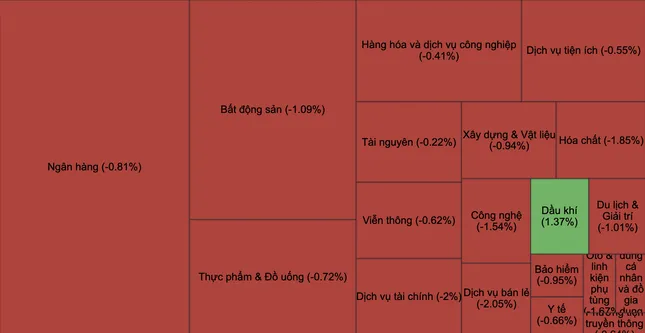

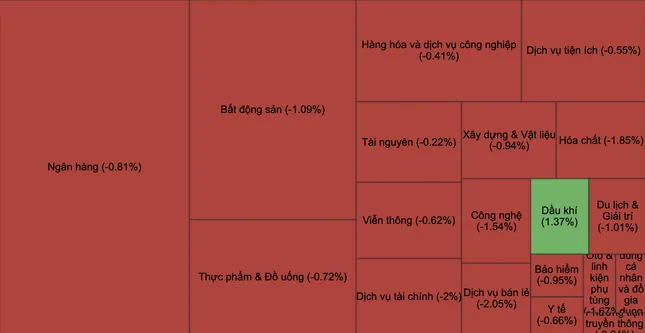

Selling pressure intensified in the afternoon session, causing the VN-Index to plummet and close over 12 points lower. More than 230 stocks on the HoSE were in the red, with most sectors undergoing adjustments. Among the large-cap stocks in the VN30 group, 22 out of 30 stocks declined, with TCB, VIC, GVR, and VHM being the biggest negative influencers on the index.

Sectors with significant influence, such as banking and real estate, faced strong selling pressure. Nearly 20 bank stocks declined, including TCB, VPB, MBB, EIB, MSB, TPB, and CTG, among others.

The market was painted red.

The information technology sector led the decline in the market, mainly due to the performance of FPT (-1.54%), CMG (-1.98%), ITD (-0.36%), and HPT (-3.59%). The number of declining stocks dominated, particularly among large-cap stocks in the real estate and securities sectors. Securities stocks like VND, VIX, SSI, HCM, and VCI also witnessed a decline.

On the bright side, investors shifted their focus to oil and gas stocks in search of profit opportunities. Oil and gas stocks unexpectedly rebounded, with PLX, OIL, PVS, and PVD making gains. On the UPCoM, PXS hit the daily limit-up.

Steel stocks also exhibited positive dynamics. Despite the overall market adjustment, HPG, HSG, and NKG surged, becoming bright spots amid expectations of benefits from public investment policies and the recovering construction steel demand.

At the closing bell, the VN-Index lost 12.2 points (0.91 points) to settle at 1,329 points. The HNX-Index decreased by 2.58 points (1.12%) to 228.61 points, while the UPCoM-Index edged up 0.02 points (0.02%) to 98.89 points.

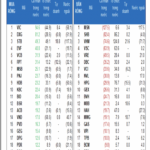

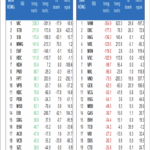

Liquidity climbed, with the trading value on the HoSE surpassing 22,620 billion VND. The maintained trading value indicates that money is not exiting the market but rather shifting towards sectors with better prospects. Foreign investors aggressively net sold, surging to nearly 2,100 billion VND, with notable transactions in VHM (1,579 billion VND).

“Market Meltdown: VN-Index Plunges Below 1330 Points as Investors Bail Out”

Selling pressure soared in the afternoon session, plunging numerous mid and small-cap stocks into the red. While 107 tickers on the HoSE fell by over 1% in the morning, this number skyrocketed to 160 by the closing bell. The drop in the VN-Index fails to convey the full extent of the damage inflicted on individual stocks.

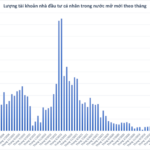

The New Stock Market Boom: Over 10 Million Trading Accounts Nationwide, Surpassing Government Targets

By the end of May, domestic individual investors held over 10 million accounts in total, equivalent to 10% of the population. This surpasses the initial target set for 2025, and the country is now aiming for 11 million accounts by 2030.