Vietnam Commercial Joint Stock Bank (VAB-UPCoM) announces the trading results of its insiders and related persons.

Previously, Vietnam Investment Group Joint Stock Company registered to sell 17 million VAB shares from May 28, 2025, to June 26, 2025, via matching or negotiated contracts. The purpose of this sale was to adjust the ownership ratio as stipulated by the Law on Credit Institutions of 2024, which states that institutional shareholders must not own more than 10% of a bank’s charter capital.

However, after just three trading sessions from May 28-30, the Group completed the sale of 17 million VAB shares through negotiated contracts, as previously registered.

Following this transaction, Vietnam Investment Group’s ownership in VietABank decreased from 65.9 million shares, or 12.21%, to 48.9 million shares, representing 9.06% of VAB’s capital.

According to HNX data, over three consecutive sessions from May 28 to 30, 2025, VAB shares recorded a total of 17 million shares traded via negotiated contracts – matching the volume sold by Vietnam Investment Group. The total value of these transactions amounted to VND 238 billion, equivalent to VND 14,000 per share.

Vietnam Investment Group is related to Mr. Phuong Thanh Long, Chairman of the Board of Directors, and is the nephew of the Chairman of Vietnam Investment Group.

Previously, VAB announced that it had received notification from HOSE regarding the registration of listing for 539,960,043 shares, corresponding to a charter capital of VND 5,399,600,340,000. These shares are currently traded on the UPCoM exchange.

It is worth noting that 444,963,567 VAB shares were listed on the UPCoM exchange on July 20, 2021, at a price of VND 13,500 per share.

According to the 2024 Annual Report, VAB’s shareholder structure as of December 31, 2025, comprised: 46,999,660 state-owned shares and 492,960,383 shares held by other shareholders.

VAB’s executive team consists of six members, of which only Mr. Tran Tien Dung, Deputy General Director, holds nearly 5.5 million shares, representing 1.01% of VAB’s capital. The remaining five members do not own any VAB shares.

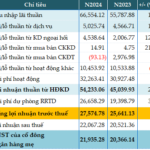

For the first quarter of 2025, VAB reported a standalone after-tax profit of VND 286.12 billion, a 40.77% increase compared to the same period last year. The consolidated after-tax profit reached VND 292.93 billion, a 44.49% year-on-year increase. This improvement was attributed to enhanced service income, contributing positively to the bank’s profitability. By introducing innovations and diversifying products for all customer segments, VAB was able to boost its service income.

The provision for credit risks in the first quarter of 2025 decreased compared to the previous year due to efficient debt handling and continuous improvement in the financial situation of borrowing customers.

As a result of the above factors, the standalone after-tax profit for the first quarter of 2025 increased by VND 82.88 billion, a 40.77% year-on-year rise. The consolidated after-tax profit for the same period increased by VND 90.2 billion, a 44.49% year-on-year increase.

For the year 2025, VietABank aims to achieve a profit of VND 1,306 billion and double its charter capital to over VND 11,500 billion. Despite acknowledging the challenges posed by credit and market risks in a globally uncertain economic environment, the bank’s management proposed a profit plan of VND 1,306 billion, representing a growth of over 20%.

Additionally, VietABank targets to increase its charter capital to VND 11,582 billion, with total assets growing by 7.1% to nearly VND 128,381 billion. Credit growth is expected to reach 10.3%, with outstanding loans amounting to VND 88,110 billion. Customer deposits and issued papers are projected to increase by 9.3% to VND 101,007 billion. The bank aims to maintain its bad debt ratio below 3%.

“Agribank Aims for a 3-5% Rise in Pre-Tax Profits in 2025”

According to the 2024 Annual Report, the Vietnam Bank for Agriculture and Rural Development (Agribank) has set an ambitious target for its 2025 pre-tax profit. The bank aims to achieve a 3-5% increase compared to its 2024 performance and strives to meet or exceed the profit plan approved by the State Bank of Vietnam.

“Vietbank’s Q1 2025 Profit Soars: A Triple-Digit Surge in Core Income”

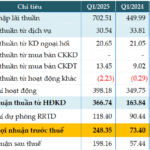

The consolidated financial statements for Q1 2025 reveal that Vietbank (VBB on UPCoM) recorded a remarkable performance with a pre-tax profit of over VND 248 billion, tripling its earnings from the previous year’s first quarter. This impressive growth is primarily attributed to the bank’s core income streams.

The Deputy CEO’s Stock Sell-Off: Unveiling the Mystery

The sale of shares by the Vice President is estimated to reap a whopping 28 billion VND. A substantial sum, indeed, and a testament to the value of the company’s stock.