The VN-Index closed the 23rd trading week of 2025 at 1,329.89 points, a decrease of 2.71 points or -0.2% from the previous week, as trading activities slowed down with the average matching trading value slightly down by 6.4%.

This was the first week of correction after four consecutive weeks of gains since late April 2025 (with a total increase of +8.7%). Nonetheless, the average matching trading value on the Ho Chi Minh Stock Exchange (HOSE) still reached VND 20,032 billion, up 9.2% compared to the 5-week average.

In terms of capitalization, there was a shift in money flow towards small-cap stocks, causing the VNSML index to rise against the overall market downturn. Meanwhile, liquidity in large-cap stocks declined for the third consecutive week, causing the weight of money flow allocated to the VN30 group to fall to its lowest level in a year at 40%.

By sector, money flow exhibited significant differentiation last week. Specifically, some sectors witnessed notable declines in liquidity, including Banking, Real Estate, IT, Retail, and Textile & Garment. In contrast, Securities, Agriculture & Fisheries, Food & Beverage, and Oil & Gas sectors experienced price increases alongside improved liquidity.

Across the three exchanges, the average trading value during the 23rd week of 2025 reached VND 25,498 billion, of which the average matching trading value was VND 22,616 billion, down -4.5% from the previous week but still higher than the 5-week average by 13%.

From an investor category perspective, Individuals and Proprietary traders were net buyers, while foreign investors were net sellers for the second consecutive week.

Foreign investors sold a net amount of VND 2,106.5 billion, and their net selling value in matching transactions was VND 692.5 billion. Their main net buying sectors in matching transactions were Food & Beverage and Financial Services. The top net bought stocks by foreign investors included VND, SHB, NLG, MSN, NVL, GEX, EIB, DIG, DBC, and DGW.

On the net selling side, their main sector was Banking. The top net sold stocks included STB, FPT, HAH, VHM, VCI, DXG, VRE, HCM, and VCB.

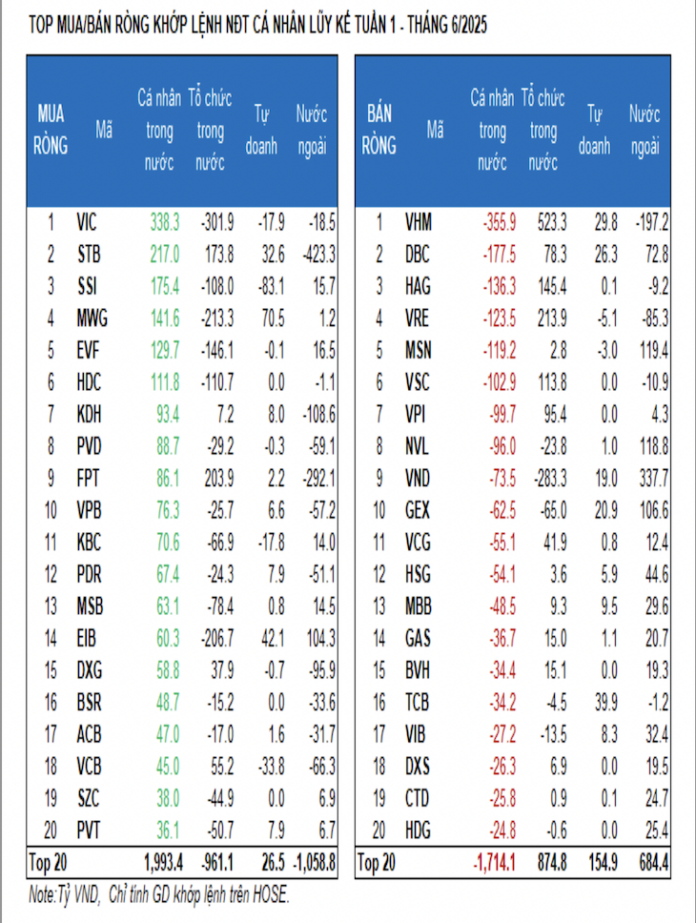

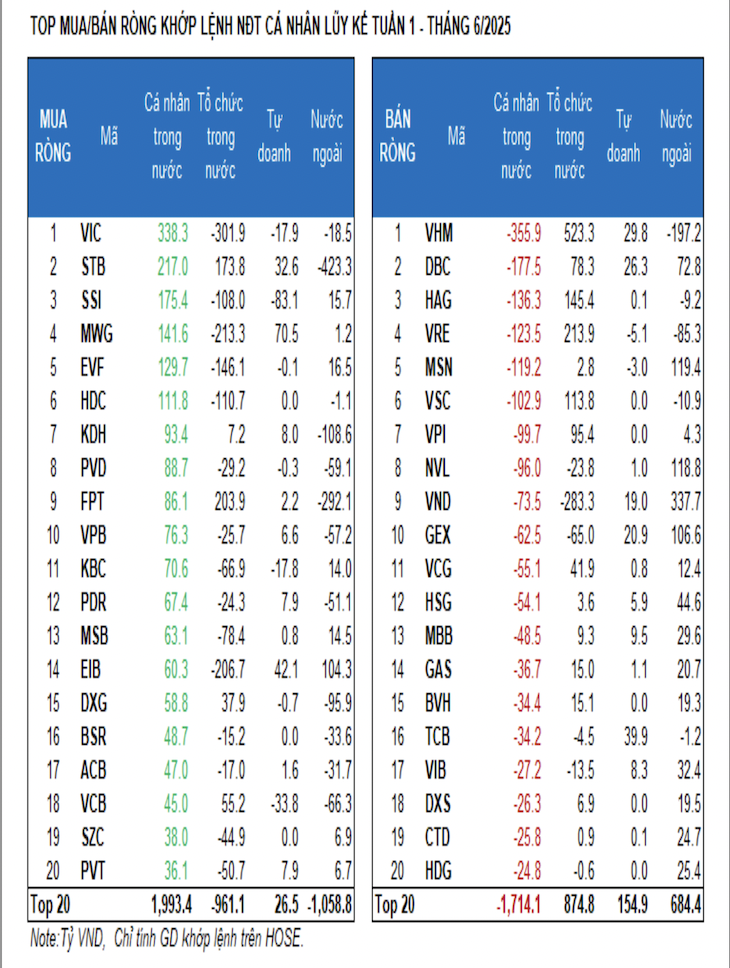

Individual investors net bought VND 2,605.7 billion, including VND 543.5 billion in matching transactions. In matching transactions, they net bought 12 out of 18 sectors, mainly in the Banking sector. Their top net bought stocks included VIC, STB, SSI, MWG, EVF, HDC, KDH, PVD, FPT, and VPB.

On the net selling side, they net sold 6 out of 18 sectors, mainly in Food & Beverage and Industrial Goods & Services. The top net sold stocks included VHM, DBC, HAG, VRE, MSN, VSC, NVL, VND, and GEX.

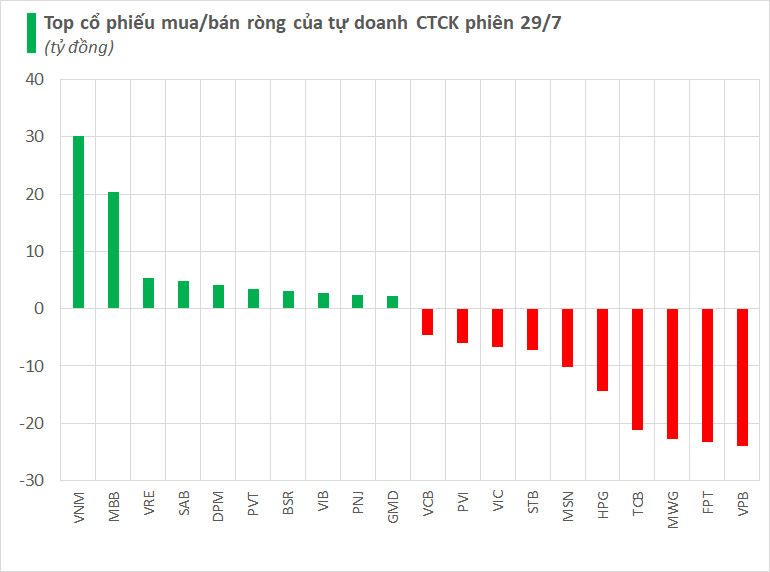

Proprietary traders net sold VND 601.0 billion, but they net bought VND 208.7 billion in matching transactions. In matching transactions, they net bought 13 out of 18 sectors, with the top sectors being Banking and Retail. Their top net bought stocks for the week included MWG, EIB, VIX, TCB, STB, VHM, GMD, DBC, REE, and GEX. Their top net sold sector was Real Estate. The top net sold stocks included SSI, NLG, VCI, VCB, PNJ, VIC, KBC, PLX, HCM, and DGW.

Domestic institutional investors net bought VND 101.7 billion, but they net sold VND 59.7 billion in matching transactions. In matching transactions, they net sold 9 out of 18 sectors, with the highest value in the Retail sector. Their top net sold stocks included VIC, VND, SHB, MWG, EIB, EVF, HDC, SSI, DIG, and NLG.

In terms of net buying value, the top sector was Industrial Goods & Services. Their top net bought stocks included VHM, HAH, VRE, FPT, VCI, STB, HAG, VSC, VPI, and DBC.

The weight of money flow increased in Securities, Food & Beverage, Agriculture & Fisheries, and Oil & Gas Equipment sectors, while it decreased in Real Estate, Banking, Steel, and Retail sectors. It remained stable in Construction, Chemicals, and Mining sectors.

From a capitalization perspective, money flow tended to shift towards small-cap stocks, causing the VNSML index to rise against the overall market downturn. Conversely, the weight of money flow allocated to the VN30 group touched its lowest level in a year.

In the 23rd week, the average trading value of large-cap stocks in the VN30 group decreased by VND 930 billion or -10.4%, marking the third consecutive week of decline. This caused the weight of money flow allocated to the VN30 group to fall to its lowest level in a year at 40%. The weakened proactive demand for blue-chip stocks also led to a -0.33% decrease in the VN30 index, a more significant adjustment than the overall market.

For mid-cap stocks, money flow showed signs of slowing down as liquidity slightly decreased by VND 217 billion (-2.3%) compared to the previous week – the first decline after four consecutive weeks of improvement. Nonetheless, the VNMID index maintained its upward trend, recording the eighth consecutive week of gains.

Meanwhile, the VNSML index moved against the overall market with a +0.91% increase, supported by stable money flow, which rose by VND 75 billion (+3.7%) compared to the previous week.