PVCFC – Ca Mau Fertilizer Joint Stock Company (PVCFC – Ca Mau Fertilizer, stock code DCM) held an investor meeting on June 2nd, 2025, to share its business performance for the first half of the year and reveal its long-term development strategy. The event was attended by Mr. Tran Ngoc Nguyen – Chairman of PVCFC, Mr. Van Tien Thanh – General Director of PVCFC, Mr. Nguyen Duc Hanh – Member of the Board of Directors, and other investors.

Ca Mau Fertilizer shared that its business results for the first six months of 2025 demonstrated the company’s continuous efforts. The estimated converted urea production reached 501 thousand tons (55% of the plan and equivalent to the same period), NPK production reached 136 thousand tons (62% of the plan, up 40% over the same period), and functional fertilizers reached 70 thousand tons (58% of the plan, equivalent to 94% compared to the same period in 2024).

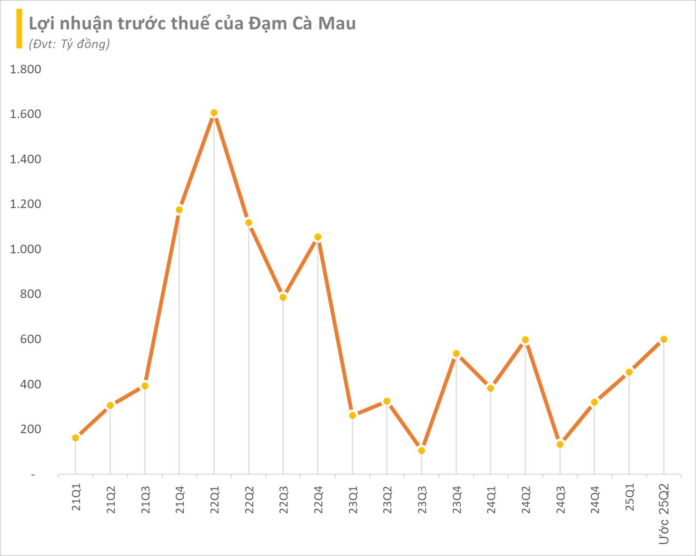

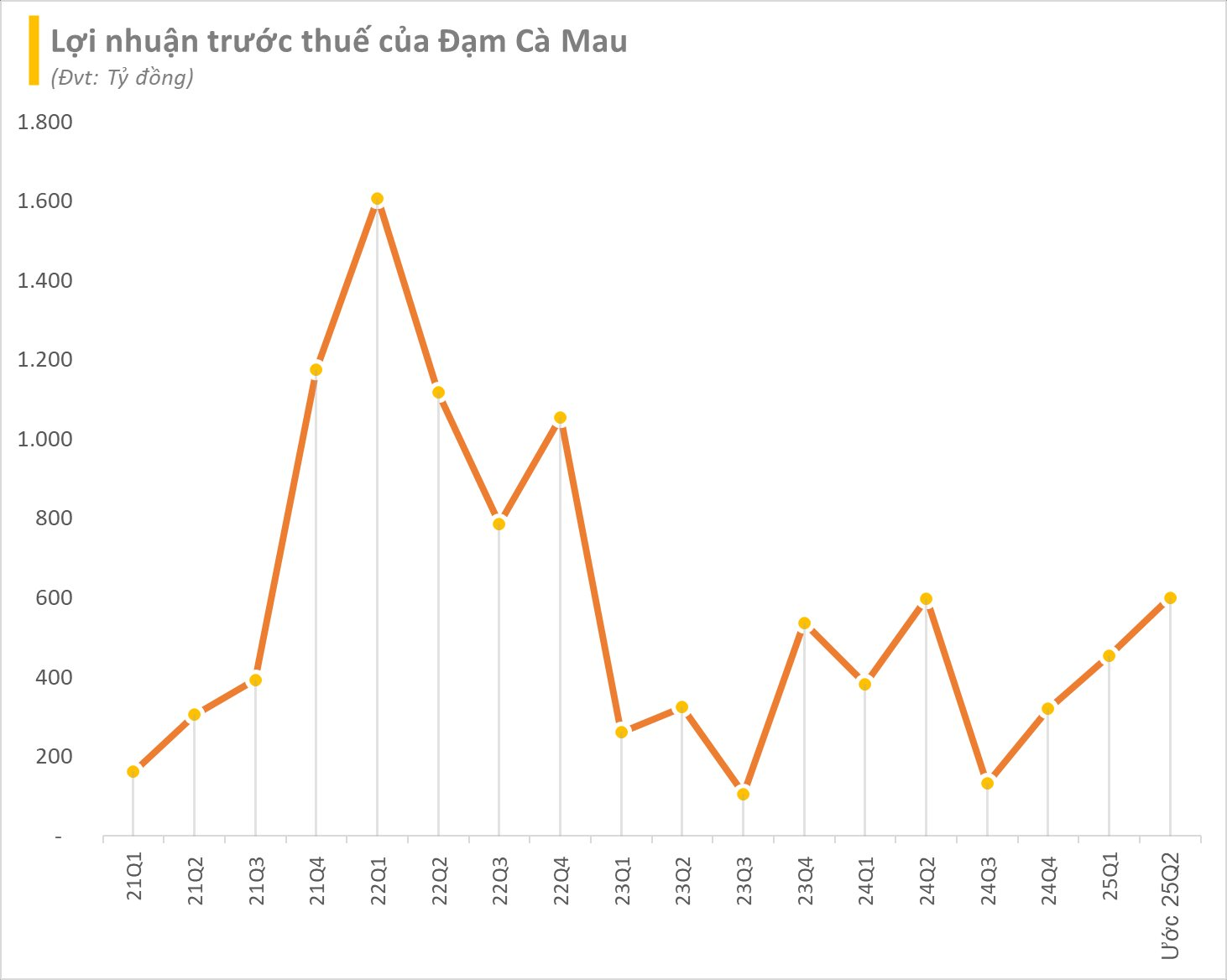

The consolidated revenue for the first six months was estimated at VND 9,591 billion (68% of the plan, up 36% over the same period in 2024), and pre-tax profit was VND 1,054 billion (exceeding the plan by 21% and up 5% over the same period in 2024).

Thus, in the second quarter of 2025, revenue is estimated at VND 6,200 billion, up 60% over the same period last year, and pre-tax profit reached VND 600 billion, a slight decrease of 2% compared to the second quarter of 2024, but up 32% compared to the previous quarter.

In 2025, Ca Mau Fertilizer sets a consolidated revenue plan of VND 13,983 billion and after-tax profit of VND 774 billion, an increase of 0.3% in revenue but a decrease of 46% in profit compared to 2024. The expected dividend ratio for 2025 is 10% of charter capital. This plan will be presented to shareholders for approval at the upcoming Annual General Meeting of Shareholders scheduled for June 16th.

In its latest report, Yuanta Securities stated that the management of Ca Mau Fertilizer remains confident that fertilizer prices, especially urea prices, will continue to be favorable in the period of 2025-2030, due to increasing demand, especially from Cambodia, where cultivated land area is expected to double, and DCM currently holds 40% of the urea market share in this region. In addition, the closure of coal-fired urea plants due to stricter ESG compliance requirements and limited expansion of new production capacity will also positively impact fertilizer prices.

Regarding market expansion, Ca Mau Fertilizer aims to increase its urea market share in the Mekong Delta region from 61% to 72% in the short term. In the long term, DCM plans to increase NPK export volume to Cambodia from 20,000 tons/year to 100,000 tons/year. Additionally, DCM plans to launch high-quality organic and bio-fertilizer product lines in early 2026, although details have not yet been disclosed.

Yuanta also shared that the fertilizer company plans to invest $200 million in the production of industrial gas and fertilizer-related chemicals in the period of 2026-2030, targeting a revenue of VND 5-6 thousand billion. This project will focus on the collection and processing of N₂, O₂, Ar, H₂, and CO₂ gases. Simultaneously, Ca Mau Fertilizer also aims to expand into post-harvest processing, with the goal of building an integrated value chain from cultivation to deep processing of products used in food, beverages, pharmaceuticals, and cosmetics.

Local Authorities Investigate Stores and Slaughterhouses Linked to C.P. Vietnam

“The Department of Animal Husbandry and Veterinary Services of Region VII paid a visit to Soc Trang to collect pork samples from C.P. Vietnam’s store in the Soc Trang city.

A New Era for the Ca Mau Petrochemical Fertilizer Company: Leadership Transition

The Board of Directors of the Ca Mau Petroleum Fertilizer Joint Stock Company (PVCFC) has made a resolution to not renew Mr. Le Ngoc Minh Tri’s term as Vice President of PVCFC, effective June 1st, 2025.