The event was graced by the presence of leaders from Thanh Hoa province, representatives from head offices of credit institutions with branches in Thanh Hoa, and over 100 outstanding local businesses.

Mr. Tran The Hung, Director of State Bank – Branch 7, emphasized in his speech that the banking system has always been under the close direction of the State Bank of Vietnam to expand its network and improve its capacity to serve enterprises in the province and the region.

BUSINESSES ARE THIRSTY FOR CAPITAL, BUT BANKS ALSO FACE CHALLENGES

According to a report by State Bank – Branch 7, as of the end of May 2025, the total credit outstanding in the region reached VND 594,798 billion, an increase of 7% compared to the end of 2024. Thanh Hoa province alone accounted for VND 237,767 billion in credit outstanding, a rise of 7.03%. Credit institutions’ capital sources have timely met the capital needs of local people and businesses, contributing to production, business, and economic development.

However, according to assessments from management agencies and feedback from businesses, there are still many difficulties and obstacles in accessing credit sources, especially for small and medium-sized enterprises and those in the fields of production, processing, and manufacturing. Meanwhile, the banking system is facing significant challenges in credit risk control, bad debt treatment, and ensuring safe operations.

There remains a gap and barriers in information, mutual understanding, and approach between banks and businesses.

At the conference, representatives of credit institutions, commercial banks, and enterprises focused on discussing and clarifying bottlenecks in mechanisms, administrative procedures, loan procedures, and credit evaluation methods. Many opinions proposed practical solutions such as simplifying loan procedures, improving credit consulting quality, enhancing information exchange, and making the loan approval process more transparent.

Enterprise representatives also shared the challenges in meeting collateral requirements and presenting feasible production and business plans, as well as the criteria for credit evaluation from banks. Meanwhile, commercial banks affirmed their desire to accompany and support enterprises but needed a solid legal basis to ensure credit safety.

WALKING SIDE BY SIDE TO OVERCOME DIFFICULTIES AND DEVELOP TOGETHER

Mr. Nguyen Van Thi, Vice Chairman of the People’s Committee of Thanh Hoa province, emphasized the conference’s role as a practical dialogue channel to remove capital difficulties for enterprises, thereby promoting the province’s economic growth.

According to Mr. Nguyen Van Thi, the organization of this conference demonstrates the attention and companionship not only of the banking sector in the province but also of the commitment of the provincial authorities to support the business community in overcoming challenges and stabilizing and expanding investment, production, and business activities.

“If the parties continue to maintain their distance, shy away from responsibility, and are slow to innovate, businesses will run out of resources, banks will not be able to develop healthily, and the entire local economy will be severely affected,” he said.

Therefore, he requested that State Bank – Branch 7 proactively grasp and forecast the situation and effectively implement programs to connect banks and enterprises. In addition, it is necessary to research and issue specific solutions to remove obstacles in accessing and absorbing capital for enterprises in the province.

Regarding enterprises, the Vice Chairman of the People’s Committee suggested improving transparency in financial management, completing legal procedures, and proactively building feasible production and business plans. “Enterprises should not just wait for capital but also change their approach to credit, proactively preparing to absorb capital effectively and sustainably,” he added.

ENHANCING THE ROLE OF ENTERPRISE ASSOCIATIONS AS A BRIDGE

At the conference, the leaders of Thanh Hoa province also proposed that the Enterprise Association of the province should further promote its role as a bridge between member enterprises and the government and credit institutions. Through dialogue activities, policy consulting, and information connection, the Association can help enterprises grasp the state’s new credit policies promptly.

In addition, the Association should continue to reflect the difficulties and obstacles of the business community to the competent authorities for timely handling. It can also coordinate with credit institutions to introduce new credit products, support enterprises in building suitable loan procedures, and gradually improve access to capital for production and business activities.

The conference on unblocking capital for businesses in Thanh Hoa was not just a formal meeting but an opportunity for all parties to review the situation, identify challenges, and propose solutions together to build a more open and effective credit environment. This will contribute significantly to achieving the province’s socio-economic development goals in the next phase.

Streamlined Reform Proposal: Slashing Red Tape from 300 to 75 Days to Salvage Social Housing Plans

“The current process of selecting a social housing investor through a tender process takes an average of 300 days, a lengthy and cumbersome procedure. However, with the implementation of proposed reforms, this duration could be significantly reduced to just 75 days. This radical transformation will streamline the process, making it more efficient and accessible for all involved parties.”

A Bold Reform Proposal: Slashing Processing Time from 300 to 75 Days to Revitalize Social Housing Projects

“The current process of selecting a social housing project investor through a tender process takes an average of 300 days, a lengthy and cumbersome procedure. However, with the implementation of proposed reforms, this duration can be significantly reduced to just 75 days. This radical transformation will not only streamline the process but also open up opportunities for efficient and effective project development, ensuring timely delivery of much-needed social housing initiatives.”

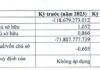

“The Staggering Scale of Bad Debt: Vietnam’s Banking Sector Woes”

As of December 31, 2024, the non-performing loan ratio of the banking system, including potential risk loans, stood at an estimated 5.46%, translating to a total bad debt of VND 1,030 trillion. In the first two months of 2025, the total non-performing loans in the banking system increased by VND 34 trillion to VND 1,064 trillion.