The Hanoi Stock Exchange (HNX) has recently published a disclosure on Nova Thao Dien Co., Ltd.’s bond principal and interest payment status.

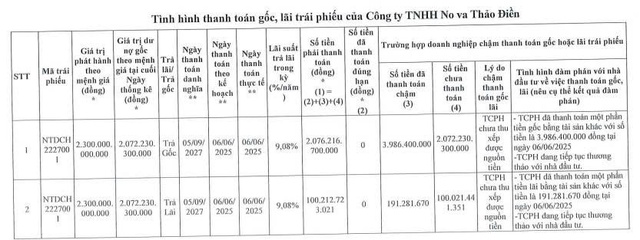

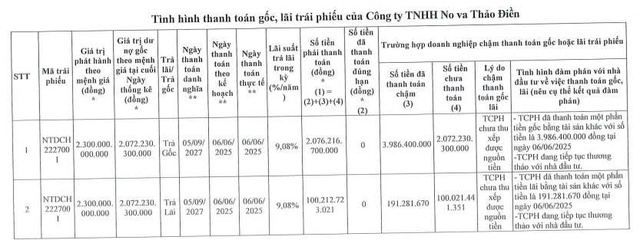

As per the schedule, on June 6, 2025, Nova Thao Dien was due to pay over VND 2,176.4 billion in principal and interest for the NTDCH2227001 bond lot. This included more than VND 2,076.2 billion in principal and over VND 100.2 billion in bond interest.

However, the company has only managed to pay nearly VND 4.2 billion in non-cash assets, with the remaining amount of over VND 2,172.2 billion unpaid.

Source: HNX

Nova Thao Dien attributed the delay in bond principal and interest payments to difficulties in arranging funds and is currently in discussions with investors regarding the settlement of the aforementioned bond debt.

The NTDCH2227001 bond lot comprises 23 million bonds issued on September 5, 2022, with a total issuance value of VND 2,300 billion. The bonds have a five-year term and are expected to mature on September 5, 2027.

In 2024, Nova Thao Dien also experienced a delay in payment of over VND 45.2 billion and deferred more than VND 2,182.9 billion in principal and interest for the same bond lot, citing similar reasons of fund unavailability.

Nova Thao Dien Co., Ltd. was established in 2008 and primarily operates in the field of real estate business, ownership, or leased land use rights.

It is a subsidiary of Nova Land Investment Group Joint Stock Company (Novaland, stock code: NVL, HoSE exchange) with an ownership and voting rights ratio of up to 99.99% as of March 31, 2025.

In terms of business performance, according to the semi-annual financial statement for 2024, Nova Thao Dien reported a net profit of nearly VND 400.8 billion, compared to a net loss of nearly VND 163.7 billion in the previous year.

As of March 31, 2024, owner’s equity stood at nearly VND 7,826.5 billion, an increase of 4.7% compared to the same period last year. The debt-to-equity ratio improved from 0.52 times to 0.37 times, equivalent to total liabilities of nearly VND 2,895.8 billion.