The Vietnamese stock market closed out the final trading week of May with volatile movements. After continuing its impressive upward trajectory and reaching its highest close since the beginning of the year during the mid-week session, the VN-Index reversed course in the last two sessions with a clear divergence.

Active money continued to be present, taking turns to seek out different groups of stocks, but profit-taking forces quickly increased as the index approached strong resistance levels.

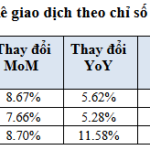

For the week, the VN-Index gained 18.14 points, or 1.38% from the previous week, closing at 1,332.6 points.

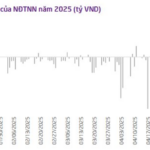

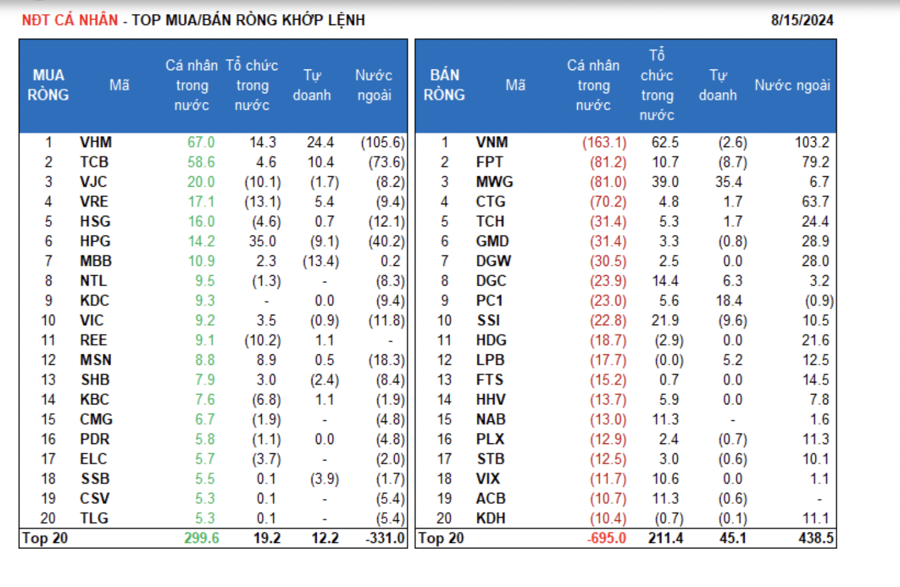

Foreign investors were a negative factor as they continued to net sell a value of VND 2,917 billion on the entire market. This included net selling of VND 2,755 billion on HoSE, VND 46 billion on HNX, and VND 116 billion on UPCoM.

The uptrend lacks consensus

Analyzing the weekly performance, Mr. Dinh Quang Hinh, Head of Macro and Market Strategy Department at VNDirect Securities Corporation, pointed out that if we look closely at the trading activities during the week, we can see that the upward momentum was concentrated in a few stocks in the real estate, textile, and seafood sectors.

Meanwhile, many stock groups witnessed notable corrections in the last sessions of the week, notably in banking and retail stocks. It appears that money is still flowing into a handful of stocks with their own narratives, and the market’s uptrend lacks consensus and clear breadth.

VN-Index movements over the last 5 sessions (Source: TradingView).

According to Mr. Nguyen Anh Khoa, Director of Analysis at Agribank Securities, investors should note that the influx of money into midcap speculative stocks often carries short-term cyclical characteristics, is prone to sharp fluctuations, and entails the risk of deep corrections when the overall market encounters turbulence.

At this stage, risk management and meticulous stock selection based on solid fundamentals and good liquidity are key. Preferred stocks to choose from are those with appropriate valuations, and for the real estate sector, the focus should be on projects in the 2025-2026 period that will support the business performance of enterprises.

Some undervalued stocks may be lagging in reflecting the recovery trend or still facing existing risks, such as tariff impacts, legal issues, debt burdens, or inflexible business models lacking growth drivers.

Avoid short-term trading due to high risk of loss

Entering the new trading week, VNDirect’s expert predicts that the market will likely continue its accumulation trend to absorb profit-taking forces and await new supportive information.

The 1,340-1,350 zone will remain a strong resistance level in the short term, especially with foreign investors net selling and offloading large volumes in recent sessions. Conversely, the 1,300-1,320 zone will act as a market support level.

Given the market’s continued choppy performance, the expert advises investors to maintain a moderate stock proportion in their portfolios, considering profit-taking in stocks that have surged recently.

If the VN-Index retreats to the 1,300-1,320 range, new buying can be considered with a low proportion in groups that have not fully recovered to April levels (before the US announced countervailing duties), such as banking, securities, steel, textiles, and seafood.

Meanwhile, Mr. Phan Dung Khanh, Investment Advisory Director at Maybank Investment Bank, believes that the market’s overall trend is positive for the medium and long term.

The short-term correction is more technical in nature, and after many consecutive gaining sessions, the market is quite close to the important resistance level of 1,350 points, which may trigger some adjustments but won’t alter the positive medium and long-term trend.

The movement of money flow indicates that leading sectors like banking and, notably, real estate, after a long period of stagnation, are gradually becoming active again. This trend is likely to persist in 2025, so investors can pay attention to this and the fact that blue-chip stocks continue to attract money flow. Therefore, market and sector corrections are opportunities to accumulate more stocks.

Currently, with the market moving in tandem with the economy’s positive growth trajectory in the medium and long term, and as economic growth gains momentum, the market receives better support. Thus, investors’ portfolios should have a higher proportion of medium and long-term holdings than short-term ones.

Consequently, market corrections are opportunities to accumulate assets. Short-term trading should be avoided due to the high risk of loss, and it may be challenging to repurchase stocks at favorable prices.

The Power of Persuasive Writing: Crafting Compelling Headlines

Unleashing PYN Elite’s “Slow-Paced” Performance to Reach a 16-Month High

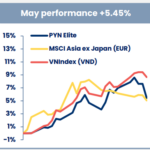

Despite lagging behind the robust growth of the VN-Index in May, PYN Elite Fund’s investment performance delivered the highest returns in 16 months since January 2024.

The Foreign Sell-Off Continues: Nearly $20 Million in Outflows and the Stocks Feeling the Heat.

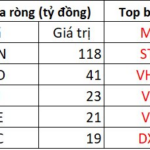

The afternoon session saw a strong net buying trend for MSN across the market, with a total value of 118 billion VND. This significant buying activity indicates a potential shift in market sentiment and highlights the stock’s resilience and appeal to investors. As one of the leading stocks in the industry, MSN’s performance continues to be a key focus for market participants.

Trump Dynasty Ventures into Vietnam: A Sign of Easing US Tariffs?

In a recent letter to investors, Petri Deryng, the head of PYN Elite Fund, shared an intriguing perspective on the US-Vietnam trade policy.