BIG has taken another step forward in its share issuance process to pay dividends for the year 2024, according to the plan approved at the 2025 Annual General Meeting of Shareholders on April 27.

As planned, BIG will issue over 905,000 new shares to pay dividends for 2024, at a ratio of 50:3, meaning that for every 50 shares owned, shareholders will receive 3 new shares. The newly issued shares will not be restricted from transfer. The source of the issuance will be from undistributed profits for the year 2024.

With this plan, BIG expects to increase its number of shares from nearly 15.1 million to nearly 16 million, corresponding to a capital scale of nearly VND 160 billion. This is also the second consecutive year that BIG has paid dividends since its listing on the stock exchange in 2022. In 2023, the company distributed dividends at a rate of 5%.

BIG decided to distribute dividends as the company closed the year 2024 with a record profit of nearly VND 10 billion, more than four times that of 2023. BIG’s growth in 2024 mainly came from the expansion into the agricultural produce sector, especially durian and raw coffee beans. Establishing links with several export partners in the industry has significantly supported sales activities.

At the 2025 Annual General Meeting, BIG’s management board announced that the orientation for this year will continue to focus on agricultural produce development, with a plan to achieve VND 480 billion in revenue and a net profit of nearly VND 10 billion, an increase of 3% and 2%, respectively, compared to the previous year.

Another highlight is BIG’s official name change to Big Group Holdings, marking a shift in orientation and business model. The company stated that the name change reflects its strategy to expand into multiple business areas, rather than focusing on a specific industry as before.

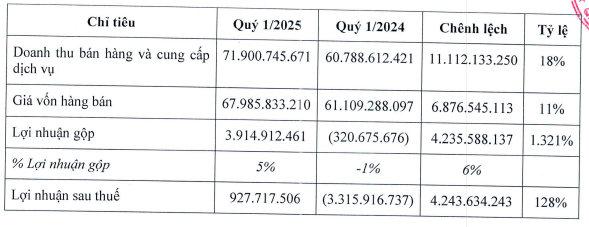

In the first quarter of 2025, BIG reported a positive net profit of nearly VND 928 million, a significant improvement compared to a net loss of over VND 3.3 billion in the same period last year.

The company attributed the improvement to a 15% increase in revenue from the sale of goods and finished products. BIG also achieved gross profit by optimizing input costs and increasing the proportion of high-profit margin items. Among them, agricultural produce products (coffee) with high gross profit margins were introduced, generating a total revenue of over VND 27 billion, contributing 38% to the total.

The financial results were also supported by reductions in other expenses and corporate income tax expenses.

|

BIG’s Financial Results for Q1/2025

Unit: VND

Source: BIG

|

Huy Khai

– 16:25 06/06/2025

The King of Cooking Oil Ventures into Real Estate: A Mega Project Unveiled

The KIDO Group unveils its strategic initiative to capitalize on its existing land banks to embark on large-scale real estate ventures. With a vision to expand its ecosystem and attract investments, the group is poised to transform these lands into thriving hubs of development, creating opportunities for growth and innovation.

The State Bank of Vietnam Approves Capital Increase for Nam A Bank to Over VND 18,000 Billion

On June 4th, 2025, the State Bank of Vietnam (SBV) approved Nam A Bank’s request to increase its charter capital by a maximum of VND 4,281 billion. This move will see the joint-stock commercial bank, listed as NAB on the Ho Chi Minh City Stock Exchange (HOSE), strengthen its financial position by issuing shares from its owner’s equity and through an employee stock ownership plan (ESOP).

HAG Ventures into Equity Swap: A Bold Move to Convert $100 Million Debt into Shares

Let me know if you would like me to tweak it further or provide additional suggestions!

The HAG Board of Directors has approved a plan to issue shares to partially redeem a debt related to the “Bonds issued by Hoang Anh Gia Lai Joint Stock Company on December 30, 2016 – Group B”. As of December 31, 2024, this bond issue carries a principal debt of VND 2,000 billion and accrued interest of VND 1,937 billion.