After a significant dip in April due to adverse impacts from tariff information and heightened global risks, the Vietnamese stock market made a remarkable comeback in May 2025. The VN-Index closed May at 1,332.6 points, a surge of 106 points compared to the previous month’s end.

In its June strategy report,

Tien Phong Securities (TPS)

attributes the market’s positive performance in May to restored investor confidence as the impact of US policy risks was gradually priced in. Additionally, the flexible management policies of the State Bank of Vietnam (SBV) to stabilize exchange rates and maintain low-interest rates provided further momentum.

Expectations of robust business results in 2025 also supported the recovery. However, the upward trend in the coming months depends on broader participation from mid-cap and small-cap stocks, along with sustained investment inflows at higher price levels.

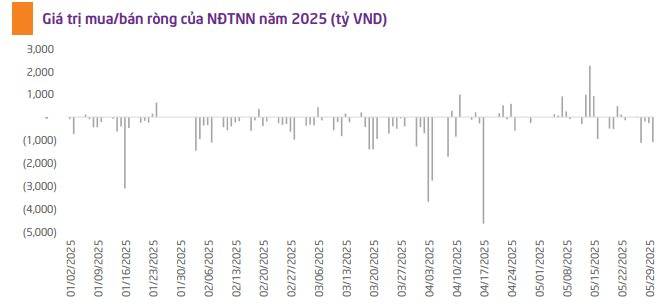

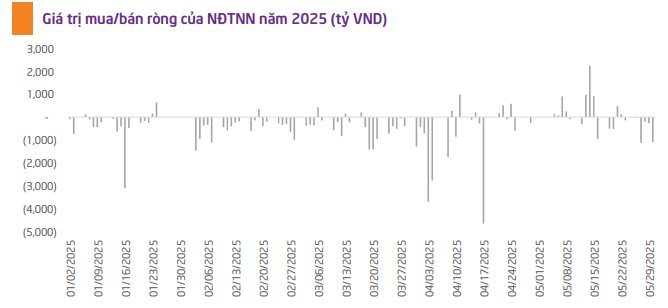

Regarding foreign investors’ activities, after consecutive net selling days, this group returned to net buying in May with a value of about VND 914 billion, a significant improvement from the previous month’s net selling of VND 13,400 billion. There was a slight pause in the middle of May, but the recovery trend was not sustainable, indicating that foreign investors’ confidence in the market remains weak.

Analyzing potential risks that may influence foreign investors’ trading activities, TPS points out that existing exchange rate pressure is considerable. If the exchange rate continues to fluctuate strongly and the VND depreciates further against regional currencies, it could trigger capital outflows from the Vietnamese stock market.

Additionally, risks associated with high-interest rates in the US may divert capital to developed markets. Moreover, the strong recovery of the VN-Index in May has led to higher market valuations, reducing the attractiveness of the Vietnamese market relative to its peers.

”

However, looking ahead, the stable operation of the KRX system and Vietnam’s progress toward its market upgrade goal are factors that could attract capital from professional foreign institutional investors and funds

,” the report states.

3 scenarios for the VN-Index trend

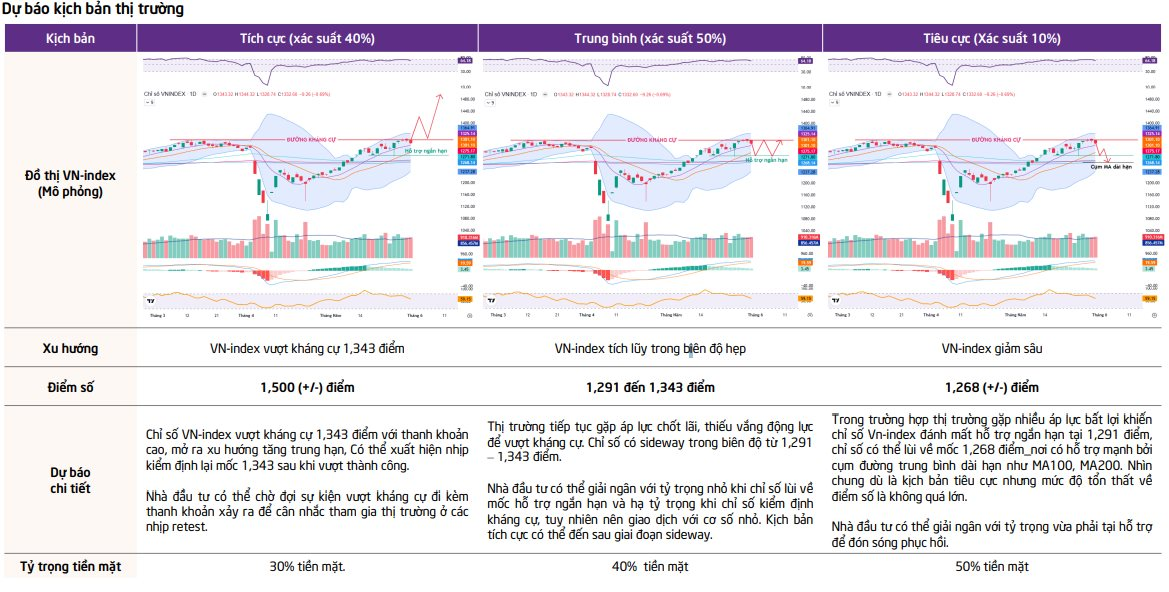

From a technical analysis perspective, TPS assesses that the market’s current trend remains positive based on momentum indicators and the moving average system. However, the market may experience volatility or a mild technical correction as the VN-Index approaches the crucial resistance level of 1,343 points, while momentum indicators show signs of weakening from overbought conditions. In contrast, short-term and long-term support levels are at 1,291 points and 1,268 points, respectively, which should prevent a deep correction.

TPS presents three scenarios for the VN-Index:

Positive scenario:

The VN-Index could surpass the 1,343-point resistance and reach the 1,500-point milestone with high liquidity, signaling a medium-term uptrend. A retest of the 1,343 level may occur after a successful breakthrough. Investors can consider participating in the market during retests, provided that the breakthrough is accompanied by high liquidity.

Neutral scenario:

The market continues to face profit-taking pressure and lacks the momentum to overcome resistance. The index is expected to trade within a range of 1,291 – 1,343 points. Investors can consider small-scale investments when the index retreats to short-term support levels and reduce exposure when it tests resistance. However, it is advisable to trade with a small capital base.

Negative scenario:

If the market encounters multiple adverse pressures, causing the VN-Index to breach the short-term support of 1,291 points, it may fall back to the 1,268-point level, which is strongly supported by long-term moving averages like MA100 and MA200. Although negative, this scenario does not imply significant point losses. Investors can consider medium-scale investments at the support level to capitalize on the recovery wave.

The Foreign Sell-Off Continues: Nearly $20 Million in Outflows and the Stocks Feeling the Heat.

The afternoon session saw a strong net buying trend for MSN across the market, with a total value of 118 billion VND. This significant buying activity indicates a potential shift in market sentiment and highlights the stock’s resilience and appeal to investors. As one of the leading stocks in the industry, MSN’s performance continues to be a key focus for market participants.

The Arrest of VPG’s Leadership Leaves Stock ‘Stranded’

The recent indictment of its leadership has sent shares of Viet Phat Import-Export Trading Investment Joint Stock Company, known as VPG, into a tailspin. Today’s session (June 4th) witnessed a frantic sell-off as investors offloaded their holdings at any price, yet they remained trapped with over 7.6 million VPG shares still on offer at the floor price.

Stock Market Outlook for Tomorrow, June 5-6: The Tug-of-War Continues

The Vietnamese stock market witnessed a volatile session on June 4th, with stocks fluctuating within a narrow range.

“My Investment Appetite”: “I Prefer Stocks Because They’re Transparent, Merit-Based, and Free From Schmoozing.”

“I prefer the title ‘savvy investor’ to ‘stock market queen,’ because it reflects my belief that anyone can create wealth through wise financial decisions. It’s not about royalty or privilege; it’s about empowering individuals to take control of their financial destiny and turn their money into a productive asset.”