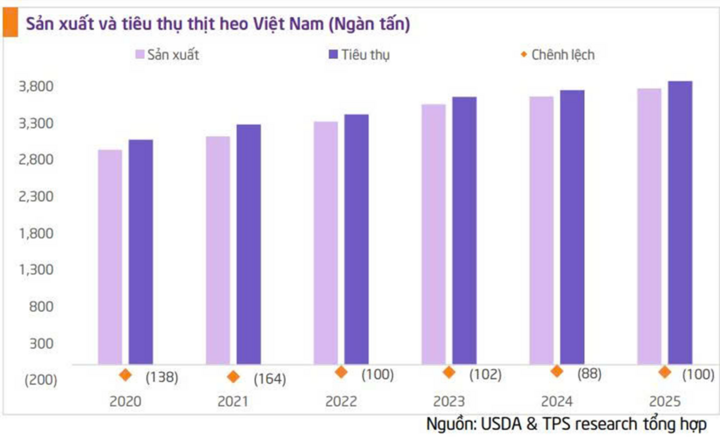

Vietnam is the second-largest consumer of pork in the world, just behind China, and the largest in Southeast Asia, with a per capita consumption of 27.7 kg per year (2023). According to forecasts by the United States Department of Agriculture (USDA), Vietnam will be one of the countries with strong growth in pork consumption during 2023-2029. In 2025 alone, Vietnam’s pork production is expected to reach 3.8 million tons.

The Organisation for Economic Co-operation and Development (OECD) also predicts that pork consumption in Vietnam this year could reach 4 million tons, an increase of 3.3% from last year.

Pork remains the preferred choice of Vietnamese consumers. (Photo: Da Ly)

The 2025 Securities Investment Strategy Report by TPBank Securities Company (TPS) shows that Vietnam’s pig farming industry is undergoing a significant transition, with a profound reform in the period of 2025-2026. In particular, changing consumer habits and increasing focus on food safety will drive this reform.

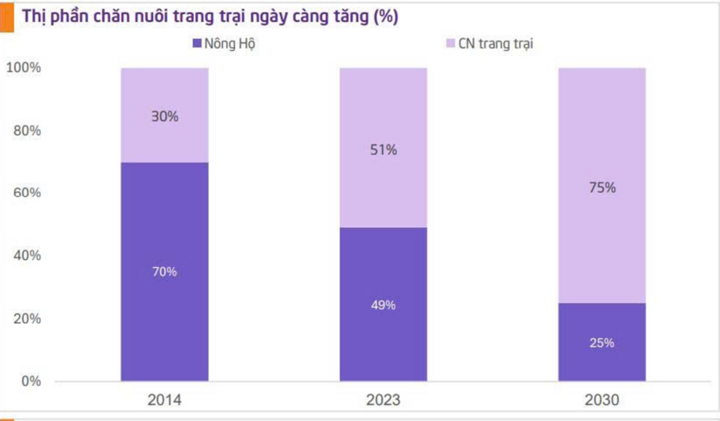

According to analysts at TPS, the farm-based farming model is reshaping the Vietnamese livestock industry, making it more sustainable.

In 2025, Vietnam’s pork supply is expected to be stable, with no sudden increase in imports. Production is projected to be nearly 3.8 million tons, while consumption will be around 3.9 million tons and is expected to reach 4.7 million tons by 2030, corresponding to an average growth rate of 3.1% per year.

The report also shows that household farming is decreasing, while the market share of large-scale farming enterprises is increasing, thanks to their advantages in production costs and lower mortality rates.

Demand is high, but domestic production only meets about 95% of it. The pork market still has a lot of potential, but it is concentrated among large enterprises, while small-scale farmers are gradually losing their foothold.

In an interview with VTC News, Mr. Nguyen Kim Doan, Chairman of the Dong Nai Livestock Association, said that the “hub” of livestock farming is now dominated by large companies. In the period of high pork prices from the beginning of 2025 until now, small-scale farmers have not benefited much due to diseases, competition, and other factors, causing them to leave the industry. Compared to five years ago, the number of farming households in the region has decreased to about 10%.

A Playing Field for Large Enterprises

With a decades-long head start and modern operations, C.P. Vietnam has far surpassed other enterprises in the livestock and food processing industry. The first-quarter 2025 financial report of Charoen Pokphand Foods (C.P. Foods – the parent company of C.P. Vietnam) shows that the Vietnamese market brought in approximately $812 million, contributing 19% of the group’s total revenue in the first quarter.

The livestock farming market share in Vietnam is held by large enterprises, while small-scale farming is declining. (Source: TPS)

C.P. Vietnam also operates three chains of stores: C.P. Fresh Shop, C.P. Fresh Mart, and Five Star, specializing in the sale of fresh meat, processed food, and fried chicken, with more than 1,000 stores nationwide.

However, C.P. is not alone in the Vietnamese pork market, which also sees the strong participation of a series of domestic enterprises with annual revenues of thousands of billions of VND.

The first-quarter 2025 report of BAF Vietnam Agricultural Joint Stock Company shows that net revenue exceeded VND 1,120 billion, while profit from the livestock and farming services provision segment was more than VND 133 billion, thanks to high pork prices, which have been maintained above VND 70,000/kg since the beginning of the year.

BAF Vietnam, a company engaged in pig farming and pork processing, was established in 2017 and has an annual revenue of VND 5,000-7,000 billion, even reaching over VND 10,000 billion before the COVID-19 pandemic.

In 2025, the company is expected to earn more than VND 5,600 billion, of which nearly VND 5,500 billion will come from pig farming, with more than 831,000 pigs sold to the market.

A modern, closed-loop pork production process at a factory invested in by a Vietnamese enterprise. (Photo: Da Ly)

“Vegetarian pigs,” a pork product of BAF’s farm-to-table process, has gained the trust of consumers. The company aims to supply the market with 10 million commercial pigs by 2030, with 100 farms and 13 processing plants.

MEATLife, a chilled meat brand of Masan MEATLife, which was also launched in 2018, is available in Winmart, Winmart+, and most other modern retail chains. It has quickly become familiar to consumers.

The first-quarter 2025 financial report shows that Masan MEATLife had revenue of VND 2,070 billion, a growth of more than 20% over the same period in 2024, while gross profit increased by 43%, reaching over VND 571 billion, and net profit was nearly VND 116 billion.

Like other enterprises in the industry, the revenue of Masan MEATLife’s meat segment increased impressively thanks to the high pork prices maintained since the beginning of the year.

When it was first established, the company set a target for 2025 to hold 10% of the animal protein market share in Vietnam. At the annual general meeting of shareholders held in April, the company’s leaders emphasized the long-term strategy of comprehensively transforming into a branded meat processing company, aiming to capture the $2 billion opportunity and become a leading enterprise in the branded meat and processed meat industry.

In 2025, Masan MEATLife sets a revenue target of VND 8,250 – 8,749 billion and plans to increase the value of by-products from each pig raised to an average of VND 10 million.

In 2025, Vietnamese consumers are expected to consume about 3.9 million tons of pork, while domestic production is projected at 3.8 million tons. (Source: TPS)

Dabaco Vietnam Joint Stock Company, established in 1996, is also a large market share holder in livestock farming and food processing, mainly in the pork sector. In the first quarter of this year, Dabaco earned nearly VND 3,750 billion in revenue and over VND 508 billion in after-tax profit, seven times higher than in the first quarter of last year.

The surge in Dabaco’s profit is also explained by the high pork prices, farmers’ confidence in restocking, and the effective control of diseases in livestock and poultry herds.

In the last five years, Dabaco’s average annual revenue has been over VND 10,000 billion. In 2024, revenue exceeded VND 13,000 billion, and after-tax profit was over VND 769 billion. The livestock farming segment has always been the main contributor to the company, with the goal of becoming a leading enterprise in the production of animal feed, livestock and poultry breeding, and food processing.

A familiar name to consumers is the Vietnam Technical Commercial Joint Stock Company (VISSAN), which has been operating since 1974 in the fields of livestock farming, production, and trading of fresh and processed foods, with pork as the main product. VISSAN’s pig slaughter line is considered one of the most modern in Vietnam today.

In recent years, the company has always had revenue of over VND 3,000 billion. In 2024, its net revenue reached over VND 3,180 billion.

In the first quarter of this year, like other enterprises in the pig farming industry, VISSAN also benefited from high pork prices, with revenue of over VND 765 billion.

Pork consumption in 2025 is expected to be about 3.9 million tons. (Photo: Da Ly)

GreenFeed Vietnam Joint Stock Company, established in 2003, is a billion-dollar revenue enterprise specializing in the production of animal feed and the trading of fresh food and processed products.

The G brand for meat and pork products is distributed at large supermarkets and food stores such as Co.op Mart, Bach Hoa Xanh, Tops Market, and Kingfoodmart… and the G Kitchen retail chain, which is well-loved by consumers. In 2024, GreenFeed Vietnam achieved a record after-tax profit of over VND 2,100 billion.

The “Banana-Fed Pork” of Hoang Anh Gia Lai, a new product on the market in 2022, was once sought after by housewives in Ho Chi Minh City. However, unlike other enterprises in the industry that are growing with the business of livestock farming and meat processing, Hoang Anh Gia Lai’s pork products have disappeared after three years of launch, and Bapi Food is no longer a linked company of Hoang Anh Gia Lai.

Nevertheless, Hoang Anh Gia Lai’s banana-fed pork is still being sold on the website heoanchuoihagl.com, which is self-distributed by the enterprise.

Hoang Anh Gia Lai had about 30.8 million pigs in 2024, but the number of pigs of all kinds sold was only 181,400, with a revenue of VND 1,004 billion and a gross profit of VND 86 billion. The decrease in revenue in the livestock farming sector in 2024 was explained by the fact that when pork prices fell in 2023, the company focused its capital on the fruit sector.

This year, the company is promoting the restocking of pigs and developing the pig herd according to the capacity of the modern cage system that has been invested in.