Yuanta Securities has provided an analysis and assessment of the banking sector’s trends based on five factors within the CAMEL model (Capital, Asset, Management, Earnings, and Liquidity).

Firstly, regarding capital – there is a trend of cutting cash dividends and restarting capital sale plans. Several banks have cut cash dividends in 2025, including MBB, VPB, and TCB. MBB plans to buy back 100 million shares in 2025-2026. VPB and TCB will establish life insurance companies, and VPB also aims to establish an asset management company, which will reduce the capital adequacy ratio of these banks.

This could also be the reason why banks decided to reduce cash dividend payouts to maintain their capital adequacy ratios.

The upcoming implementation of Basel III will require banks to maintain a higher CAR, at 10.5% (compared to 8.0% for Basel II). Currently, the industry’s CAR is around 12%, higher than the Basel II requirement; however, this is mainly contributed by large-scale private banks such as VPB (14.7%) and TCB (15.3%). Therefore, banks, especially state-owned banks, need to raise more capital to improve their CAR.

VCB announced it would issue 543.1 million shares (equivalent to 6.5% of the total outstanding shares) to a maximum of 55 investors, including strategic and professional investors, in 2025-2026.

Asset Quality: Asset quality deteriorated in Q1 2025 as the NPL ratio increased, and the LLR ratio declined. Based on discussions with several banks, the primary reason for the rise in NPLs was the increase in new non-performing loans rather than restructured loans under Circular 02 and Typhoon Yagi.

Yuanta expects asset quality to improve in the second half of 2025, along with a recovery in the real estate market. Housing loan growth remained modest in Q1 2025. Not all banks disclosed data on housing loans, and only five banks, including ACB, MSB, TCB, VCB, and VPB, reported an average growth rate of 2.0% quarter-on-quarter in Q1 2025. These banks account for about 30% of the industry’s total assets (including 28 banks).

However, the government’s strong push to develop infrastructure, untangle legal bottlenecks, and merge provinces will better support the real estate market’s recovery in the coming periods. This will help improve banks’ asset quality, thereby reducing provisioning pressure and boosting banks’ profits.

Management Efficiency: Digitization helps reduce costs. The median cost-to-income ratio (CIR) of the industry (28 banks) was 39% in Q1 2025. The high CIR may reflect inefficiencies in operations and cost control, and banks with a CIR of > 50% will face challenges in boosting profits.

The banking industry’s CIR in Vietnam shows a clear differentiation. The median adjusted CIR for the industry is 39%. Banks like ACB, CTG, HDB, LPB, MBB, SHB, SSB, TCB, TPB, VCB, VIB, and VPB have adjusted CIRs below the industry median due to their scale and digital transformation advantages. VPB stands out with a superior cost management efficiency, with an adjusted CIR of only 25% in Q1 2025.

In contrast, a few small-scale banks have significantly higher CIRs than the industry median, negatively impacting profitability. Overall, the industry’s CIR can decrease with the strong digital transformation trend among banks.

Earnings: Efforts to diversify non-interest income sources. The industry’s profit (28 listed and OTC banks) in Q1 2025 was mainly contributed by extraordinary income from SSB’s divestment at its finance company subsidiary – Postal Finance Company Limited (PTF) to AEON Financial Service. Excluding this, the industry’s PATMI was VND 63 trillion (unchanged from the previous quarter / +9.8% YoY).

Liquidity: The government remains steadfast in its ambitious 8.0% GDP growth target for 2025, despite market uncertainties such as US tariffs. Therefore, the State Bank will continue its loose monetary policy to support the economy, especially with the weak USD and low and declining domestic inflation.

From the beginning of the year to May 16, the State Bank has injected VND 814 trillion (~USD 31 billion) into the financial system through the OMO channel and has stopped withdrawing liquidity since February 24, 2025.

In the stock market, bank stocks have experienced three significant dips since 2019. The first dip was during the Covid period in 2020. The second dip occurred in 2022 after the corporate bond market scandal, and the most recent one was in 2025 due to US tariffs. However, stock prices quickly recovered after each sell-off.

According to Yuanta, bank stocks are still undervalued, currently trading at less than one standard deviation below the 10-year historical average.

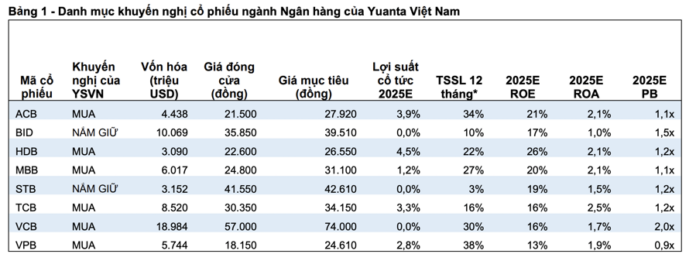

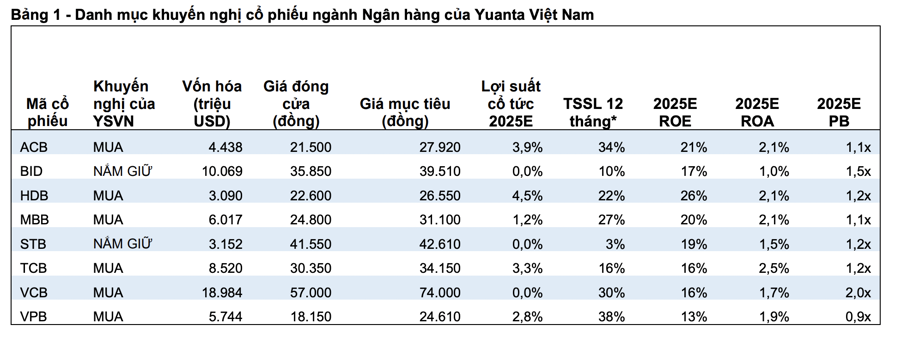

Yuanta updated the target prices for its recommended portfolio after switching the valuation basis to 2026. It prioritizes ACB, HDB, TCB, and VCB. The capital sale plans of HDB and VCB, along with the TCBS IPO, will be strong catalysts for HDB, VCB, and TCB. Meanwhile, it recommends buying MBB and VPB.

Listed Companies Aim for a 13.6% Revenue Increase in 2025

Based on the 2025 statistical plan of 104 large-cap listed companies, which account for approximately 70% of market capitalization, the total revenue plan for 2025 shows an increase of about 13.6% compared to the revenue realized in 2024.