In the latest announcement, Saigon Investment and Debt Trading JSC and Nam Sai Gon Debt Trading Co., Ltd. have reported purchasing a total of nearly 12 million shares of

BCG Energy JSC (code: BGE)

, thereby officially becoming major shareholders in this “Bamboo Capital” enterprise. The transactions were executed during the trading session on May 28th.

Post-transaction, Saigon Investment and Debt Trading JSC holds over 38 million BGC shares, representing a 5.26% stake. Nam Sai Gon Debt Trading Co., Ltd. owns nearly 42 million shares, equivalent to a 5.71% stake. The total value of these transactions is estimated at approximately VND 47 billion.

These acquisitions by the two organizations come amidst BGE’s leadership selling their shares before the BGE code was officially restricted from trading from May 29th due to a delay in submitting the audited 2024 financial statements beyond the 45-day deadline from the end of the reporting period as stipulated by regulations.

Specifically, during the May 28th session, BGE’s Deputy General Director, Dang Dinh Quyet, successfully sold 3 million BGE shares and now holds only 100,000 shares. Mr. Quyet is estimated to have earned nearly VND 12 billion from this transaction.

In a similar vein, Board Member Le Thanh Tung has registered to offload his entire holding of over 3 million BGE shares. The expected trading period is from May 28th to June 19th. Mr. Tung has not yet reported the outcome of this transaction.

Turning to BGE’s business performance, according to the company’s self-prepared Q1/2025 financial statements, consolidated revenue reached VND 297 billion, a 7% decrease compared to the same period last year. Consequently, net profit stood at only VND 4.4 billion, a significant drop of 92%. BGE attributed this decline to unfavorable weather conditions reducing power output and losses from joint ventures, as well as foreign exchange losses at units with foreign currency-denominated debts.

In another development, BGE has just announced receiving an administrative fine for tax violations due to late submission of personal income tax returns. Specifically, BGE’s personal income tax returns for December 2024 and December 2023 were submitted past the deadline. As a result, BGE was fined over VND 7 million and VND 11.5 million, respectively.

In the stock market, BGE shares closed the trading session on June 5th at VND 4,300 per share.

“Leading Battery Brand Announces First Interim Dividend for 2025: A Generous 20% Payout”

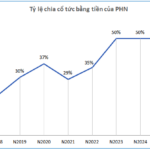

The Hanoi Battery Joint Stock Company (HNX: PHN), proud owners of the renowned Bunny Battery brand, is thrilled to announce an interim cash dividend for the first quarter of 2025, offering a generous 20% dividend payout ratio, equivalent to VND 2,000 per share. Shareholders will be delighted to know that the record date for this dividend is set for June 13th, with payments expected to be made by June 24th.

Unlocking THACO’s 2025 Vision: Strategically Navigating Challenges to Boost Profits and Transform Performance

In 2024, THACO recorded a remarkable consolidated after-tax profit of VND 3,228 billion, with the majority of this success attributed to the outstanding performance of Thaco Auto. Thaco Auto’s impressive contribution stood at VND 4,410 billion in consolidated pre-adjusted tax profit, showcasing its pivotal role in driving THACO’s overall profitability.