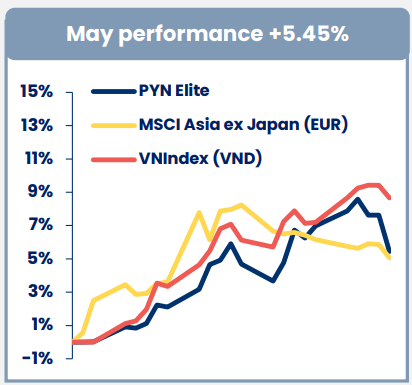

According to PYN Elite’s report, the investment performance in May increased by 5.45%, led by the strong gains of stocks HVN (+19.2%) and GEX (+40.5%), along with a group of securities companies.

|

PYN Elite’s performance compared to VN-Index

Source: PYN Elite Fund

|

Meanwhile, the VN-Index surged by 8.7%, with about 40% of the increase attributed to the two stocks of Vingroup and Vinhomes, fueled by the enthusiasm of individual investors regarding the high-speed North-South railway project and the government’s growth support policies.

|

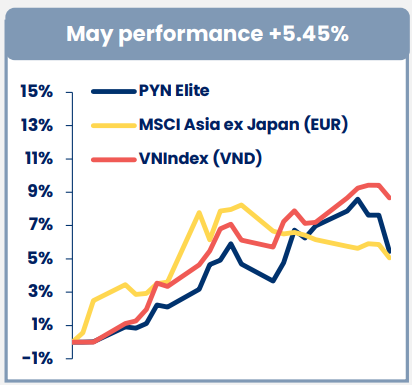

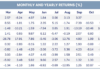

PYN Elite’s investment performance for 2024-2025

Source: PYN Elite Fund

|

Despite lagging the VN-Index, May marked PYN Elite’s highest monthly performance in 16 months, since January 2024. As a result, the fund narrowed its cumulative loss from -6.84% in the first four months to -1.77% after five months.

The fund attributes the improved market sentiment to positive macroeconomic factors. Specifically, Vietnam held its second trade negotiation round with the US in May and commenced the third round in June.

Additionally, the government issued Resolution 154, targeting a GDP growth rate of over 8% for 2025 and 8.2% for the second quarter, following a 6.9% growth in the first quarter. The resolution emphasizes infrastructure development and private sector stimulation, despite potential short-term increases in the public debt-to-GDP ratio.

Legal approval processes are being expedited, particularly in the real estate and renewable energy sectors – industries with high potential for attracting large-scale investment but previously hampered by procedural obstacles.

According to PYN Elite, one of the most notable highlights of May was the acceleration of public investment. The total disbursed value for the month reached $2.7 billion, double the five-year average. For the first five months of the year, this figure stood at $7.7 billion, a significant increase of 38.8% compared to the same period last year. These results demonstrate the government’s determination to boost infrastructure development and address bottlenecks in the disbursement process.

The Vietnamese economy continues to display resilience. Retail revenue in May increased by 10.2% year-on-year, pushing the cumulative growth for the first five months to 9.7%. The industrial production index (IIP) also accelerated, reaching 9.4% in May and 8.8% for the first five months.

Foreign direct investment (FDI) attraction in the first five months reached $18.4 billion, a substantial increase of 51.1% compared to the same period last year. May’s exports rose by 17%, partly due to businesses taking advantage of favorable market conditions by shipping goods earlier.

– 08:18 06/07/2025

The Foreign Sell-Off Continues: Nearly $20 Million in Outflows and the Stocks Feeling the Heat.

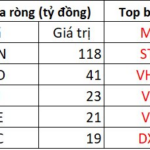

The afternoon session saw a strong net buying trend for MSN across the market, with a total value of 118 billion VND. This significant buying activity indicates a potential shift in market sentiment and highlights the stock’s resilience and appeal to investors. As one of the leading stocks in the industry, MSN’s performance continues to be a key focus for market participants.

The Arrest of VPG’s Leadership Leaves Stock ‘Stranded’

The recent indictment of its leadership has sent shares of Viet Phat Import-Export Trading Investment Joint Stock Company, known as VPG, into a tailspin. Today’s session (June 4th) witnessed a frantic sell-off as investors offloaded their holdings at any price, yet they remained trapped with over 7.6 million VPG shares still on offer at the floor price.

“Stock Market Outlook: VN-Index Faces Adjustment Pressures for the Week of June 2-6, 2025”

The VN-Index witnessed a significant decline during the week’s final session, bringing an end to its four-week streak of consecutive gains. The index’s repeated tests of the old March 2025 peak (equivalent to the 1,320-1,340 range) indicate a crucial resistance level that the VN-Index must surpass to sustain its upward trajectory. Erratic trading volume fluctuations around the 20-day average reflect investors’ unstable sentiment. Moreover, consistent selling pressure from foreign investors has further intensified the burden on the VN-Index. Should this trend persist, the likelihood of a corrective phase looms large.

The Rise of Stock Market Enthusiasts in Vietnam: Over 10 Million Trading Accounts and Counting

As of May 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, with almost 10.1 million registered accounts, according to the Vietnam Securities Depository and Clearing Corporation (VSDC). This marks an increase of 190,852 accounts compared to the previous month, showcasing a vibrant and growing investment landscape in the country.