MARKET REVIEW FOR THE WEEK OF 02-06/06/2025

During the week of 02-06/06/2025, the VN-Index declined, with trading volume surpassing the 20-week average, indicating strong profit-taking sentiment among investors following four consecutive weeks of gains. The Stochastic Oscillator has entered the overbought zone, suggesting an increased risk of a short-term correction if sell signals emerge.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – MACD issued a sell signal

On 06/06/2025, the VN-Index declined and formed a Three Black Candles pattern with increased trading volume compared to the previous session, reflecting a pessimistic investor sentiment.

Additionally, the index is testing the Fibonacci Projection 78.6% level (corresponding to the 1,315-1,330 point range), while the MACD indicator has issued a sell signal. If the situation does not improve and the index falls below this threshold, the outlook will become more pessimistic.

HNX-Index – Stochastic Oscillator issued a sell signal

On 06/06/2025, the HNX-Index declined, ending a four-day winning streak, with trading volume exceeding the 20-day average, indicating a pessimistic investor sentiment.

Furthermore, the index is testing the SMA 200-day level (corresponding to the 226-230 point range) while the Stochastic Oscillator has issued a sell signal after forming a bearish divergence in the overbought zone. If the indicator falls below this zone in the coming sessions and the index fails to hold this support level, the situation will become more pessimistic.

Money Flow Analysis

Smart Money Flow Variation: The Negative Volume Index indicator for the VN-Index has dropped below the EMA 20-day. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will increase.

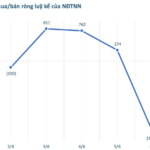

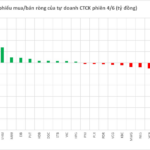

Foreign Money Flow Variation: Foreign investors continued to sell on 06/06/2025. If this trend continues in the coming sessions, the situation will become more pessimistic.

Technical Analysis Department, Vietstock Consulting

– 16:58 08/06/2025

“June Starts With a Bang: Foreign Blocks and a Near 2,000 Billion VND Weekly Selling Spree – What’s the Focus Now?”

The foreign transactions were a notable downside during the week of June 2-6, with significant net selling, especially in the final trading session.

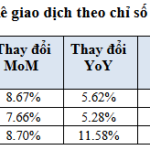

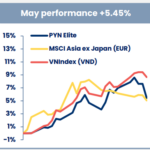

The VN-Index Recovers Its Score, but Liquidity Takes a Dip in May

The VN-Index ended May at 1,332.6 points, an impressive 8.7% increase, but liquidity took a downturn. Volume and value traded decreased by 8% and 7%, respectively, compared to the previous month of April 2025.