FPT Retail, a leading digital retail company in Vietnam (ticker: FRT), has announced a resolution by its Board of Directors to issue bonus shares as dividends for the year 2024. The company will issue 34 million new shares to existing shareholders in a 25% ratio (for every four shares held, one new share will be received). Following this issuance, FPT Retail’s charter capital will increase to 1,700 billion VND.

The additional capital will come from the company’s undistributed post-tax profits as of December 31, 2024, as recorded in the audited separate financial statements for 2024. The Board has authorized the company’s legal representative to choose an appropriate time to implement this plan after obtaining approval from the competent authorities.

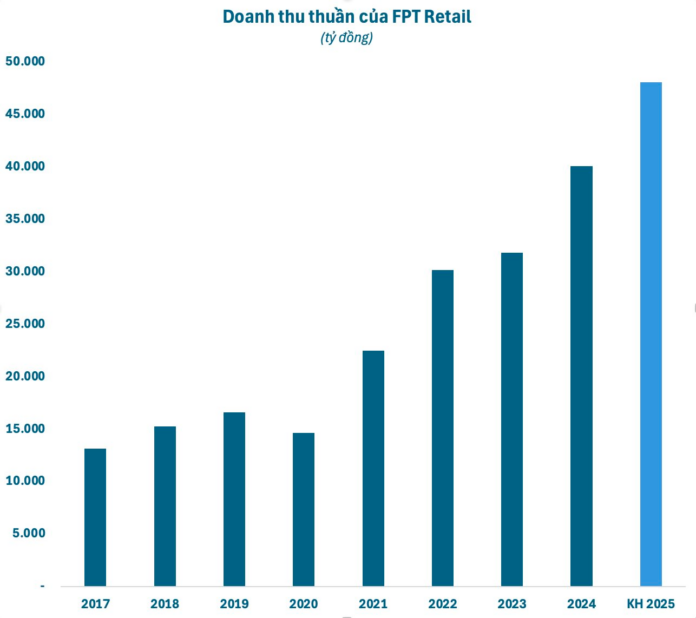

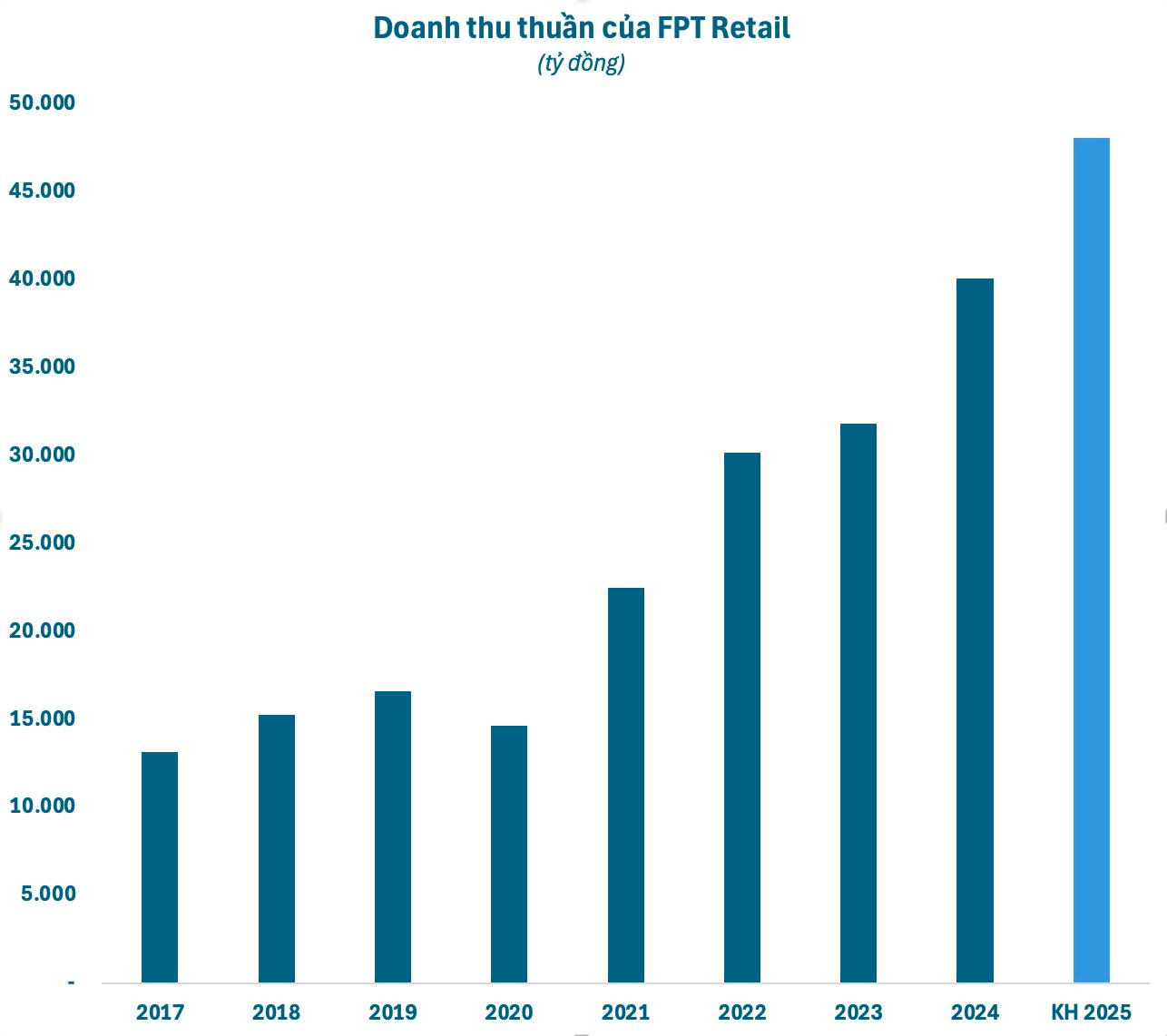

For 2025, FPT Retail has set ambitious business targets, aiming for consolidated revenue of 48,100 billion VND and pre-tax profits of 900 billion VND, representing a 20% and 71% increase, respectively, compared to the previous year. If these goals are met, the company will break its revenue and profit records.

In the first quarter of 2025, FPT Retail reported impressive results with a 29% increase in net revenue to 11,670 billion VND, and a remarkable 3.5-fold surge in post-tax profits compared to the same period last year. With these achievements, the company has accomplished 24% of its full-year business plan.

FPT Long Chau, the company’s pharmacy chain, contributed 8,054 billion VND in revenue during the quarter, reflecting a 46% growth rate year-over-year and accounting for 69% of the company’s total revenue. Long Chau has now achieved an average revenue of 1.3 billion VND per pharmacy per month. Notably, FPT Long Chau’s vaccination centers experienced a significant increase in customer visits, especially for flu and pneumococcal vaccines.

FPT Shop, the company’s other prominent chain, generated 3,682 billion VND in revenue through a strategic focus on operational optimization and a product portfolio realignment towards high-potential items. Across the board, FRT witnessed positive growth in sales of watches, smart wearable devices, tablets, and audio accessories, validating their product diversification and upselling strategies.

Trading on the HoSE, FRT is among the highest-priced stocks. As of the market close on June 6, the share price stood at 165,000 VND, 20% below its peak in mid-January this year. The corresponding market capitalization is approximately 22,500 billion VND.

“Two Fined for Posting Fake Medicine Sale at Long Chau Pharmacy”

“In their statements to the authorities, the two individuals confessed to posting unverified content that spread misinformation, causing public concern and damaging the reputation of the FPT Long Châu system. Their actions serve as a stark reminder of the responsibility that comes with online influence and the potential impact on businesses and society.”

“Leading Battery Brand Announces First Interim Dividend for 2025: A Generous 20% Payout”

The Hanoi Battery Joint Stock Company (HNX: PHN), proud owners of the renowned Bunny Battery brand, is thrilled to announce an interim cash dividend for the first quarter of 2025, offering a generous 20% dividend payout ratio, equivalent to VND 2,000 per share. Shareholders will be delighted to know that the record date for this dividend is set for June 13th, with payments expected to be made by June 24th.