Thien Nam Group, a leading trading and export company in Vietnam, has recently announced its decision to sell several of its real estate assets. These assets include three parcels of land located in prime areas of Ho Chi Minh City, specifically in District 10.

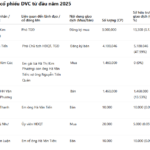

The first parcel, known as BP 443739, is addressed as 355 – 365 Ngo Gia Tu, Ward 3, District 10, with a total area of 2,003 square meters. The second parcel, BK 704772, is located at 01 – 03 Ngo Gia Tu, Ward 2, District 10, spanning 391 square meters. Lastly, BK 704771 is situated at 451 – 453 Nguyen Tri Phuong, Ward 8, District 10, covering 262 square meters.

The decision to sell these assets is aimed at settling debts, with an expected transaction value of approximately 60 billion VND. It’s important to note that the total value of the asset sales is less than 35% of the total assets reported in the company’s latest financial statements.

Illustrative image

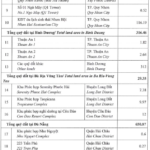

According to Thien Nam Group’s website, these three properties are among the ten locations that the company currently leases out as office spaces. The tenants for these specific properties include Saigon Eye Hospital, KFC, and ACB, respectively.

In recent news, the Hanoi Stock Exchange (HNX) has imposed restrictions on the trading of Thien Nam Group’s stocks (TNA) due to delayed submission of its audited financial statements for the year 2024. As a result, TNA stocks will only be traded on Fridays, starting from the date of lifting the trading suspension.

Additionally, Thien Nam Group’s stocks were previously suspended from trading due to mandatory delisting, as the company had violated information disclosure obligations.

In terms of financial performance, Thien Nam Group reported a decline in revenue for the first quarter of 2025, with a net loss of over 24.4 billion VND, a significant increase compared to the previous year.

As of March 31, 2025, the company’s total assets decreased to nearly 2,058.8 billion VND, with inventory accounting for 52.9% of the total. On the liabilities side, the total amount payable increased slightly to over 1,582.1 billion VND, with short-term financial loans and accounts payable making up a significant proportion.

A Sewing Brand is Unraveling: 50 Years of Threads Snipped and Over 2,500 Jobs at Risk.

With a robust financial standing, a generous dividend policy, and a nearly 50-year operational history, the 29/3 Garment and Textile Joint Stock Company, better known as Hachiba (UPCoM: HCB), stands apart from the myriad of companies that have delisted due to unforeseen circumstances or losses. Hachiba’s departure from the stock exchange is simply a consequence of its evolving shareholder structure, marking a shift towards a more closed-off business model.

“Khải Hoàn Land and Phước Thành Join Forces to Construct the Main Structure of Khải Hoàn Prime”

On June 06, KHAI HOAN LAND CORPORATION (HOSE: KHG) officially signed a contract with Phuoc Thanh to construct and complete the Khai Hoan Prime project, marking a pivotal moment in the journey of creating an iconic and desirable landmark in the South of Ho Chi Minh City.

“Phat Dat Targets Triple Revenue for 2025”

At the upcoming Annual General Meeting on June 27, the leadership team of Phat Dat Real Estate Development JSC (HOSE: PDR) plans to present an ambitious business plan for 2025. With a target of VND 3.2 trillion in total revenue and VND 907 billion in pre-tax profits, the company aims to surpass the previous year’s performance by 2.5 and 3.5 times, respectively. If these goals are met, 2025 will be remembered as the most profitable year for PDR in the recent period from 2023 to 2025.