Fears of tariff-related repercussions are once again gripping the market, despite positive developments in Vietnam-US trade negotiations. While the expected tariff rates may be lower than the maximum 46%, they still negatively impact export-oriented sectors, hindering economic growth.

The index plummeted as much as 9 points but later recovered, closing 3.65 points lower at 1,342. The breadth was worse than the previous day, with 168 declining stocks versus 143 gainers. Large-cap stocks witnessed capital outflows, while only a handful of sectors in the mid-cap space managed to stay in the green. These included investment and utilities, which rose 1.56% and 1.39%, respectively, with stocks like HUT, HTN, VC2, REE, ISH, and CC1 surging by 13%.

Most other sectors, including banking, securities, and real estate, dipped into the red. Vin stocks also experienced profit-taking. However, there was a glimmer of hope in the industrial real estate sector, with KBC, BCM, SIP, and SNZ maintaining their upward trajectory. Brokerage stocks like DXS hit the daily limit-up, while CRE rose by 2%…

The securities sector also witnessed broad-based selling, with VCI and CTS being the only exceptions. The average decline among stocks in this sector was 1%. The top stocks dragging down the market included VCB, GAS, TCB, BID, HPG, VNM, VHM, and VPB, collectively wiping out 3.10 points from the VN-Index.

On the flip side, MSN and REE single-handedly propped up the market, reclaiming over 1 point. Investor sentiment turned cautious as the highly anticipated tariff negotiation results draw near. Total matched orders across the three exchanges reached VND21,500 billion, with foreign investors net selling VND489.6 billion. Specifically, they net sold VND476.7 billion in matched orders.

Foreign investors’ net buying in matched orders was concentrated in the food and beverage and chemical sectors. The top stocks in their net buying list included MSN, VND, SSI, VRE, KBC, NVL, VIB, CSV, and SZC. On the selling side, they offloaded banking stocks, with STB, VHM, VIC, VIX, DXG, FPT, HPG, HAH, and EIB being the top sells.

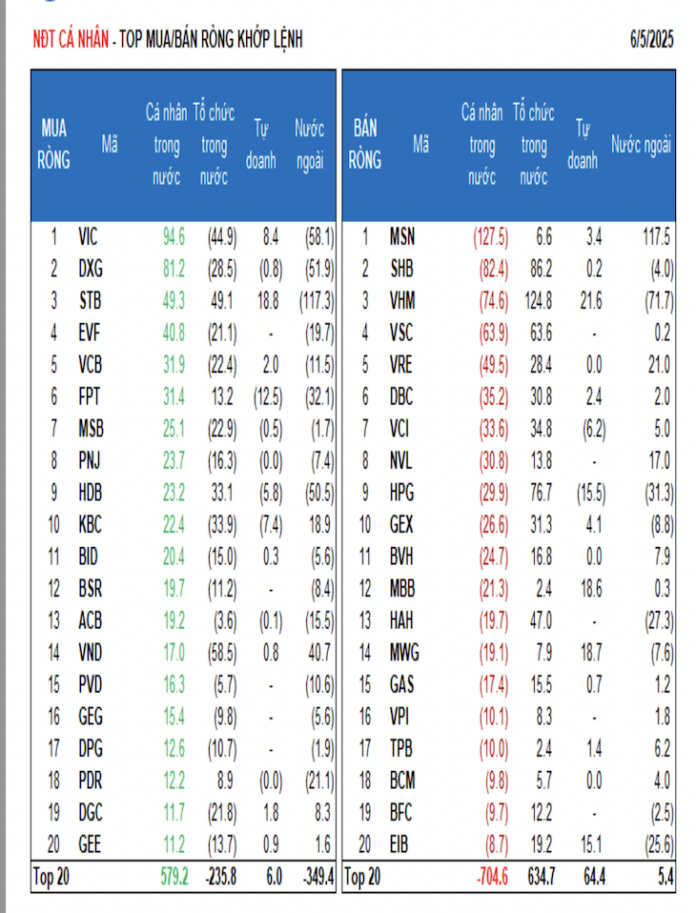

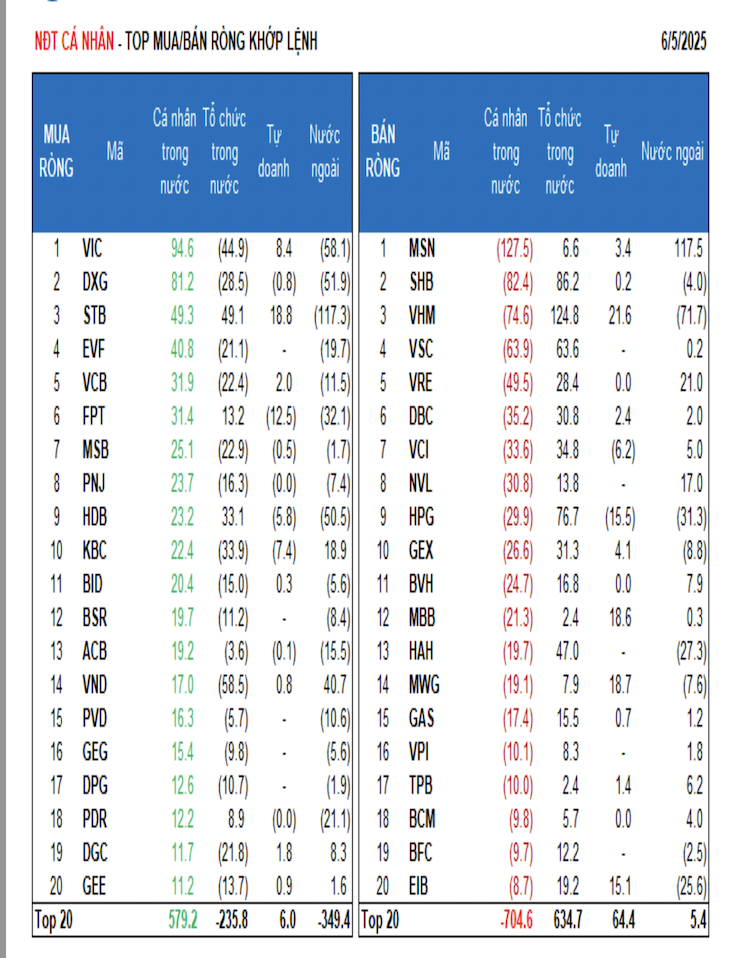

Individual investors net sold VND154.0 billion, including VND59.9 billion in matched orders. In terms of matched orders, they were net buyers in 11 out of 18 sectors, primarily in real estate. Their top buys included VIC, DXG, STB, EVF, VCB, FPT, MSB, PNJ, HDB, and KBC. On the selling side, they net sold 7 out of 18 sectors, mainly in the food and beverage and industrial goods and services sectors. Their top sells included MSN, SHB, VHM, VSC, VRE, DBC, NVL, HPG, and GEX.

Proprietary trading accounts were net buyers to the tune of VND130.9 billion, with matched orders accounting for VND122.0 billion. In terms of matched orders, they were net buyers in 13 out of 18 sectors. The top sectors on their buying list were banking and real estate. The stocks they bought included VHM, STB, MWG, MBB, EIB, TCB, VIC, VHC, GMD, and SSI. On the selling side, they offloaded basic resources stocks, with HPG, FPT, KBC, VCI, HDB, VIB, PLX, CII, VGC, and DXG being the top sells.

Domestic institutions were net buyers to the tune of VND498.8 billion, with matched orders accounting for VND414.7 billion. In terms of matched orders, they were net sellers in 5 out of 18 sectors, with chemicals being the largest. Their top sells included VND, VIC, KBC, SSI, DXG, MSB, VCB, SZC, DGC, and EVF. On the buying side, they scooped up industrial goods and services stocks. Their top buys included VHM, SHB, HPG, VSC, STB, VIX, HAH, VCI, HDB, and GEX.

Today’s matched order value stood at VND2,003.3 billion, down 27.6% from the previous session and contributing 9.2% to the total trading value. Notable matched order transactions among domestic institutions involved FPT, STB, EIB, HAH, VND, and KDC.

In terms of cash flow allocation, there was an increase in securities, construction, chemicals, food, warehousing, logistics and maintenance, mining, courier services, and automobile production. Conversely, there was a decrease in real estate, banking, steel, agricultural and marine products, retail, oil and gas, and personal finance.

Specifically, in terms of matched orders, there was an increase in large-cap (VN30) and small-cap (VNSML) stocks, while mid-cap (VNMID) stocks witnessed a decrease.