At the Vietnam Investment Forum 2025: Mid-Year Update, Ms. Doan Mai Hanh, Senior Director of Sales and Trading at TCBS, and Mr. To Tran Hoa, Deputy Head of Market Development at the State Securities Commission of Vietnam, shared insights on the proposed minimum paid-up capital requirement of 10 trillion VND (approximately 420 million USD) for organizations licensed to operate a crypto asset exchange.

This staggering amount surpasses the capital requirements for industries such as banking, insurance, and aviation in Vietnam.

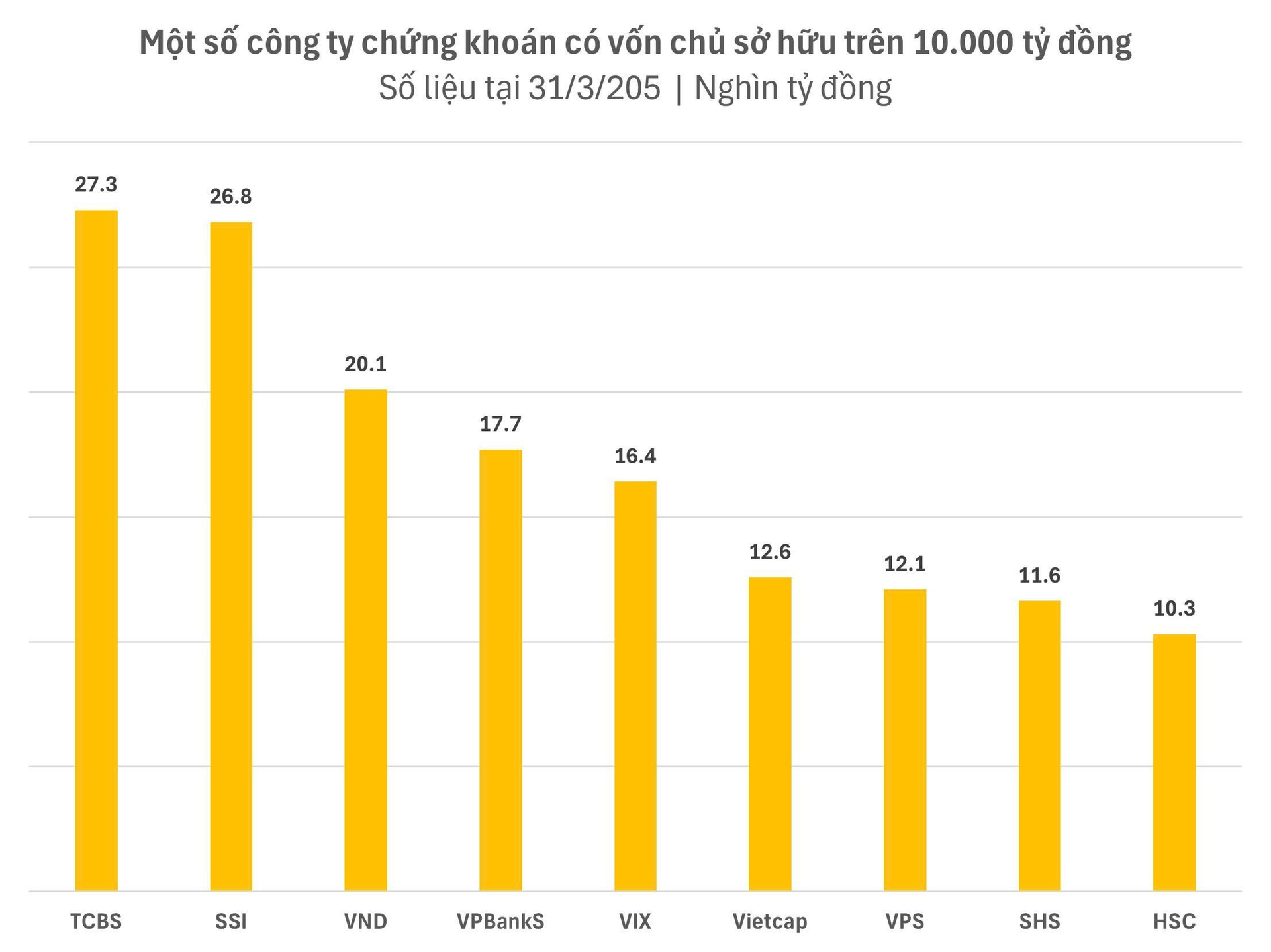

As of the end of March 2025, only nine securities companies in Vietnam have shareholder equity exceeding 10 trillion VND.

Ms. Hanh assessed that the recent moves by regulators, including the development of policies on crypto assets and the pilot of exchanges, demonstrate a “very open and proactive” approach to recognizing crypto assets as a legitimate asset class.

She views this as a positive signal, opening up opportunities for service providers, businesses seeking alternative funding channels, and investors looking to diversify their portfolios.

However, she emphasized that crypto assets are a novel and highly risky field. Thus, stringent capital and shareholder composition requirements are necessary to ensure that only well-capitalized, experienced, and risk-management-capable organizations can participate, protecting both the market and investors.

Doan Mai Hanh, Senior Director of Sales and Trading, TCBS

Regarding the regulation that 35% of the paid-up capital must come from organizations in five specified sectors: banking, securities companies and investment funds, technology companies, and insurance companies, Ms. Hanh believes that each of these sectors possesses distinct advantages.

Banks have strong financial resources and well-established KYC and anti-money laundering systems; securities companies and fund managers have extensive trading and asset management experience; technology companies have a deep understanding of blockchain technology; and insurance companies can offer investment insurance products.

However, she acknowledged that raising 10 trillion VND in paid-up capital is a challenging task, especially for businesses aiming to participate in the experimental phase. Additionally, there is pressure to achieve consensus among diverse shareholders.

To Tran Hoa, Deputy Head of Market Development, State Securities Commission of Vietnam

Mr. Hoa, a member of the policy drafting team, added that while the 10 trillion VND and 35% requirements are accurate, they are not sufficient. In fact, the entire 100% of the paid-up capital – the full 10 trillion VND – must come from organizations, with no allowance for individual investors. This crucial point enhances transparency, improves governance, and mitigates the risk of individuals manipulating the system.

Mr. Hoa justified the high capital requirement by equating the role of a crypto asset exchange to that of a stock exchange, a securities depository, and a securities company combined. These organizations collectively undertake complex functions such as market organization, payment processing, issuance, and depository, necessitating a highly stable, secure, and transparent operating system.

Currently, the two stock exchanges in Vietnam have a combined capital of approximately 7 trillion VND, and the Depository Center has 3 trillion VND in capital, totaling 10 trillion VND. Hence, Mr. Hoa affirmed, “If the crypto asset exchange integrates all these functions, a similar capital requirement is reasonable.”

In reality, some initially proposed a requirement of 20 trillion VND. However, considering this is a pilot phase, 10 trillion VND is deemed appropriate, given the capabilities of businesses at present.