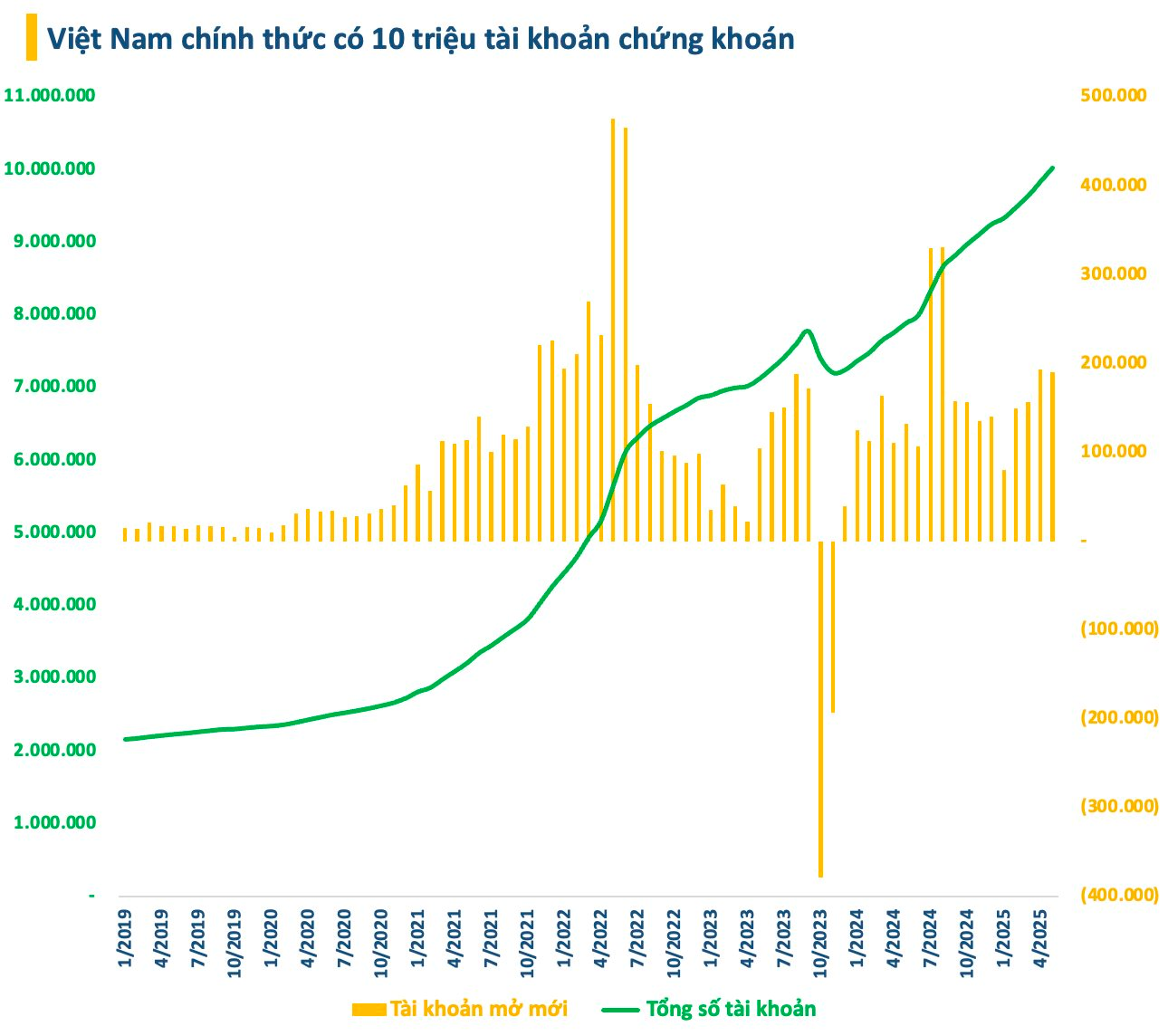

According to data from the Vietnam Securities Depository (VSD), the number of domestic investor accounts increased by nearly 191,000 in May 2025, a slight decrease from the previous month but still a high figure for the past year. The new accounts opened in May belonged primarily to individual investors.

As of the end of May, the total number of domestic individual investor accounts exceeded 10 million, equivalent to 10% of the population, achieving the target set for 2025 ahead of schedule and now aiming for 11 million accounts by 2030.

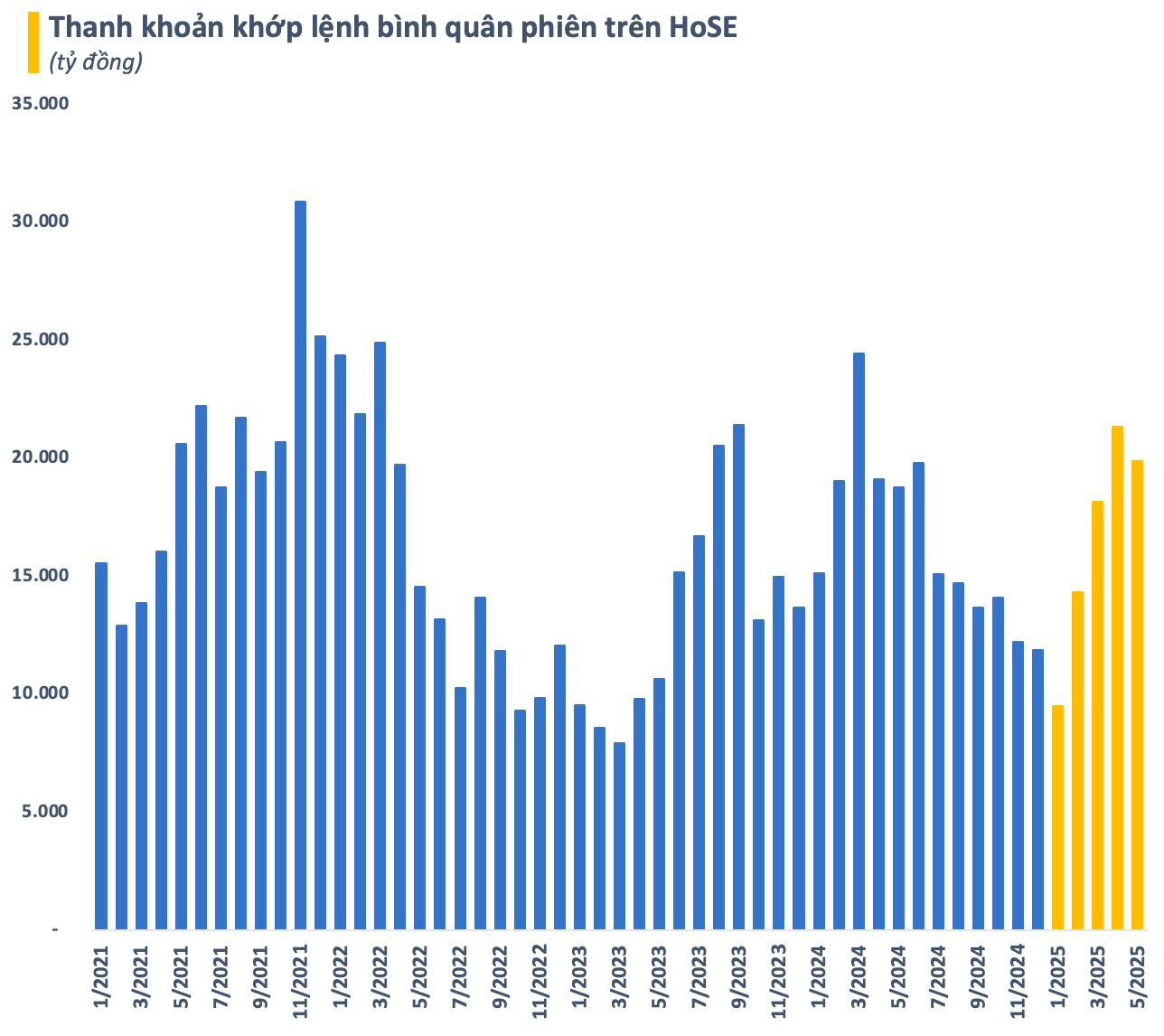

The increase in new account openings comes as the Vietnamese stock market experienced a brilliant May. The VN-Index rose by 106 points (+8.7%), recording the strongest increase since July 2023 in relative terms. Trading was also vibrant, with matching liquidity maintained at a high level, reaching nearly VND 20,000 billion/session.

The progress of tariff negotiations showed positive signals, the new KRX technology system officially operated, attractive market valuation after a deep drop in April, and the “blockbuster” Vinpearl listing relieved the thirst for new goods for the Vietnamese stock market, … were the factors that promoted the market recovery in May.

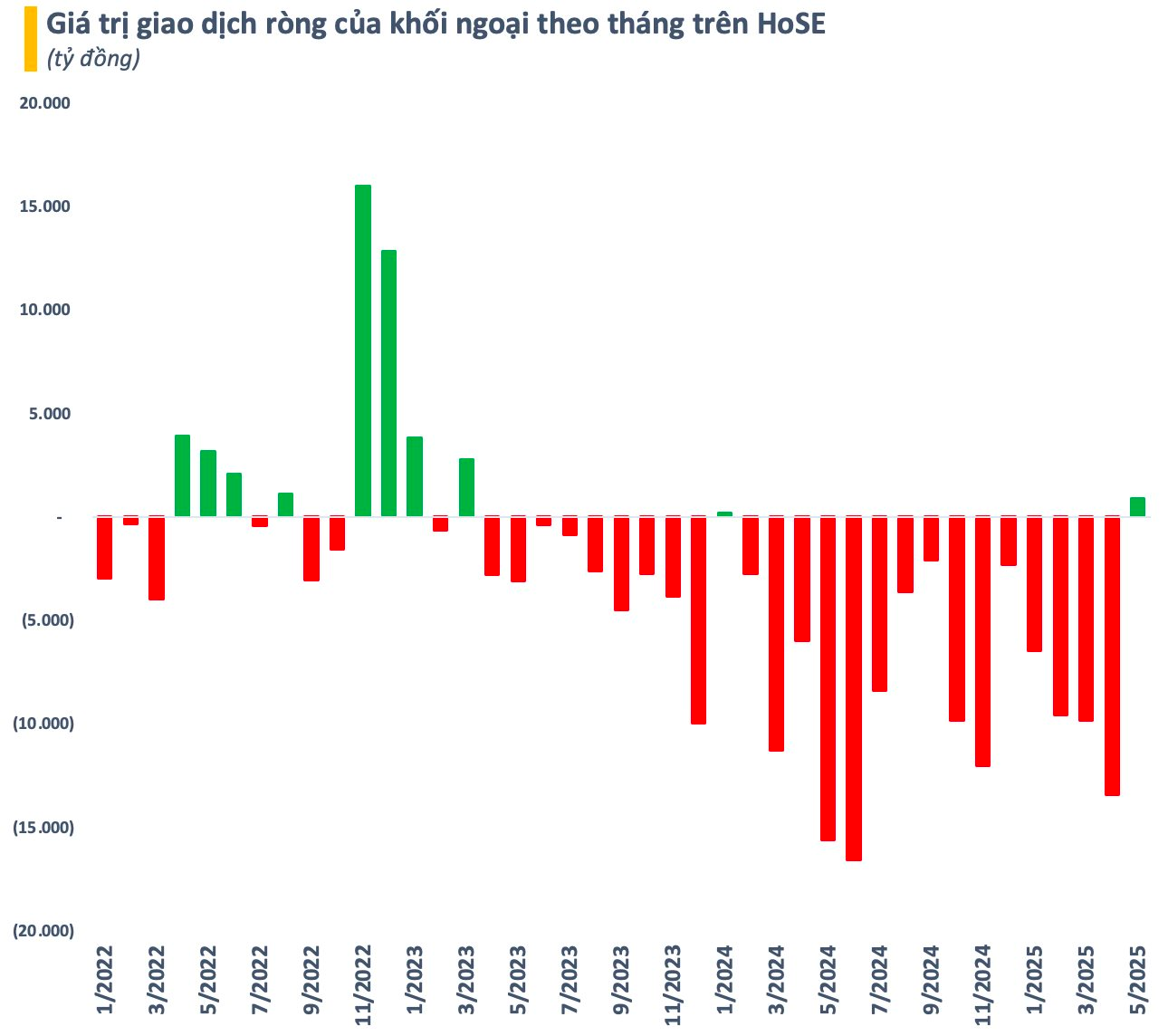

Another factor supporting the market in May was the foreign block’s move to stop selling. Although the net purchase value was not large (nearly VND 900 billion on HoSE), it was still a positive signal, raising expectations that foreign capital would soon return to the Vietnamese stock market after a long period of continuous net selling.

According to many assessments, foreign capital often comes early before the upgrade time about 6-12 months. If the roadmap takes place as expected, Vietnamese stocks can be upgraded by FTSE and MSCI in 2025 and 2026, respectively. Thus, this period can be considered a golden time for foreign capital to catch the upgrade wave.

In fact, the number of foreign investor accounts in Vietnam has increased again after an unexpected drop in the previous month. However, the increase in foreign accounts was mainly from individual investors (up 186 accounts) while institutional accounts decreased by 12 units. As of the end of May, the total number of foreign investor accounts stood at 48,407.

“Market Meltdown: VN-Index Plunges Below 1330 Points as Investors Bail Out”

Selling pressure soared in the afternoon session, plunging numerous mid and small-cap stocks into the red. While 107 tickers on the HoSE fell by over 1% in the morning, this number skyrocketed to 160 by the closing bell. The drop in the VN-Index fails to convey the full extent of the damage inflicted on individual stocks.