VNDIRECT: Crystal Bay’s Subsidiary Increases Capital Without Bondholder Representative’s Approval

Mr. Nguyen Duc Chi – Chairman of Crystal Bay’s Board of Directors

|

Despite the potential fine for this violation ranging from 50 to 70 million VND, Crystal Bay was given the lowest penalty due to their cooperative attitude and willingness to rectify the situation. Specifically, the Company was considered to have mitigating circumstances such as “sincere remorse” and “active support to authorities during the handling of the violation.”

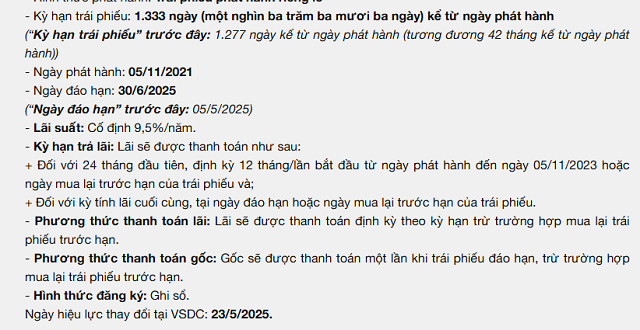

Meanwhile, the company’s bond situation continues to evolve as Crystal Bay has been granted an extension by bondholders to repay the CBGCB2124001 bond series for an additional 56 days, until June 30, 2025. This is the third extension for this debt.

The VND 450 billion bond series was issued on November 5, 2021, with a term of 36 months and a fixed interest rate of 9.5% per annum. When it matured in November 2024, Crystal Bay, facing financial difficulties, was granted an extension by the bondholder representative, most recently until May 5, 2025.

VSDC announces the extension of Crystal Bay’s bond maturity to June 30, 2025. Source: VSDC

|

– 16:44 09/06/2025

“A Securities Firm Suspended from Making Payments and Trading Private Bonds for One Week”

On May 20th, HD Securities JSC (HDS) announced that it had received a decision from the Vietnam Securities Depository and Settlement Corporation (VSDC) and the Vietnam Stock Exchange (VNX) to suspend the company’s settlement operations and activities in the private corporate bond market from May 20th to May 26th.

“VNDIRECT Earns an Impressive A- Credit Rating”

The Vietnam Investment Credit Rating JSC (VIS Rating) has assigned an A- long-term issuer credit rating with a stable outlook to VNDIRECT Securities Corporation (stock code: VND). This inaugural credit rating assessment underscores VNDIRECT’s strong standing and positive trajectory in the eyes of industry evaluators.