As per the current regulations of the 2014 Social Insurance Law, participants in voluntary social insurance are entitled to two benefits: retirement and survivor pensions. However, starting July 1st, with the entry into force of the 2024 Social Insurance Law, participants in voluntary social insurance will enjoy additional benefits.

Regarding retirement pensions: According to the new law, the minimum social insurance contribution period to be eligible for a retirement pension has been reduced from 20 years to 15 years. The retirement pension benefit for participants in voluntary social insurance is similar to that of mandatory social insurance.

Specifically, female workers who have contributed to social insurance for 15 years will receive a retirement pension equal to 45% of the average monthly income on which social insurance contributions were based, while males with 15 years of contributions will receive only 40%. The maximum benefit is 75%.

Retirement pension recipients are also entitled to pension adjustments as decided by the government. In addition to receiving a retirement pension, participants in voluntary social insurance will be provided with a lifetime health insurance card.

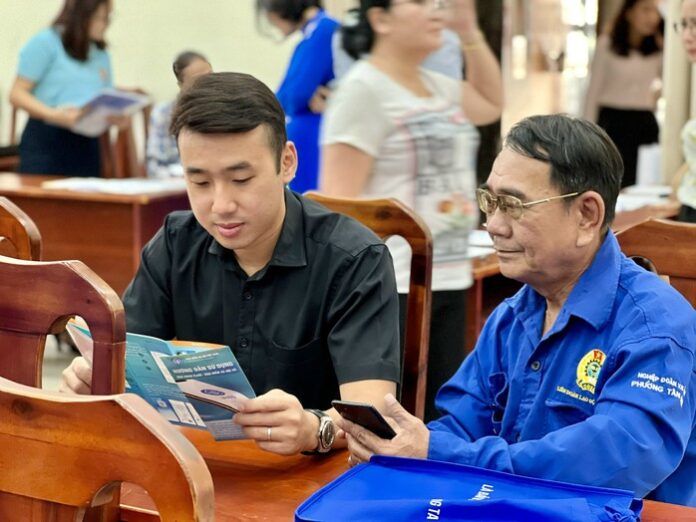

Voluntary social insurance participants will receive additional benefits starting July 1st

Receiving a lump-sum social insurance payment: Participants in voluntary social insurance may receive a lump-sum payment if they meet one of the following conditions: Reaching retirement age but having less than 15 years of social insurance contributions and not continuing to participate in social insurance (in this case, if the participant does not wish to receive a lump-sum payment, they may choose to receive a monthly allowance as stipulated); Emigrating to another country; Suffering from one of the dangerous diseases specified in the Law; Having a reduction in working capacity of 81% or more; Being severely disabled; Having contributed to social insurance before the effective date of the 2024 Law and, after 12 months, not continuing to contribute to social insurance but having less than 20 years of contributions.

Eligibility for maternity benefits: This is one of the notable new features of the 2024 Social Insurance Law. Participants in voluntary social insurance – including both men and women who have contributed to social insurance for at least 6 months in the 12 months before giving birth or adopting a child – will be entitled to a maternity allowance.

Article 95 of the 2024 Social Insurance Law provides detailed regulations on maternity allowances. Accordingly, the maternity allowance is VND 2 million for each child born.