The gold market in Vietnam experienced a volatile period from early April to early June 2025, presenting opportunities for short-term traders to make significant profits within a short period—an unusual occurrence for gold, typically considered a long-term investment to hedge against risks.

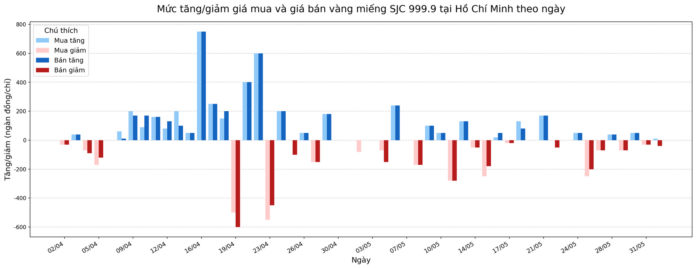

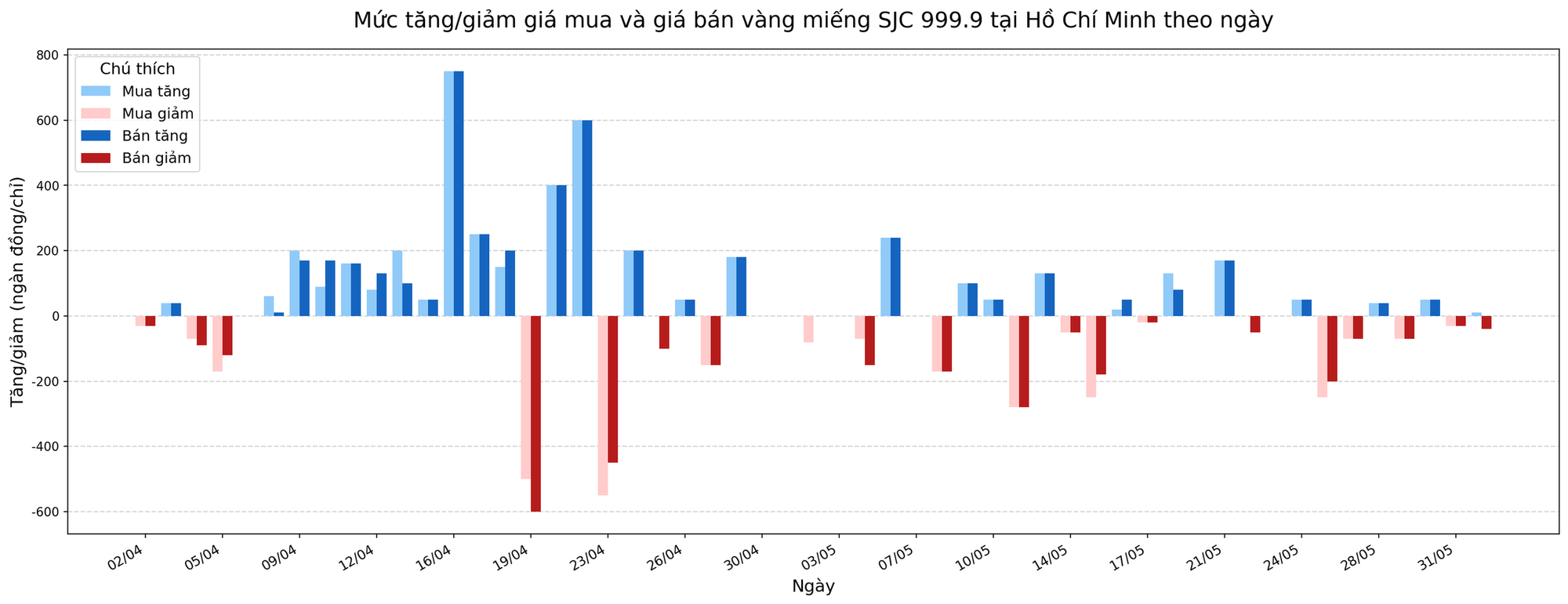

In mid-April 2025, gold prices witnessed dramatic trading sessions with increases or decreases of up to 7.5 million VND per tael in a single day. For instance, on April 16, 2025, SJC gold bar prices in Ho Chi Minh City suddenly surged by 7.5 million VND per tael for both buying and selling, reaching 118 million VND per tael by the end of the day. The following day, on April 17, prices continued to climb by another 2.5 million VND per tael, resulting in a consecutive two-day increase of 10 million VND per tael.敏 traders who bought at low prices and sold at the peak could have profited by 5-7 million VND per tael within just a few days. However, this period was also fraught with risks as the market underwent continuous fluctuations, with sessions from April 19 to April 23, 2025, witnessing sharp declines of 6 million VND per tael, followed by strong gains of 4-6 million VND per tael.

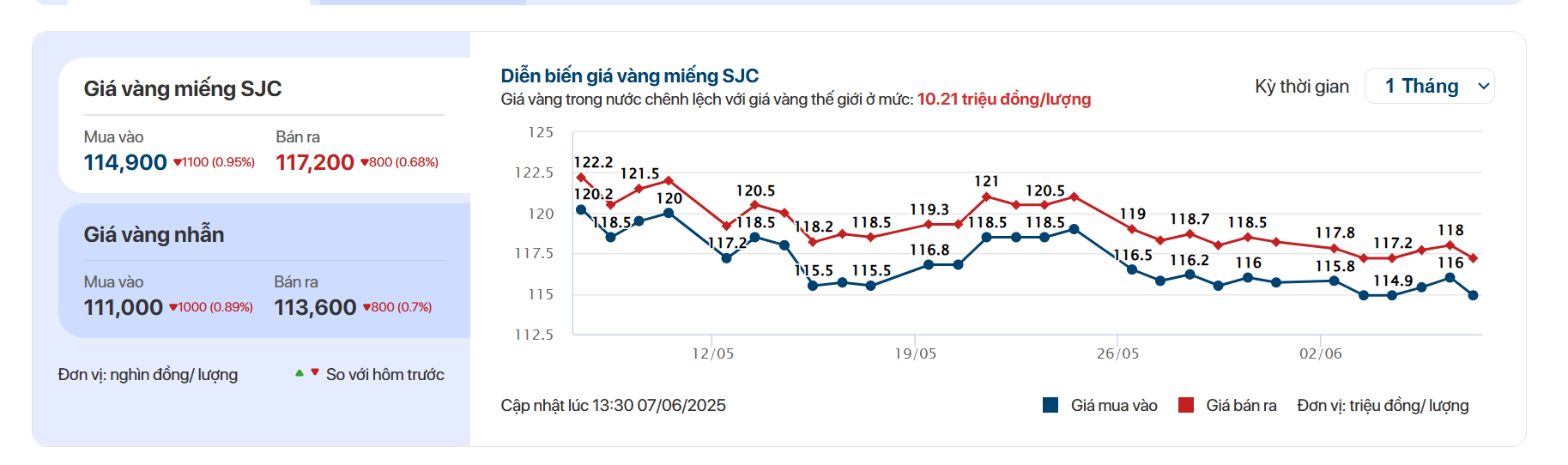

Currently, the opportunity for gold trading has almost vanished. From late May to early June 2025, SJC gold bar prices have been ranging between 118-120 million VND per tael, with daily fluctuations of only 0.5-2 million VND per tael. For instance, during the first week of June 2025, SJC gold prices fluctuated between 117.8-118.2 million VND per tael, with a typical daily variation of 0.5 million VND per tael. This range is too narrow to yield profits after transaction costs and buy-sell spreads (typically 1-2 million VND per tael) are factored in, making trading unfeasible.

Data: CafeF

In reality, the prevailing mindset among Vietnamese gold investors remains geared towards long-term holding, considering gold as a defensive asset against economic risks such as inflation or exchange rate fluctuations. However, during periods of intense volatility like mid-April 2025, speculative trading emerges, particularly among small-scale investors caught up in the price frenzy. Nonetheless, experts caution that short-term speculation entails substantial risks, especially in an unpredictable market.

The recent stability in domestic gold prices can be attributed to several factors. Over time, the State Bank of Vietnam has intensified inspections of gold businesses, curbing price manipulation and speculative hoarding. These inspections have enhanced market transparency and mitigated abnormal fluctuations.

Notably, world gold prices, which directly influence domestic prices, have also refrained from violent swings and shocking moves witnessed a few months ago. This stability stems from the steady monetary policies of major central banks and controlled global inflation. Additionally, the State Bank of Vietnam has efficiently regulated the supply of gold bars in the domestic market, contributing to price stability. Thanks to these factors, the gold market no longer experiences tsunamic waves, reducing short-term speculative opportunities but instilling confidence in long-term investors.

Current Gold Prices

This weekend, domestic gold prices stood at 111-113.5 million VND per tael for plain gold rings and 114.9-117.2 million VND per tael for SJC gold bars. Meanwhile, in the international market, spot gold prices were at 3,303 USD per ounce, equivalent to approximately 104.5 million VND per tael (excluding taxes and fees).

While gold previously benefited from concerns surrounding tariffs and geopolitical tensions in April, these drivers have since lost momentum. In fact, gold may face challenges as the USD recovers and riskier markets, such as stocks, perform well.

This week, Kitco News’ Gold Survey showed that out of 14 Wall Street analysts, 50% (7) predicted higher gold prices, 43% (6) expected a decline, and 7% (1) remained neutral. In the same survey, out of 256 Main Street investors, 66% (169) voted for higher gold prices, 15% (39) expected a decline, and 19% (48) were neutral.

May CPI Rises by 0.16%

The surge in rental prices, home maintenance costs, electricity tariffs, and dining out has led to a notable rise in the consumer price index (CPI) for May 2025, up by 0.16% from the previous month. This indicates a substantial shift in consumer trends and spending patterns, with a weighted average increase of 3.21% for the first five months of 2025 compared to the same period last year. The core inflation rate also rose by 3.1%, signaling a change in the economic landscape that demands attention from policymakers and businesses alike.

Gold Prices Slip as Dollar Recovers, SPDR Gold Trust Sharks Circle

“Market analysts attribute the recent fluctuations in gold prices to seasonal factors and the ongoing trade negotiations. In a bid to expedite the process, the Trump administration has urged its trade partners to submit proposals before the Wednesday deadline. This development has stirred anticipation and uncertainty in the market, with investors closely monitoring the situation.”