In a recent share, Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn in the Southern region, revealed that first-time homebuyers and investors alike can easily be enticed by attractive advertisements promising high profits and prime locations.

However, whether one is purchasing a home or investing, considering the rental yield of a property can help investors make informed decisions, steer clear of speculative waves, and optimize their cash flow.

Mr. Tuan offered six handy tips for investors to consider when deciding whether to buy, sell, or hold a particular asset.

First, rising purchase prices coupled with stagnant rental rates indicate speculation. Mr. Tuan explained that if property prices are soaring while rental rates remain unchanged, it signifies speculative bubble activity rather than intrinsic value. When credit tightens or demand for rentals falls, these markets can quickly deflate.

For instance, in Hanoi during the 2023-2024 period, property sales prices increased by 59% in a year, but rental rates only rose by 4%, resulting in a decline in yield from 4% to 2.6%. In such a scenario, investors should consider selling.

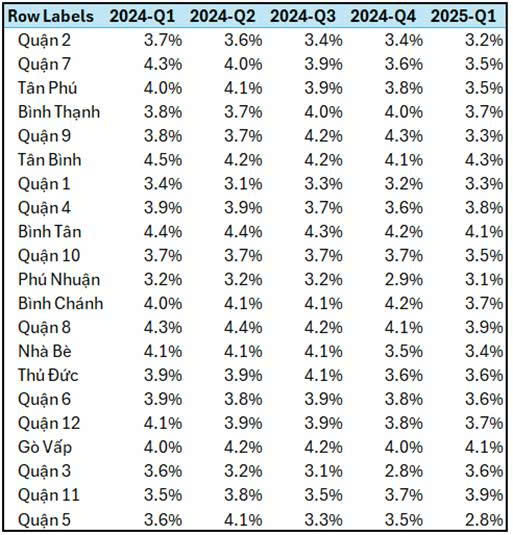

Second, if a project is 3-5 years old and its rental yield is below the market average, it’s time to sell. If a project has been operating for 3-5 years but its rental yield remains lower than the market average (except for large-scale urban areas that require a longer time to mature), it indicates a lack of appeal. The average rental yield in Ho Chi Minh City is 2.8%-3.3%, while in Hanoi, it stands at 2.6%-2.8% (according to Batdongsan.com data from February 2025).

Therefore, for assets with a rental yield of only 2-2.5%/year and an annual price increase of less than 5%, consider selling and depositing your money in a bank.

Rental yield for apartments in Ho Chi Minh City. Source: Batdongsan.com.vn

Third, if the rental yield surpasses the market average, consider buying. According to Mr. Tuan, areas with robust rental demand and higher yields often present long-term investment potential. Especially when selling prices haven’t escalated yet, it’s a golden opportunity to acquire profitable assets. For instance, areas like Phu My Hung, Thao Dien, and Binh Thanh boast high rental yields due to their popularity among foreign experts. Investing in such areas offers both steady cash flow and asset value appreciation over time.

Fourth, beware of high rental rates but low yields. Mr. Tuan pointed out that some apartments command high rental rates, but when calculating the yield, it turns out to be lower than that of other investment avenues.

For example, an apartment in District 1 with a monthly rent of VND 30 million may seem enticing, but if the purchase price is VND 10 billion, the rental yield is only 2.6%/year, which is inefficient compared to other options like shophouses, stocks, savings, or gold.

Fifth, stable rental rate growth over time signifies a worthy investment. A sound real estate investment should not only appreciate in value over time but also exhibit stable rental rate growth. This reflects the market’s genuine demand and the potential for long-term exploitation.

Sixth, expatriates are discerning renters. Mr. Tuan noted that many people assume that building luxury apartments will automatically attract foreign tenants. However, expatriates consider not just the apartment but also the quality of services, amenities, surrounding community, and proximity to their workplace.

In conclusion, to invest successfully, keep in mind these three crucial rules: Sell if the yield is too low and the asset’s value isn’t significantly increasing. Buy if the yield is high, rental demand is strong, and selling prices haven’t skyrocketed yet. Hold on to your investment if the property generates stable cash flow and both rental rates and asset value are growing over time.

Why STown Gateway is the Project Worth Investing in Right Now?

STown Gateway – A prestigious residential project located in the heart of Northeast Ho Chi Minh City is attracting investors’ attention. With its impeccable legal framework, competitive pricing, and strategic location, this development is poised to benefit from the proposed merger of Thuân An City into Ho Chi Minh City. This merger promises substantial price appreciation potential and unlocks a sustainable cash flow stream, making STown Gateway a wise investment choice with promising prospects.

“When Will Hanoi Condo Prices Stop Rising?”

The Hanoi apartment market witnessed an impressive streak of eight consecutive quarters of price increases, with average prices soaring to a remarkable 79 million VND per square meter.