In a recent proposal to the Government, the Vietnam Infrastructure Development and Finance Investment Corporation (Vidifi) has put forth an offer to expand 300km of the North-South Expressway in the north through a public-private partnership (PPP), according to VnExpress.

Vidifi has proposed to expand six sections, including Mai Son – National Highway 45, National Highway 45 – Nghi Son, Nghi Son – Dien Chau, Bai Vot – Ham Nghi, Ham Nghi – Vung Ang, and Vung Ang – Bung. The total estimated investment is over VND 45,375 billion. Vidifi has committed to arranging its own capital, ensuring progress and quality, and not requesting direct support from the state budget if selected.

Previously, Deo Ca Group and Son Hai Group also submitted proposals to the Government and the Ministry of Construction to participate in the expansion of the North-South Expressway in the east from the limited four-lane road, 17m wide, to the planned six-lane road.

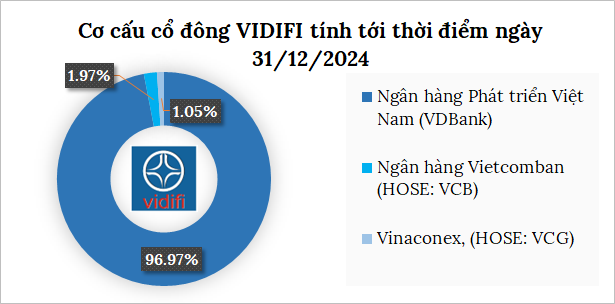

Established in August 2007, Vidifi operates in the fields of construction and traffic toll services. Its initial chartered capital was VND 5,000 billion, of which the Vietnam Development Bank (VDB, VDBank) contributed 50%, the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank, HOSE: VCB) 29%, Vietnam Construction and Import-Export Corporation (Vinaconex, HOSE: VCG) 10%, and Saigon Investment Group (SGI) 10%.

As of the end of 2024, Vidifi’s chartered capital was nearly VND 3,800 billion, with VDBank contributing up to 96.97%, VCB 1.97%, and Vinaconex 1.05%. The company is currently chaired by Nguyen Minh Tho – Vice President of VDB and General Director Tran Anh Tu.

Source: Vidifi

|

From a trillion-dollar highway to a prolonged deficit equation

Vidifi is no stranger to infrastructure businesses as it is the investor of the 105.5km Hanoi – Hai Phong Expressway, which was approved by the Prime Minister for investment under the BOT contract in 2007 and inaugurated in late 2015, with toll collection starting in early June 2015.

The project’s total investment after adjustment is over VND 44,800 billion, and the expected payback period is 28 years, 8 months, and 27 days from the commencement of construction in May 2008.

Hanoi – Hai Phong Expressway. Source: Vidifi

|

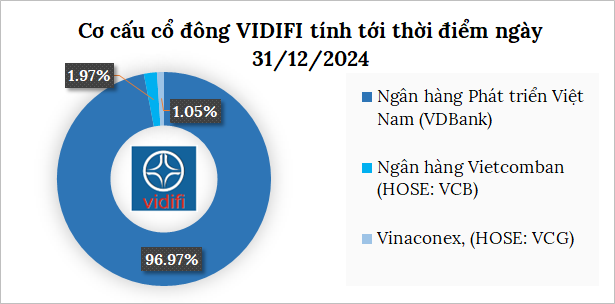

For Vidifi, this marked the beginning of prolonged and substantial losses. Specifically, during 2016-2022, Vidifi incurred a massive loss of nearly VND 9,700 billion, mainly due to revenue from toll collection on the expressway and National Highway 5 amounting to over VND 14,200 billion, while operating costs and interest expenses reached over VND 19,800 billion. The daily interest expense during this period was estimated at nearly VND 8 billion, bringing the accumulated loss by the end of 2022 to over VND 9,200 billion.

A turning point emerged in 2023 when Vidifi turned a profit of VND 489 billion and nearly VND 900 billion in 2024 due to reduced interest expenses. Revenue in 2024 set a new record of nearly VND 3,600 billion, up 22% from the previous year.

Source: VietstockFinance

|

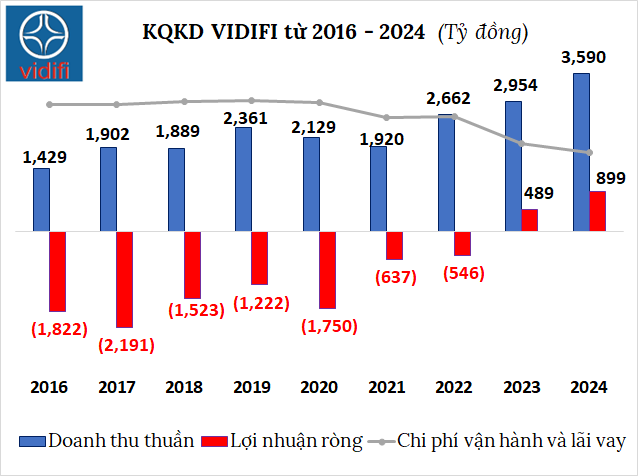

As of the end of 2024, Vidifi still had accumulated losses of over VND 7,800 billion. Total assets were approximately VND 41,500 billion, down 3% from the beginning of the year, of which more than VND 35,300 billion was the value of fixed tangible assets, mainly the Hanoi – Hai Phong Expressway. The enterprise held cash of over VND 1,300 billion, up 46% from the beginning of the year.

The company’s payables continued to decrease by 6% to over VND 30,600 billion due to a 6% reduction in financial debt to over VND 22,800 billion, with all loans from the Vietnam Development Bank (VDB).

Source: VietstockFinance

|

The VDB, headquartered in Hanoi, is a policy bank established by the Prime Minister and operates under the provisions of the Law on Credit Institutions and related laws.

On April 29, 2025, the Government issued Decree No. 95/2025/ND-CP regulating the organization and operation of the VDB. The decree states that the VDB operates on a non-profit basis to implement the socio-economic policies of the State as prescribed by law.

Accordingly, the VDB is guaranteed by the State for its solvency, receives interest rate and management fee subsidies, is exempt from taxes and other budget contributions as prescribed by law, and is not subject to mandatory reserves or deposit insurance participation.

Therefore, Vidifi’s proposal to invest in the expansion of 300km of the North-South Expressway not only showcases its ambition but also hints at a new race between state-owned and private enterprises, as infrastructure development remains a key driver of economic growth.

– 08:55 07/06/2025

A Bold Initiative: Businesses Rally to Present Unprecedented Proposals to the Prime Minister

A multitude of businesses are gearing up for an intense race to expand Vietnam’s most crucial transportation artery.

The Cosmopolitan: A Distinctive Lifestyle Manifesto for the New Global Citizen

The Cosmopolitan at Global Gate is an exclusive integrated development, comprising luxury residences, offices, and commercial spaces. What sets it apart is its focus on three core elements: a strategic location, a personalized ecosystem, and a global mindset. This is not just a place to live, but a destination that elevates one’s status and connects them with an elite network.

“The Private Sector Has Never Been Weaker and More Challenged Than in the Last 40 Years: Prof. Tran Dinh Thien”

“The esteemed Professor Trần Đình Thiên highlights a significant challenge faced by the nation. Entrusting the private sector with such a monumental task in the context of its current weaknesses presents a formidable obstacle, not just for the private sector but for the entire nation, including the government and the Communist Party.”

Is Public Investment the Key to Countering Tariff Challenges?

In the face of challenging US trade policies, experts and infrastructure businesses believe that public investment will be the key driver to sustain Vietnam’s economic growth. However, to achieve the desired goals, there is a need to create a ripple effect on private investment, FDI, and consumer spending.