While purchasing insurance provides peace of mind and legal compliance in the event of a mishap, many vehicle owners feel like they’re becoming “indebted” when making insurance claims. From being “forced” to use repair services at garages linked to the insurance company to various tactics of delay and unclear rejection of claims, many have lost faith in motor vehicle insurance.

Forcing Customers to Use Linked Garages

Mr. Tran Hoang Minh from District 1, Ho Chi Minh City, shared with Bao Nguoi Lao Dong that he once took his scratched Toyota to an authorized dealership for insurance repairs. He was told to collect his car after three days, but even on the fifth day, he hadn’t received it. Upon inquiring, he was informed that his vehicle had been taken to an external workshop due to the dealership being overloaded.

Although the staff assured him that the repair quality would be guaranteed, Mr. Minh discovered a blotchy paint job with mismatched colors and thick dust on the glass and car body upon retrieving his vehicle.

Authorized dealership insurance is a popular choice among vehicle owners for assured genuine repairs. |

Mr. Huynh Ngoc Lam from Thu Duc City, Ho Chi Minh City, encountered a bizarre situation as well. After insuring his Ford, he received a call inquiring about his experience with a Nissan, which was entirely unrelated. Upon investigation, he realized that the insurance company had entered the wrong information for his license plate number and vehicle type. Although he didn’t suffer any financial loss, Mr. Lam was deeply concerned about the negligence in the insurance process.

Similarly, Mr. Doan Huu Nguyen from District 7, Ho Chi Minh City, shared that after a minor collision, he took his Toyota Vios to an authorized dealership for repairs. When he contacted the insurance company for a claim, they responded: “We only accept repairs at linked garages.” Consequently, after having his car fixed at the designated garage, Mr. Nguyen discovered that several non-genuine parts had been used, some of which even showed signs of prior use.

These cases are not isolated incidents. Numerous vehicle owners have voiced similar concerns, with insurance companies compelling them to use specific repair services rather than allowing them to choose according to their preferences. In many instances, when customers request repairs at authorized dealerships, insurance providers cite unreasonable costs or deliberately prolong the assessment and approval process, causing inconvenience.

Deceptive Tactics

Mr. Tran Vinh Nam, owner of a car garage in Thu Duc City, pointed out that many vehicle owners don’t carefully read the terms and conditions of their insurance contracts, leading to disappointment later when they can’t get their cars repaired at authorized dealerships as expected. Instead, they are forced to use external garages designated by the insurance company.

Some authorized dealerships even take advantage of the insurance process for profit. They accept vehicles under the pretext of providing genuine repairs but secretly send them to external workshops to cut costs. The actual fees at these external workshops are only 30% to 50% of the dealership’s published rates.

In a more intricate scheme, certain dealerships hire external mechanics on a cost-per-job basis, resulting in extremely low costs. In some cases, non-genuine parts are installed in vehicles, yet the dealership bills the insurance company at higher genuine part prices, directly harming consumers.

Following complaints from vehicle owners, authorities raided several car dealerships in Ho Chi Minh City and Hanoi earlier in May to investigate fraud allegations in motor vehicle insurance claims. Initial information suggests that some dealerships were found to be using cheap, low-quality parts while billing for genuine ones, serving as a warning about lax supervision and loopholes in the linkage process between dealerships and insurance companies.

The motor vehicle insurance market has been highly competitive in recent years, with companies reducing premiums to retain customers. For instance, the insurance premium for a 2015 B-segment sedan might be lowered from VND 5 million to VND 4 million. However, to maintain profitability, some insurers have compromised on service quality, resulting in delayed processes, additional costs, and subpar repairs. This has led to a decline in customer trust, with some choosing to forgo insurance unless mandatory.

According to industry insiders, to restore confidence in traditional insurance companies, businesses must tighten management procedures, eliminate fraud, and enhance their sense of responsibility and long-term commitment to their customers.

|

Opportunity for Car Manufacturers Amid this situation, several prominent car manufacturers have ventured into the insurance sector to maintain service quality and retain customers within their ecosystem. Toyota, Honda, Ford, and Mercedes-Benz are among those offering exclusive insurance products closely tied to their authorized aftersales services. Industry experts believe that car manufacturers’ direct involvement in insurance not only enhances the service experience but also serves as a customer retention strategy. When customers use insurance linked to the manufacturer, they are more likely to return to the dealership for repairs, increasing service revenue and genuine part sales. This trend is inevitable as the automotive market saturates, prompting manufacturers to create additional value through aftersales services. |

Article and photos by Nguyen Hai

– 08:50 08/06/2025

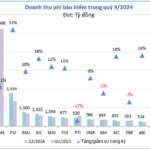

What Insurance Companies Were Hit Hardest by Typhoon Yagi?

The insurance industry’s joy was short-lived as the mid-year happiness was completely dampened by the arrival of Yagi.

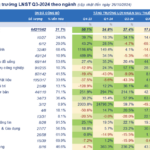

The Bottom Line: 642 Businesses Report 17.8% Increase in Q3 Profits, Real Estate Sector Bounces Back.

The third-quarter post-tax profits of 642 enterprises rose by 17.8% year-on-year, a notable increase yet shadowed by the impressive 27.4% surge in the previous quarter. This slight dip can be attributed to the high comparative base. Notably, the real estate sector experienced a profit decline this quarter, indicating a downward trajectory and a potential bottoming-out phase.

The Race to Insure Vehicles Post-Storm Chaos

Many car owners are left waiting for insurance companies to process their claims as repair shops in the northern regions are overwhelmed with vehicles in need of fixing after the recent storm and flood damage.