Slowgoing for Residential Land Transactions

Data from the Vietnam Real Estate Brokers Association reveals a slowdown in successful transactions in Hanoi during the first quarter and early second quarter of this year, with a decrease of over 45% compared to the same period last year. Once-hot areas like Hoai Duc, Dong Anh, and Thanh Tri now report near-zero transaction levels.

This phenomenon is not isolated but widespread. Even inner-city districts known for their hot transaction prices, such as Cau Giay, Thanh Xuan, and Nam Tu Liem, have experienced a lull. Real estate agencies have had to downsize, resulting in widespread unemployment for brokers, and many homeowners have been trying to sell for 6-8 months without any interest.

Hanoi’s residential land transactions are sluggish.

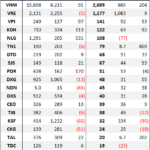

According to data from the One Mount Group’s Market Research and Customer Understanding Center, Hanoi recorded approximately 18,300 real estate transactions in the first quarter of 2025, a 14% decrease from the previous year. This decline is mainly due to a significant drop in the residential land segment, particularly in inner-city areas.

Notably, even areas with high liquidity like Dong Da, Hoang Mai, Gia Lam, and Long Bien have followed this downward trend.

Online real estate listing platform batdongsan.com.vn’s data shows a nationwide 18% decrease in property search interest in April compared to the previous month. Specifically, there was a 20% drop in detached houses and a 22% drop in shophouses. Market observations indicate that while transaction liquidity has decreased and fallen short of expectations, prices are on an upward trend.

“The market is undergoing a significant adjustment after the 2021-2022 feverish period. Buyers are currently very cautious, especially with the backdrop of unattractive loan interest rates for home purchases and insufficient supportive policies,” said Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn.

Nguyen Thanh, a broker specializing in inner-city residential land, believes that buyers and sellers are in a “stalemate,” awaiting clearer market signals.

“The biggest challenge in finalizing transactions is buyers’ mentality of wanting to hold onto their money and wait for real estate prices to drop further. This segment is stagnating, requiring adjustments to unlock capital and balance supply and demand,” Thanh stated.

Are Prices Still High?

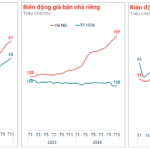

Contrary to the sluggish transaction activity, residential land prices in Hanoi have remained high and even increased slightly in some areas. According to Savills Vietnam’s Q1 2025 report, residential land prices in Hanoi increased by an average of 3-5% compared to the same period in 2024, despite a significant drop in transactions.

In districts like Thanh Xuan, Cau Giay, and Dong Da, houses in wider alleys with red books (land-use rights certificates) still fetch prices ranging from 130 to 180 million VND per square meter. In central wards like Kim Ma (Ba Dinh) and Hang Bong (Hoan Kiem), asking prices have even surpassed 350 million VND per square meter in some places, despite no transactions occurring for several months.

Besides the psychological factor of price retention, the scarcity of inner-city land is a key reason for this trend. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokers Association, stated, “The supply of low-rise housing in Hanoi’s inner city has barely increased in the past few years. Meanwhile, the expansion of new urban areas has not yet materialized, leading to a scarce supply that drives up land prices and maintains stability.”

Additionally, some outlying areas of Hanoi are experiencing price increases due to infrastructure expectations. For example, in Gia Lam and Dong Anh, which are expected to become new districts soon, residential land prices have increased by 5-10% compared to the previous year, despite low liquidity.

Another factor contributing to the difficulty in price reduction is the rising construction cost. As the prices of materials, labor, and permit fees increase, the total asset value must also adjust accordingly. For newly built houses, owners have no choice but to maintain a certain price to avoid losses.

According to Dr. Tran Xuan Luong, Vice President of the Vietnam Real Estate Research Institute, the price increase for residential land in inner-city areas is mainly due to the psychological factor of a shortage of affordable housing supply. With prices continuously escalating while people’s incomes do not increase proportionally, the market is witnessing a significant drop in transactions. Additionally, high expectations from sellers also contribute to the elevated price levels.

“Although peripheral areas and provinces adjacent to Hanoi offer more reasonable prices, the lack of synchronized infrastructure and transportation makes inner-city real estate the preferred choice for buyers. However, buyers need to be prudent and choose segments that align with their financial capabilities. If there is no immediate need for housing, it is advisable not to rush into purchases in the context of scarce supply, legal obstacles, and especially for social housing,” advised Dr. Luong.

The Expert’s Paradox: When Supply Increases, Prices Should Decrease, But Not in This Case.

Mr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, shared his insights on the country’s real estate market. He noted that it is unlikely for property prices to decrease and that there are indications of rising prices. Interestingly, he pointed out a contradiction where an improvement in supply should, in theory, lead to lower selling prices. However, in the current market, supply is increasing, but prices remain high.