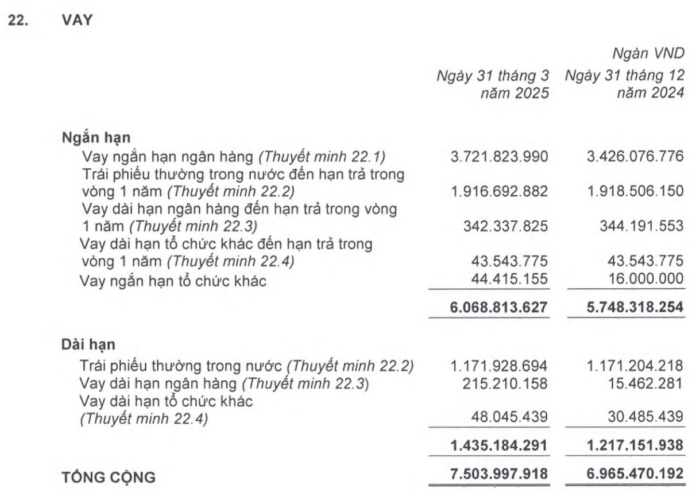

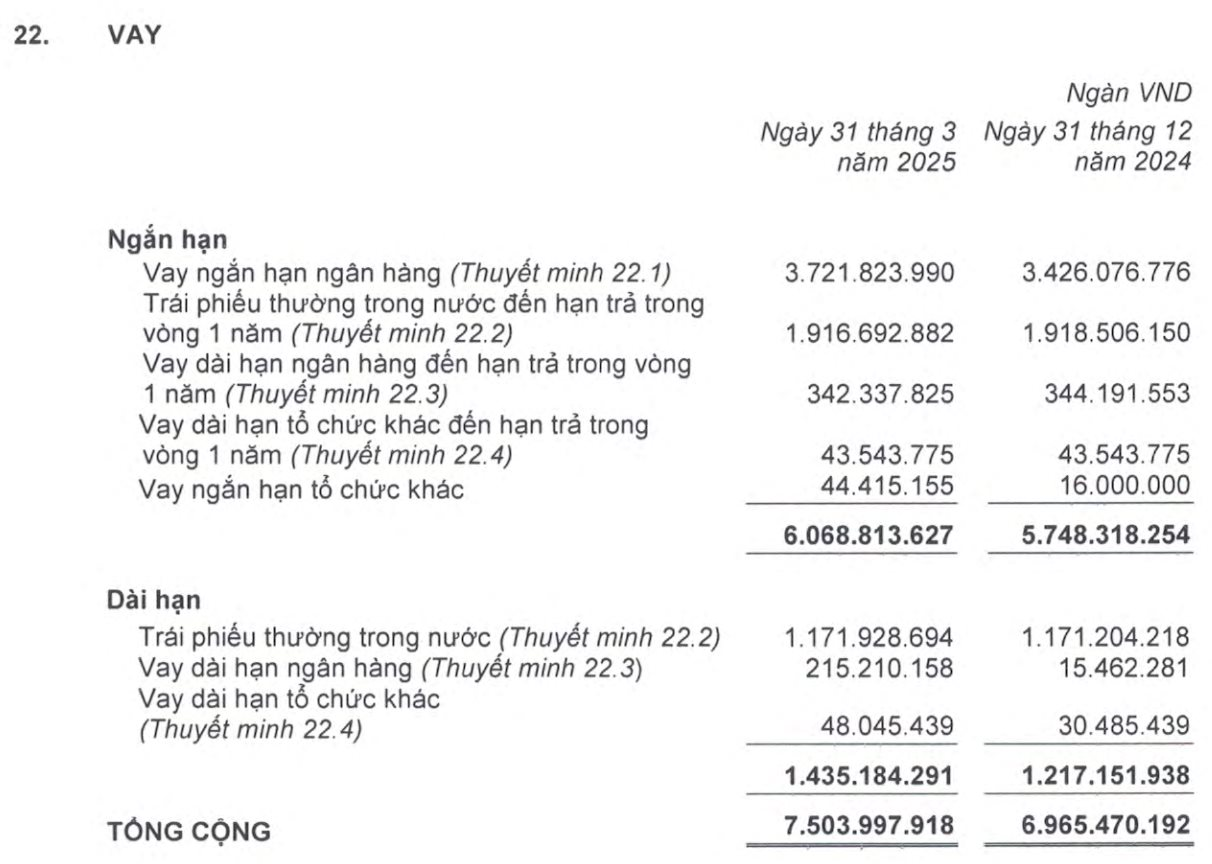

After a decade of striving to pay off debts and clear accumulated losses, Hoang Anh Gia Lai Joint Stock Company (HAGL) has made significant progress. As of the first quarter of 2025, the company has reduced its debt from a peak of VND 28,000 billion in 2016 to just over VND 7,500 billion. Simultaneously, HAGL has transformed its accumulated losses from a peak of VND 6,300 billion in 2020 to only VND 80 billion remaining.

“HAGL has always been associated with debt. Even though we have now stabilized, partners are still hesitant. We have been working hard to reduce debt and clear accumulated losses for nine years, and we are almost there. We have achieved more than 95% of our goal. By the end of this year, HAGL will have an impressive financial statement, and our debt-to-equity ratio or debt-to-total assets ratio will no longer be in the multiples,” said Mr. Duc.

Photo: HAGL has repaid VND 21,000 billion of debt in the past nine years.

Mr. Duc also shared that, for the first time in a decade, he feels confident in encouraging shareholders to hold on to their HAG shares if they can. The company aims to clear all accumulated losses in 2025 and potentially pay dividends afterward.

Issuing 210 million shares for debt conversion, HAGL aims to settle VND 4,000 billion of debt

The meeting approved the proposal to handle bond liabilities to Group B creditors by issuing 210 million shares. The maximum expected debt value for conversion is VND 2,520 billion.

The proposed issuance price is VND 12,000 per share, and the issued shares will be restricted from transfer for one year from the end of the issuance. The company plans to execute this proposal in 2025, pending approval from the State Securities Commission of Vietnam.

Regarding this plan, Mr. Duc shared: “If the meeting approves and the State Securities Commission gives the green light, not only will VND 2,520 billion of debt be converted, but an additional VND 1,500 billion of interest payable by HAGL may also be waived by the creditors.”

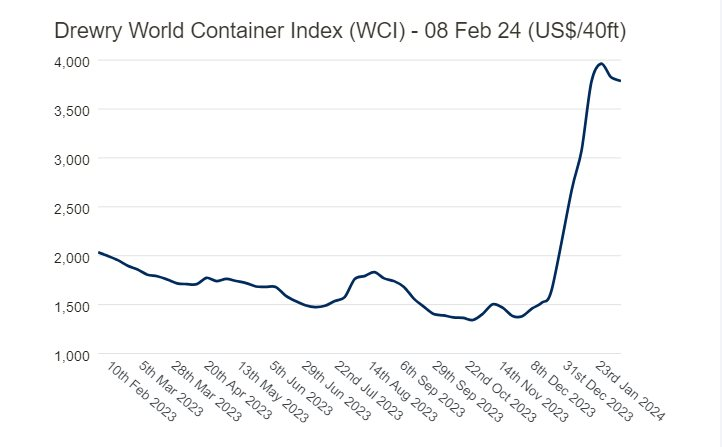

Previously, in the fourth quarter of 2023, HAGL recorded a record profit after tax of nearly VND 1,800 billion for the year, thanks to a waiver of interest payable by Eximbank. The company is currently in negotiations with BIDV for a similar arrangement.

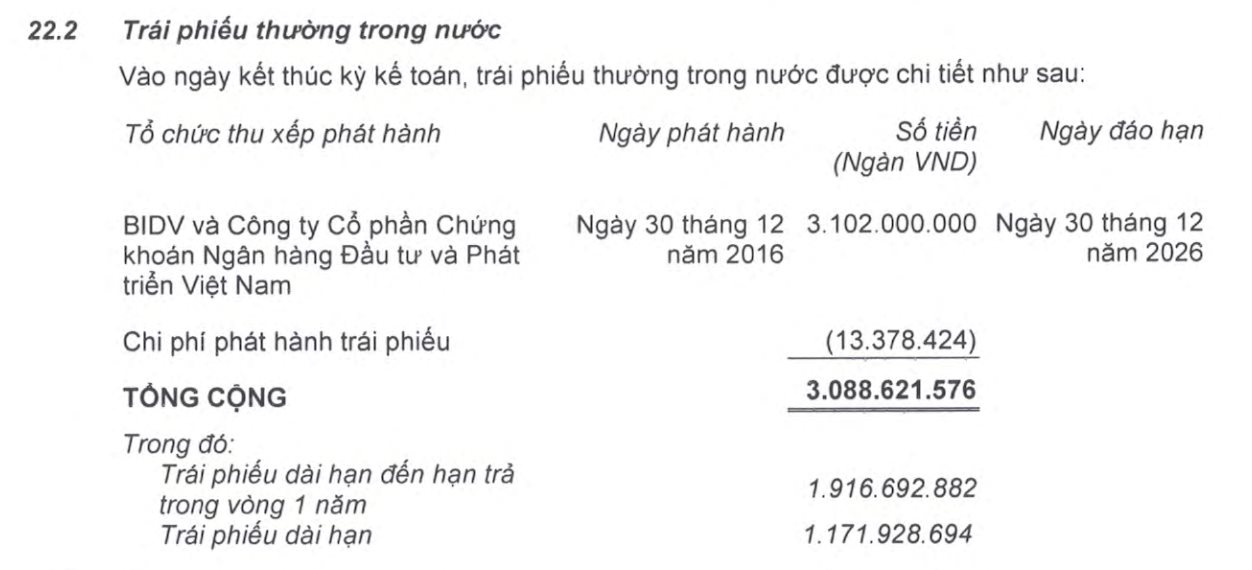

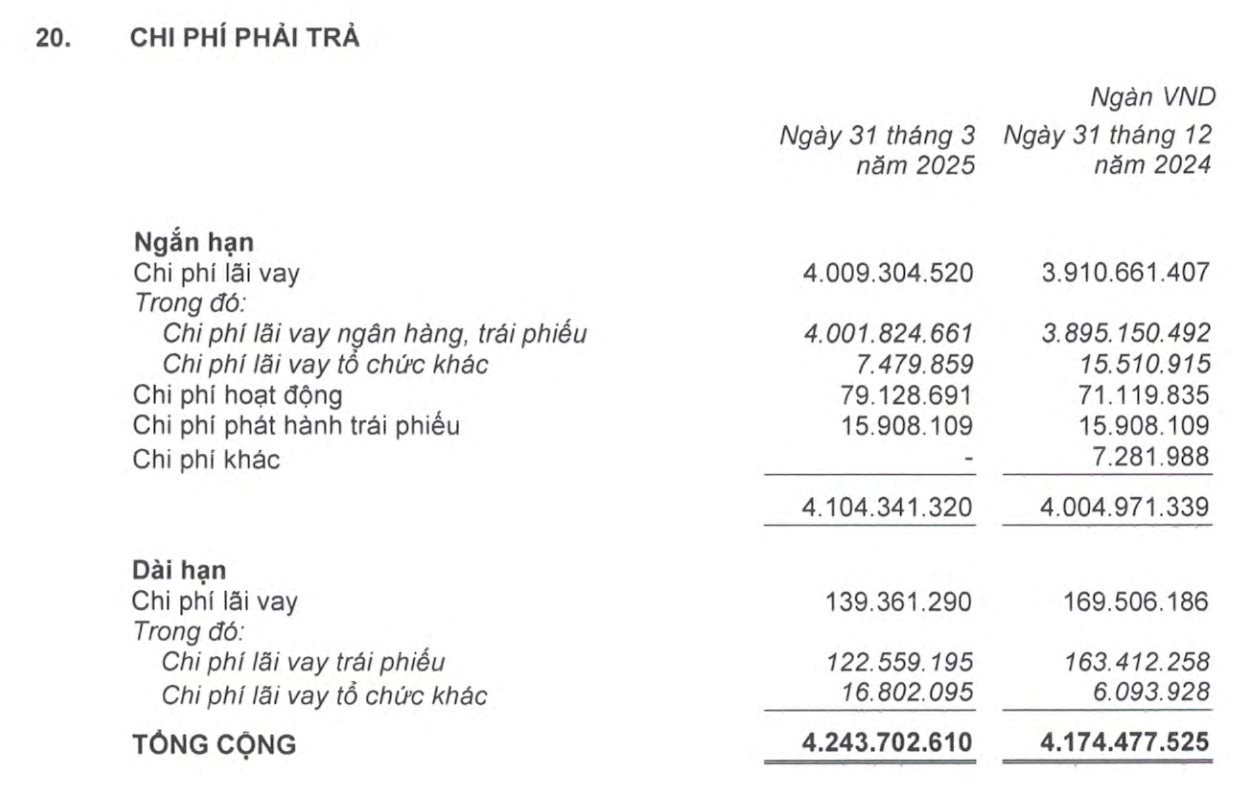

According to the first-quarter 2025 financial statements, HAGL still has VND 3,000 billion in bonds held by BIDV, maturing in late 2026. The company records payables of over VND 4,244 billion, of which over VND 4,223 billion is bond interest payable, mainly to BIDV.

Photo: HAGL owes over VND 3,000 billion in bonds to BIDV.

Photo: Interest expense of over VND 4,200 billion, mainly related to BIDV debt.

Addressing concerns about potential stock dilution from the large issuance, Mr. Duc affirmed that they would find solutions, such as buying treasury stocks.

As a major shareholder, Mr. Duc himself is directly affected but still supports this plan because “debt reduction is the top priority this year.”

Aiming for a profit of VND 5,000 billion by 2028

From this year onwards, HAGL, according to its leader, will return to making three- to five-year plans after a decade of focusing solely on debt repayment: “I set a goal of achieving a profit of VND 5,000 billion after tax by 2028.”

For 2025, HAGL agreed on a target of VND 5,514 billion in revenue, with fruit contributing the largest proportion at 76%, followed by pork at 19%, and the remaining 5% from other goods.

After expenses, HAGL expects a profit after tax of VND 1,114 billion, a 5% increase compared to 2024.

Regarding the fruit segment: HAGL has added strawberries and coffee to its previous model of “two trees and one animal,” transitioning to a new model of “four trees and one animal.” In 2025, the company will invest in 2,000 hectares of strawberries, having already piloted the crop in 2024. Additionally, HAGL is investing in 2,000 hectares of tea coffee.

Simultaneously, the company has 7,000 hectares of bananas and 2,000 hectares of durians (80% in Laos).

Regarding the pork segment: HAGL has established a pig farm system with a capacity of 500,000 pigs. This year, the company will not expand the farm but focus on improving operational efficiency and management.

According to the first-quarter 2025 consolidated financial statements, HAGL recorded revenue of nearly VND 1,379 billion, an 11.2% increase compared to the same period last year. After deducting taxes and fees, the company reported a net profit of over VND 360.4 billion, a 59.2% increase compared to the first quarter of 2024.

“LDG Schedules 3rd Annual General Meeting for 2025”

The LDG Group is pleased to announce that it will be holding its 3rd Annual General Meeting of Shareholders for the year 2025 on June 26, 2025. This important event will be conducted virtually, allowing shareholders to participate and engage with the company’s latest developments from the comfort of their homes.

A Rising Star: Eastspring Vietnam’s Deputy CEO Appointed as Information Disclosure Officer After Just One Month on the Job

Feel free to provide any additional information or further details if you want me to refine or expand upon this title.

On May 27th, Eastspring Investments Fund Management Company Limited (Eastspring Vietnam), a member of Prudential Vietnam Life Insurance, announced the appointment of Mr. Nguyen Quoc Dung as the Authorized Information Disclosure Representative. The decision came shortly after Mr. Dung’s appointment as Deputy General Director on April 28th.

How Profitable is This Enterprise, With State Budget Submissions of 12,300 Billion VND Over Five Months?

As one of the leading state-owned economic groups, we are proud to be at the forefront of ensuring energy security for our nation. With a strong foundation and a dedicated team, we strive to be the pillar of support for the country’s energy needs, now and in the future. Our commitment to excellence and innovation drives us to explore new horizons and secure a sustainable energy landscape for generations to come.