|

Hủa Na Hydropower Plant – Illustration

|

Vietnam Installation Corporation – JSC (LILAMA, UPCoM: LLM) has just announced the auction of over 8.72 million HNA shares, equivalent to 3.71% of its charter capital. The sale will take place through a public auction at the Hanoi Stock Exchange (HNX), with a starting price of VND 34,400 per share, corresponding to a minimum transaction value of approximately VND 300 billion.

The auction will be held at 9:00 am on July 3rd. Investors must submit their auction participation forms no later than 4:00 pm on July 1st, and the registration and payment period will be from June 7th to 3:30 pm on June 26th. The minimum number of shares to be registered for purchase is 100 shares, and in multiples of 100 thereafter, except in the case of purchasing all shares.

Previously, LILAMA planned to auction HNA shares at a starting price of VND 33,200 per share, which is 3% lower than the latest adjusted price. However, the Board of Directors has extended the offering period to between 90 and 120 days from the date the public offering certificate takes effect (March 19, 2025). With the latest announcement, the auction process has officially been initiated, with a starting price of VND 34,400 per share, approximately 38% higher than the market price of VND 25,000 per share.

In the stock market, HNA shares once fell sharply to below VND 22,000 per share in early April 2025 – after a period of accumulation from the VND 10,000 per share range in late September 2021 to a historical peak of over VND 27,000 per share in mid-July 2024. In the past year, this stock has been trading around VND 25,000 per share with low liquidity, averaging just over 4,000 shares per day.

| HNA share price movement in the past year |

|

|

Expanding capital divestment from two member companies

Along with the plan to divest from HNA, LILAMA also approved the transfer of all capital from two member companies. Specifically, the company will sell 576,000 shares, equivalent to 60% of the capital at International Consulting Joint Stock Company (LHT) at a price of VND 9,100 per share, and sell 542,750 shares, equivalent to 36.18% of the capital at Mechanical Installation – Electrical Testing Joint Stock Company (EMETC) at a price of VND 81,000 per share. The expected value is over VND 5.2 billion and nearly VND 44 billion, respectively. The divestment is expected to take place in the second quarter of 2025, after approval from the competent authorities. This divestment move is part of LILAMA’s restructuring plan for the 2021-2025 period.

In another development, LILAMA plans to hold its 2025 Annual General Meeting of Shareholders in Hanoi on June 27, presenting the 2024 business results, profit distribution plan, 2025 business plan, and electing an additional member to the Board of Directors for the 2021-2026 term to replace Mr. Le Van Tuan, who resigned on September 16, 2024.

2025 profit target increases by 30%

In 2024, LILAMA expected to pay a cash dividend of 3.5%, equivalent to about VND 28 billion, lower than the 4.5% of the previous year but still higher than the 2020-2022 period. From 2016 to the present, LILAMA has consistently paid dividends, with the highest rate being 6% in 2017.

Regarding the 2025 business plan, consolidated revenue is expected to reach VND 6,145 billion, a slight decrease of 2% compared to 2024. However, profit before tax is expected to increase by 30%, to over VND 107 billion.

| LILAMA’s annual profit |

|

|

In the first quarter of 2025, LILAMA recorded revenue of VND 2,327 billion, up 41% over the same period last year, and achieved 38% of the yearly plan. Profit before tax reached over VND 50 billion, up 42%, and accounted for 47% of the full-year plan. This result was mainly due to reduced management costs and increased other income from provision reversals. Some associated companies also improved their operating performance.

LLM shares are currently in the warning status and are trading around VND 16,800 per share, down 16% in the last quarter but still up 73% in the past year. Average liquidity reached nearly 10,000 shares per day. In early March 2025, the market price of LLM reached its highest level in more than 3 years at nearly VND 23,000 per share, an increase of 217% compared to the bottom of VND 7,000 per share in late October 2023.

| Movement of LLM share price since the beginning of 2025 |

|

|

The Manh

– 2:58 pm, June 9, 2025

The Foreign Sell-Off Continues: Nearly $20 Million in Outflows and the Stocks Feeling the Heat.

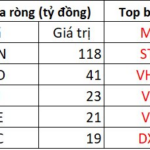

The afternoon session saw a strong net buying trend for MSN across the market, with a total value of 118 billion VND. This significant buying activity indicates a potential shift in market sentiment and highlights the stock’s resilience and appeal to investors. As one of the leading stocks in the industry, MSN’s performance continues to be a key focus for market participants.

The Ultimate Guide to the Perfect Cup of Tea: A Journey through the Historic Mỹ Trà Resort

After more than 12 years on UPCoM, My Tra Tourist will delist from the exchange at the end of June. The MTC stock price has plummeted to just VND 1,900, with no liquidity for months. The company has consistently made losses, experienced a significant decline in personnel, and halted dividend payments since 2019.

“VE9 Surges in Liquidity, Soaring Amidst Major Shareholder Transition”

“VE9 stock soared by over 50% in just one week, with four consecutive ceiling-hitting sessions and a staggering 15-fold increase in trading volume compared to the yearly average. The highlight was on May 28, with a record-breaking trading session of over 5.5 million shares changing hands. This coincided with a major shareholder exiting their entire position and a new investor accumulating nearly 14% of the company’s stock.”

The Ultimate Penmanship: Crafting a Captivating Title

“The Penultimate Stroke: Unveiling the Intricacies of a 17-Million Share Trade”

The Vietnam Investment Group Joint Stock Company intends to sell 17 million VAB shares of VietABank through a matched or negotiated deal. This move is designed to comply with the Law on Credit Institutions 2024, which stipulates that institutional shareholders cannot own more than 10% of a bank’s charter capital.