Oil prices continue their upward trajectory.

Oil Prices Surge

Oil prices rose over $1 per barrel, marking the first weekly gain in three weeks. This surge came amidst positive US jobs data and the resumption of trade negotiations between the US and China, sparking hopes for economic growth in the world’s two largest economies.

On June 6th, Brent crude oil rose by $1.13, or 1.73%, to $66.47 per barrel. WTI oil also increased by $1.21, or 1.91%, to $64.58 per barrel.

Both oil types ended a two-week losing streak, with Brent crude gaining 2.75% and WTI oil climbing 4.9% for the week.

The US Labor Department’s monthly jobs report showed that the unemployment rate for May 2025 remained steady at 4.2%. Employers added 139,000 jobs, and revisions for previous months indicated a slowing demand for labor.

Additionally, oil prices were boosted by a decline in US oil rig counts, a leading indicator of future output. The number of rigs fell by 4 to 559 in the week ending June 6, 2025, the lowest level since November 2021, according to Baker Hughes, an energy services company.

US Natural Gas Prices Hit a Four-Week High

US natural gas prices rose by 3%, reaching their highest level in four weeks. This increase was driven by expectations of warmer weather, which would lead to greater use of air conditioning and, consequently, higher demand for electricity generated by natural gas. This demand surge comes despite some LNG export plants being shut down for maintenance.

The July 2025 natural gas futures on the New York Mercantile Exchange climbed 10.7 cents, or 2.9%, to $3.784 per mmBtu, hitting its highest level since May 9, 2025. For the week, natural gas prices rose 10%, following a 3% gain in the previous week.

Precious Metals: Gold Down, Silver and Platinum Up

Gold prices dropped by over 1% following stronger-than-expected US jobs data, reducing expectations of a Federal Reserve rate cut this year. Meanwhile, silver prices surged to their highest level since 2012.

Spot gold on the LBMA fell by 1.1% to $3,316.13 an ounce but posted a weekly gain of 0.8%. Gold futures for August 2025 on the New York Mercantile Exchange settled down 0.87% at $3,346.60 an ounce.

The US Labor Department reported that nonfarm payrolls increased by 139,000 in May, higher than the expected 130,000. The unemployment rate held steady at 4.2%, in line with estimates.

Gold is often seen as a hedge against inflation and geopolitical uncertainty. However, higher interest rates tend to dull the appeal of non-yielding bullion.

Silver fell by 0.5% to $35.96 an ounce after hitting its highest level in over 13 years earlier in the session. Platinum, on the other hand, rose by 2.5% to $1,158.20 an ounce, its highest level since March 2022.

Base Metals: Copper Slides

Copper prices declined due to a stronger US dollar and a weaker Chinese yuan, while inventories in London decreased, and concerns about short-term supply limited the downside.

Three-month copper on the London Metal Exchange fell by 0.5% to $9,686.50 a ton. In the previous session, copper touched $9,809.50 a ton, its highest level in over two months.

Iron Ore and Steel Rebar Futures Rise

Iron ore futures on the Dalian Commodity Exchange rose to their highest level in a week, posting weekly gains driven by progress in US-China trade negotiations and robust demand from top consumer China. However, seasonally slow steel consumption curbed the upside.

The September 2025 iron ore contract on the Dalian Commodity Exchange increased by 0.86% to 707.5 yuan ($98.48) per ton. During the session, iron ore peaked at 713.5 yuan, its highest since May 26, 2025. For the week, iron ore gained 0.6%.

Simultaneously, the July 2025 iron ore contract on the Singapore Exchange climbed 0.9% to $95.70 a ton. Iron ore touched $96.40 a ton earlier in the session, its highest since May 29, 2025. For the week, iron ore edged up 0.1%.

On the Shanghai Futures Exchange, steel rebar rose by 0.57%, hot-rolled coil and steel wire both climbed by 0.55%, while stainless steel dropped by 0.16%.

Japanese Rubber Prices Hit a One-Week High

Japanese rubber prices rose to their highest level in a week, buoyed by expectations of easing US-China trade tensions. However, rubber prices posted weekly losses as signs of weakness emerged in the US economy.

The November 2025 rubber contract on the Osaka Exchange (OSE) climbed 1.9 yen, or 0.6%, to 294.3 yen ($2.70) per kg. Rubber touched 297.3 yen per kg earlier in the session, its highest since May 30, 2025. Still, rubber prices fell by 0.2% for the week.

Meanwhile, the September 2025 rubber contract on the Shanghai Futures Exchange rose by 95 yuan to 13,650 yuan ($1,900) per ton.

Rubber for July delivery on Singapore’s SICOM exchange climbed by 0.4% to 160.4 US cents per kg.

Coffee Prices Dip

Robusta coffee futures on the London market fell by $106, or 2.4%, to $4,339 per ton after rising earlier in the session. On June 3, 2025, coffee touched its lowest level in nine and a half months at $4,235 per ton.

Vietnam, the world’s largest producer of robusta coffee, exported 813,000 tons of coffee in the first five months of the year, down 1.8% from the same period last year.

Arabica coffee futures on ICE also dropped by 0.5% to $3,5805 per lb after surging more than 4% earlier in the session.

Raw Sugar Prices Remain at a Four-Year Low

Raw sugar prices on ICE dropped to their lowest level in four years due to improved crop prospects in Asia.

Raw sugar for July delivery on ICE fell by 0.08 cent, or 0.5%, to 16.49 cents per lb, after dipping to 16.32 cents, its weakest since June 2021. For the week, sugar declined by 3.2%.

In contrast, white sugar on the London market climbed by 0.4% to $465.20 a ton.

Wheat, Corn, and Soybean Prices Extend Gains

Grain and soybean futures on the Chicago market rose, driven by improved US-China trade relations after leaders from both countries agreed to further discussions.

On the Chicago Board of Trade, July soybean futures climbed 5-1/2 cents to $10.57-1/4 a bushel. July wheat futures rose 9-1/4 cents to $5.54-3/4 a bushel, its highest since May 21, 2025. July corn futures gained 3 cents to $4.42-1/2 a bushel.

Malaysian Palm Oil Prices Rise for the Fourth Straight Week

Malaysian palm oil prices climbed for the fourth consecutive week, despite concerns about rising production and inventories.

The benchmark palm oil contract for August 2025 on the Bursa Malaysia Derivatives Exchange rose by 14 ringgit, or 0.36%, to 3,917 ringgit ($926.88) a ton. For the week, palm oil gained 1.01%.

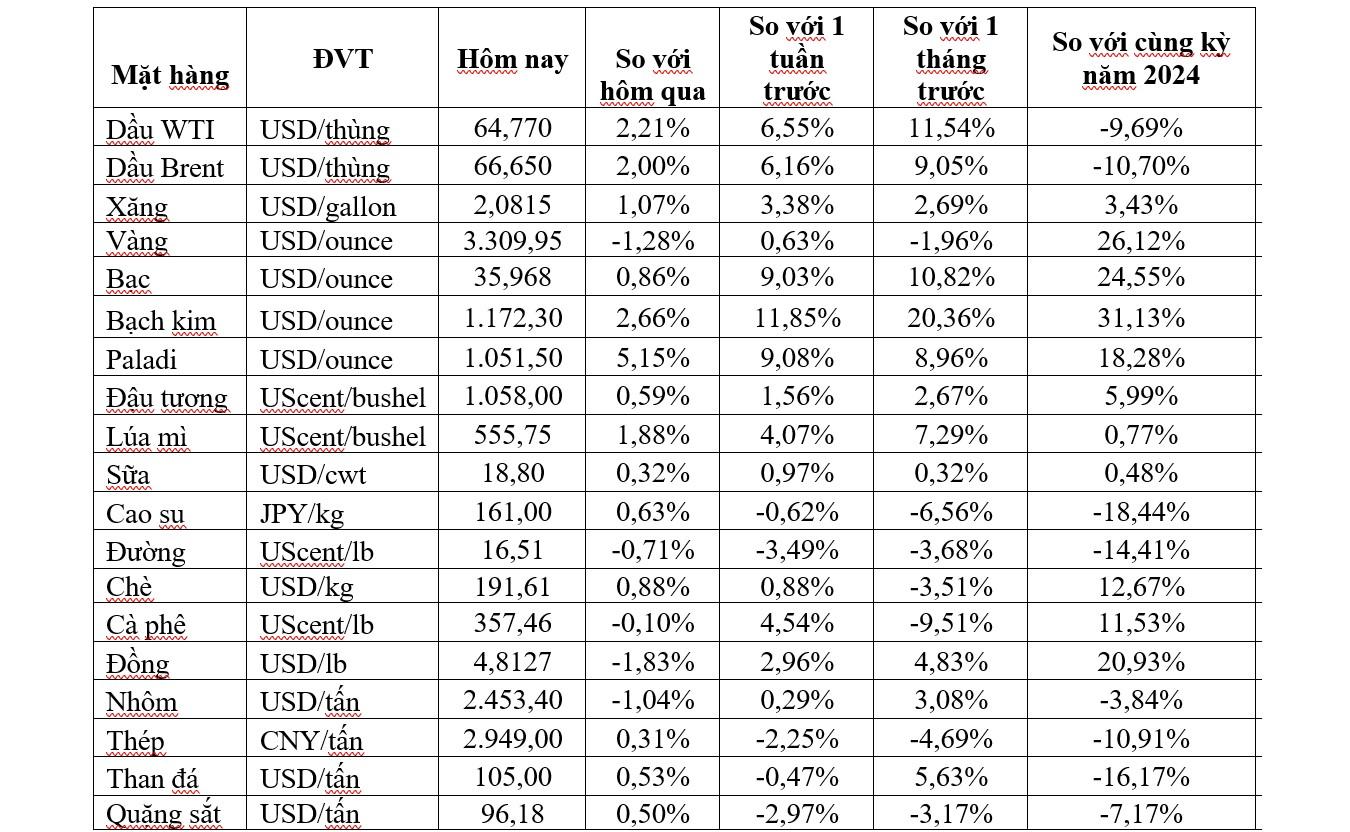

Key Commodity Prices as of June 7, 2025

Gold Prices Plummet Following US Jobs Report, SPDR Gold Trust Sells Off

However, the high demand for risk aversion and the depreciation of the US dollar this week have kept the precious metal prices buoyant, resulting in a weekly gain…

Gold Prices Slip on US-China Trade Talk Hopes

The sentiment among investors turned cautious ahead of the release of the U.S. non-farm payrolls report for May on Friday. With global economic uncertainties looming large, market participants are keenly awaiting insights into the health of the labor market, which could influence the Federal Reserve’s monetary policy trajectory. As the Fed has signaled a commitment to taming inflation, even at the risk of a recession, investors are bracing for a potential shift in their investment strategies.

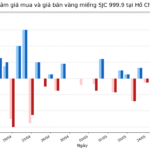

The End of Easy Profits: Riding the Golden Wave

The Vietnamese gold market witnessed a tumultuous surge in April 2025, with gold prices fluctuating by up to VND 7.5 million per tael per day. This volatility presented a lucrative opportunity for savvy traders and investors to profit from the rapid price movements. However, those days of frenzied gold trading seem to be over, as the current market offers little room for such lucrative waves.

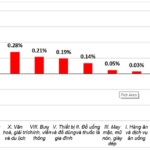

May CPI Rises by 0.16%

The surge in rental prices, home maintenance costs, electricity tariffs, and dining out has led to a notable rise in the consumer price index (CPI) for May 2025, up by 0.16% from the previous month. This indicates a substantial shift in consumer trends and spending patterns, with a weighted average increase of 3.21% for the first five months of 2025 compared to the same period last year. The core inflation rate also rose by 3.1%, signaling a change in the economic landscape that demands attention from policymakers and businesses alike.