The DXY index fell 0.24 points to 99.2 as of the June 6 trading session close, compared to the previous week.

The greenback came under pressure after the Institute for Supply Management (ISM) reported that the May PMI fell to 49.9, the lowest level since June 2024, indicating a contraction in manufacturing activity. Meanwhile, the ADP private employment report showed that only 37,000 new jobs were added in May, the lowest in over two years and well below the Dow Jones forecast of 110,000.

The official employment report from the US Bureau of Labor Statistics showed that the economy added 139,000 jobs in May, higher than expected but still lower than the upwardly revised April figure of 147,000. The unemployment rate remained at 4.2%.

Additionally, the weekly jobless claims data released on June 5 was higher than expected, while the services sector, which accounts for a significant portion of the US economy, unexpectedly weakened in the previous month.

These data have raised concerns about a possible recession or, at the very least, a slowdown in the US economic recovery, partly due to the impact of multilateral tariff negotiations. In this context, expectations that the Federal Reserve (Fed) will soon cut interest rates to support growth have reduced the appeal of the US dollar.

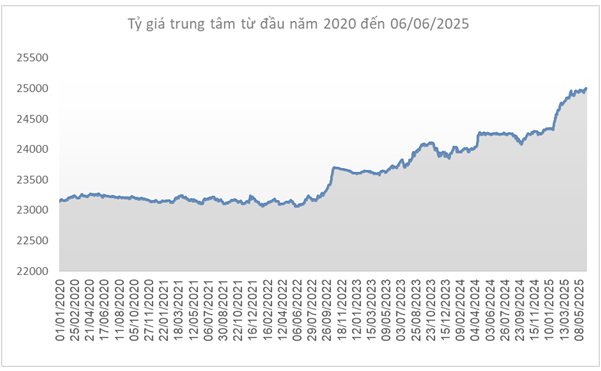

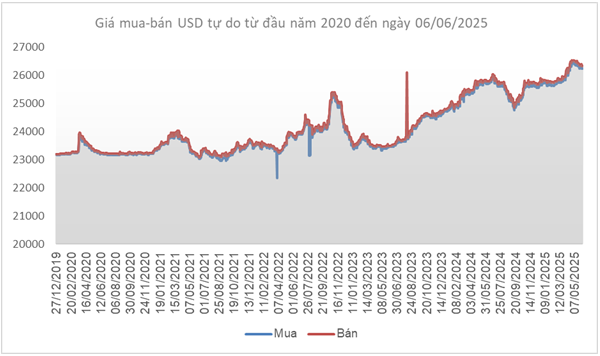

Source: SBV

|

In the domestic market, the State Bank of Vietnam set the daily reference exchange rate for June 6 at 24,992 VND per USD, up 14 VND from the previous week. With a fluctuation margin of ±5%, commercial banks are allowed to trade the USD within the range of 23,742 – 26,242 VND/USD.

The buying and selling rates of USD/VND at the State Bank of Vietnam’s Foreign Exchange Management Department also increased by 13 VND and 15 VND, respectively, from the previous week, quoted at 23,793 – 26,191 VND/USD (buying – selling).

Source: VCB

|

At Vietcombank, the exchange rate on June 6 was set at 25,830 – 26,220 VND/USD (buying – selling), an increase of 20 VND in both directions compared to the previous week.

Source: VietstockFinance

|

In contrast, in the free market, the USD fell by 63 VND in buying rate and 53 VND in selling rate, trading around 26,197 – 26,307 VND/USD (buying – selling).

– 17:12 08/06/2025

“June 4th: The State Bank Raises Central Exchange Rate Past 25,000 VND for the First Time, Bank USD Rates Hit Ceiling Again.”

The US dollar rate at banks has surged to a record high, despite the State Bank of Vietnam’s move to increase the central exchange rate by 22 VND, surpassing the 25,000 VND/USD mark for the first time.