On June 6th, the annual general meeting of Hoang Anh Gia Lai Joint Stock Company (HAGL Group, stock code: HAG) was held in Ho Chi Minh City, attracting much attention from shareholders and investors.

The highlight of the meeting was the frank and emotional sharing from HAGL Group’s Chairman, Mr. Doan Nguyen Duc (commonly known as Bau Duc). Specifically, Bau Duc proposed two important agenda items for shareholder approval.

First was the issuance of 12 million shares to officers and employees who have been dedicated to the group during its most challenging period. Mr. Duc considered this a gesture of gratitude towards those who remained with HAGL during its darkest hours, silently contributing over the past decade to keep the group from falling.

The second proposal was to issue 210 million shares at VND 12,000 per share to convert a bond debt of up to VND 4,000 billion, but the actual conversion value is only about VND 2,500 billion. If approved by shareholders, HAGL will continue to negotiate with partners to settle the entire debt. Bau Duc expects this to be a turning point for the company to “clean up” its finances and prepare for a more stable development phase.

Notably, at the meeting, Mr. Doan Nguyen Duc declared: “From now on, HAGL will never invest outside of agriculture. I will never venture into real estate, even if it profits VND 1,000 billion a year. I will focus on agriculture to prove that farming in Vietnam can be profitable and sustainable. I hope that from now on, HAGL Group will return to its golden days of 2008.”

Addressing shareholders’ concerns about HAGL’s seemingly quiet period while other enterprises continuously expand, Mr. Duc surprisingly revealed a new project that the group has quietly initiated since October 2024. This project involves sericulture and silk production for export. The project has completed its experimental phase, and the silk factory was finished just a few days before the meeting.

Mr. Duc assessed this model as highly efficient, with a short harvest time of only seven months and superior economic value compared to HAGL’s current crops.

Bau Duc sharing with shareholders during the meeting break

The meeting report showed that HAGL’s business performance, although not meeting the set plan, had many positive aspects. In 2024, the group’s net revenue reached approximately VND 5,783 billion, completing nearly 75% of the target, and profit reached about VND 1,060 billion, equivalent to over 80% of the yearly plan.

HAGL’s financial picture is noticeably improving. The company’s total debt has significantly decreased from VND 27,000 billion in 2020 to about VND 13,000 billion currently. Meanwhile, owner’s equity has increased from over VND 4,000 billion (in 2021) to over VND 9,000 billion.

In the first quarter of 2025, HAGL recorded net revenue of nearly VND 1,380 billion, an 11% increase compared to the same period last year. After-tax profit reached nearly VND 341 billion, a 59% increase, and cumulative loss was significantly reduced to only VND 83 billion. With these results, HAGL has accomplished over 25% of its yearly revenue target in just the first quarter.

Concluding the meeting, Bau Duc affirmed that he had never felt more confident in the past ten years. He believes that with a focused strategy and a shift in management thinking, HAGL Group will continue to thrive in the coming years.

Shareholders voting at the meeting

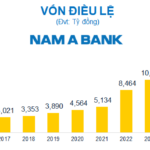

The State Bank of Vietnam Approves Capital Increase for Nam A Bank to Over VND 18,000 Billion

On June 4th, 2025, the State Bank of Vietnam (SBV) approved Nam A Bank’s request to increase its charter capital by a maximum of VND 4,281 billion. This move will see the joint-stock commercial bank, listed as NAB on the Ho Chi Minh City Stock Exchange (HOSE), strengthen its financial position by issuing shares from its owner’s equity and through an employee stock ownership plan (ESOP).

HAG Ventures into Equity Swap: A Bold Move to Convert $100 Million Debt into Shares

Let me know if you would like me to tweak it further or provide additional suggestions!

The HAG Board of Directors has approved a plan to issue shares to partially redeem a debt related to the “Bonds issued by Hoang Anh Gia Lai Joint Stock Company on December 30, 2016 – Group B”. As of December 31, 2024, this bond issue carries a principal debt of VND 2,000 billion and accrued interest of VND 1,937 billion.

“HPG Finalizes the Release Date for its 1.28 Billion Dividend Shares”

The last registration date is June 27th, and the ex-rights trading date is June 26th. Following this issuance, Hoa Phat’s chartered capital will surge to VND 76,755 billion.