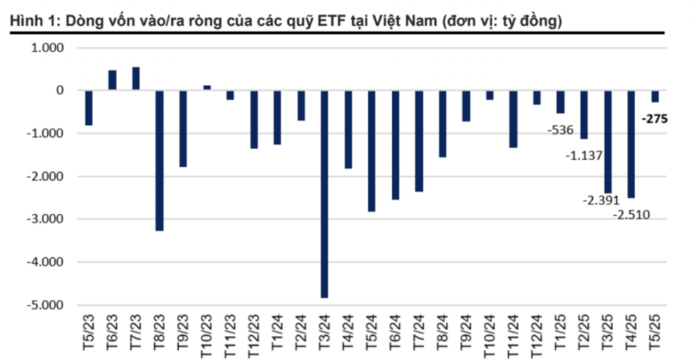

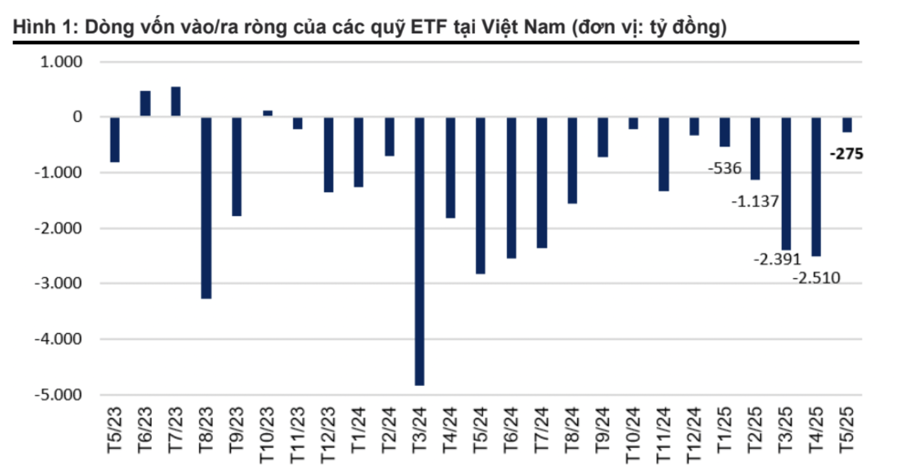

Vietnamese ETFs witnessed net outflows in May 2025, with a value of nearly VND 275 billion, a significant decrease compared to previous months, according to VnDirect statistics.

The cumulative net outflows for the first five months of 2025 totaled over VND 6,864 billion, 20.8% lower than the outflows recorded in the same period in 2024. The main ETFs experiencing outflows in May 2025 included Fubon FTSE Vietnam ETF (VND 245 billion), Xtracker FTSE Vietnam (VND 216 billion), DCVFM VN30 ETF (over VND 122 billion), and SSIAM VNFIN Lead ETF (more than VND 56 billion).

On the other hand, DCVFMVN Diamond ETF and Global X MSCI Vietnam ETF saw net inflows of over VND 335 billion and VND 44 billion, respectively.

Turning to foreign investor activity, after 15 consecutive months of net selling, foreign investors turned to net buying in May 2025, with a total net buy value of over VND 488 billion. Cumulatively, for the first five months of 2025, the total net selling value of foreign investors was over VND 41,900 billion, 16.9% higher than the net selling value in the same period last year.

In May 2025, foreign investors net bought VND 914 billion on the Hose exchange while net selling VND 258 billion and VND 167 billion on the Hnx and Upcom exchanges, respectively. The stocks that foreign investors net bought the most in May 2025 were MBB, MWG, NLG, PNJ, and CTG.

On the contrary, the stocks that foreign investors net sold the most in May 2025 included VHM, VCB, VRE, VNM, and SSI.

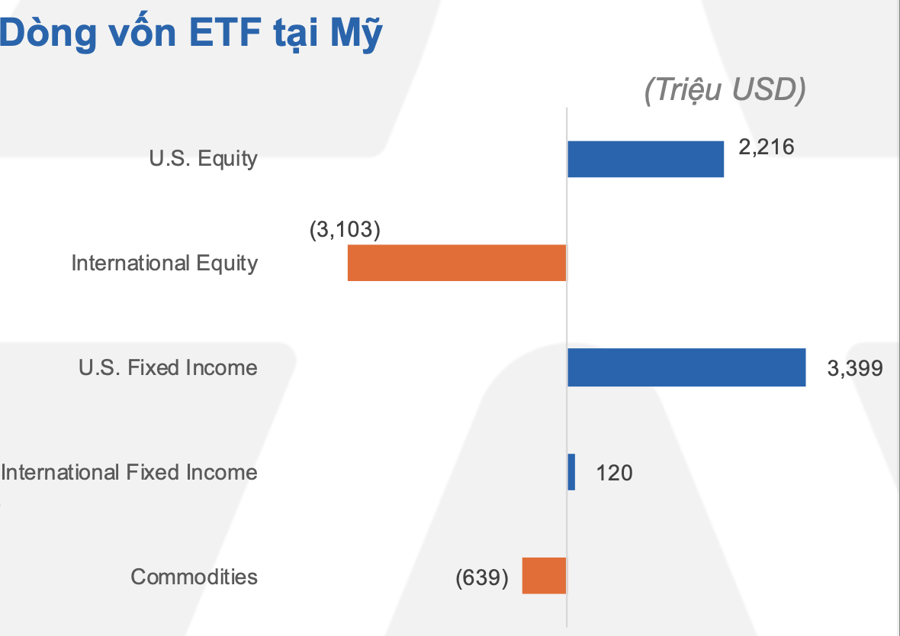

After a sharp decline in April 2025, the Dollar Index remained below 100 points in May 2025. The weakness in the Dollar Index contributed to the return of foreign investment flows to the Vietnamese stock market in May 2025.

With the expectation that the Federal Reserve (Fed) will implement two interest rate cuts in 2025 amid negative impacts from President Trump’s trade policies weakening the US economy, VnDirect forecasts that the Dollar Index will remain low in the coming time.

Additionally, the anticipated progress in Vietnam-US trade negotiations and the prospects for an upgrade of the stock market are expected to encourage foreign investors to maintain their net buying position in the Vietnamese stock market for the remainder of 2025.

In terms of valuation, VnDirect believes that the market’s P/E ratio is attractive, given the expected strong earnings growth in 2025. The impressive recovery of the VN-Index from the end of Q2 to Q3 has brought the market’s P/E ratio back to around 12.9 times, similar to the beginning of the year. However, the valuation remains appealing with a 16% discount to the 10-year average P/E. Despite the challenges posed by US countervailing duties, we forecast earnings growth of listed companies on HOSE to increase by about 12-17% in 2025, depending on tax scenarios.

This reinforces the prediction that the forward P/E of the VN-Index for 2025 will range between 11 and 11.5 times.

In the short term, it is necessary for the market to consolidate and absorb cheap supply, establishing a new price base to converge sufficient supporting factors and momentum for a breakthrough above this critical resistance level. This is also the strategic time for investors to restructure their portfolios—taking profits from stocks that have risen sharply and shifting towards sectors with attractive valuations and those that have not fully recovered to pre-April 2nd levels.

Notable opportunities are present in the securities, steel, and export-oriented industries, such as textiles and seafood, as supportive factors are expected to emerge in the near future.

VnDirect maintains three scenarios for the market in 2025, with the base case scenario targeting VN-Index at 1,400 points. In the optimistic scenario, the VN-Index could surpass the 1,500-point mark if Vietnam successfully negotiates with the US to reduce countervailing duties below 20% or significantly cuts interest rates to boost economic growth.