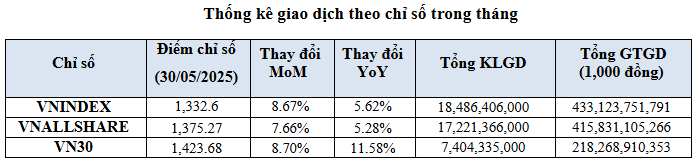

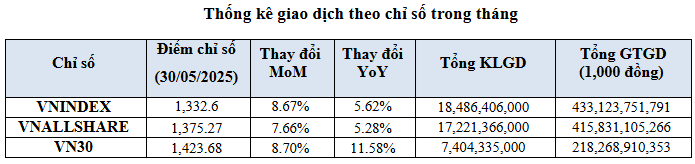

The HOSE witnessed a positive end to the last trading session of May 2025, with the VN-Index reaching 1,332.6 points, VNAllshare at 1,375.27 points, and VN30 at 1,423.68 points, reflecting respective increases of 8.7%, 7.7%, and 8.7%.

Source: HOSE

|

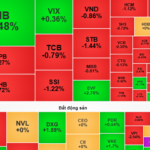

Sectoral indices displayed robust performance, with all sectors, except for essential consumer goods (VNCONS), which witnessed a minor dip of 0.08%, recording gains. Notably, the real estate (VNREAL), industrial (VNIND), and utilities (VNUTI) sectors led the surge with increments of 26.7%, 10%, and 8.5%, respectively.

In the equities market, average daily trading volume surpassed 924 million shares, while average daily trading value exceeded VND 21,656 billion, marking an 8% and 7% decline in volume and value, respectively, compared to the previous month.

Assured warrant (CW) transactions witnessed an average daily trading volume of over 46.55 million CWs and an average daily trading value of nearly VND 46 billion. These figures represent a 20.7% decrease in volume but a 10.6% increase in value compared to April 2025.

Regarding ETF certificates, the average daily trading volume stood at over 2.5 million ETFs, while the average daily trading value exceeded VND 65.9 billion. These metrics reflect a substantial decrease of 44.2% and 38.7% in volume and value, respectively, when compared to the preceding month.

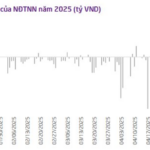

Foreign investors contributed significantly to the market, with a total trading value of over VND 107,176 billion, accounting for 12.4% of the entire market’s trading value. Notably, foreign investors displayed a net buying trend during the month, with a net purchase value of more than VND 476 billion.

As of May 30, HOSE listed and traded 604 securities, encompassing 391 stocks, 4 closed-end fund certificates, 17 ETF certificates, and 192 CWs, resulting in a total volume of over 180.4 billion securities. The market capitalization of stocks on HOSE surpassed VND 5.7 quadrillion, reflecting an 11.8% increase compared to the previous month and representing approximately 49.7% of the 2024 GDP. This market capitalization accounts for over 94.2% of the total market capitalization of listed stocks across all exchanges.

Notably, as of May 30, HOSE featured 43 enterprises with a market capitalization exceeding USD 1 billion, including 3 enterprises with a market cap of over USD 10 billion: Joint Stock Commercial Bank for Foreign Trade of Vietnam (VCB), Vingroup (VIC), and Vinhomes Joint Stock Company (VHM).

– 18:10 06/06/2025

The Foreign Sell-Off Continues: Nearly $20 Million in Outflows and the Stocks Feeling the Heat.

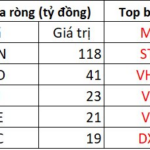

The afternoon session saw a strong net buying trend for MSN across the market, with a total value of 118 billion VND. This significant buying activity indicates a potential shift in market sentiment and highlights the stock’s resilience and appeal to investors. As one of the leading stocks in the industry, MSN’s performance continues to be a key focus for market participants.

The Arrest of VPG’s Leadership Leaves Stock ‘Stranded’

The recent indictment of its leadership has sent shares of Viet Phat Import-Export Trading Investment Joint Stock Company, known as VPG, into a tailspin. Today’s session (June 4th) witnessed a frantic sell-off as investors offloaded their holdings at any price, yet they remained trapped with over 7.6 million VPG shares still on offer at the floor price.

Stock Market Outlook for Tomorrow, June 5-6: The Tug-of-War Continues

The Vietnamese stock market witnessed a volatile session on June 4th, with stocks fluctuating within a narrow range.