The Vietnamese stock market in the first few months of 2025 has witnessed many ups and downs, reflecting the flexible shift of cash flow and macroeconomic factors. Despite this, the appeal of this investment channel has never waned, evident by the impressive number of over 500,000 new accounts opened in just the first four months of 2025. This shows that even with market adjustments, investors are constantly seeking opportunities to accumulate wealth and increase profits.

In this context, Yuanta Vietnam is proud to introduce the promotional program “Open YSsaving – Receive VND 200,000 ting ting.” This is not just an attractive incentive but also an action that demonstrates Yuanta Vietnam’s commitment to accompanying investors on the path to wealth accumulation and profit optimization, rising above market fluctuations.

THE POWER OF COMPOUND INTEREST: THE SECRET TO WEALTH IN ALL AGES

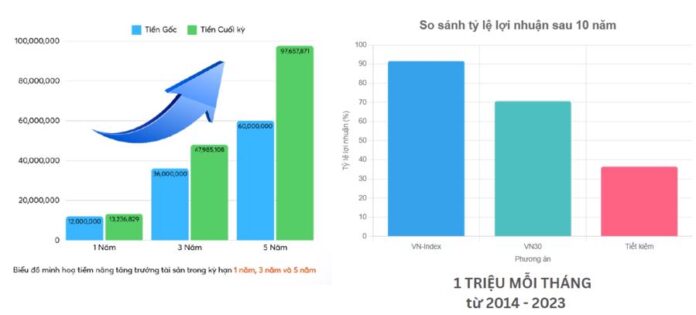

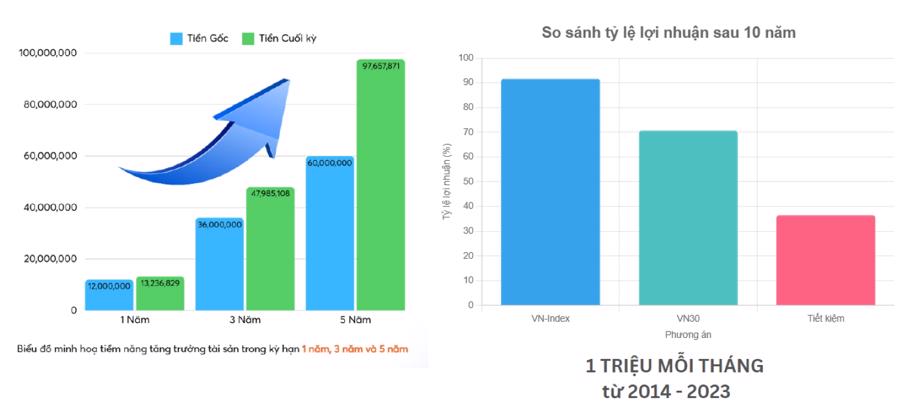

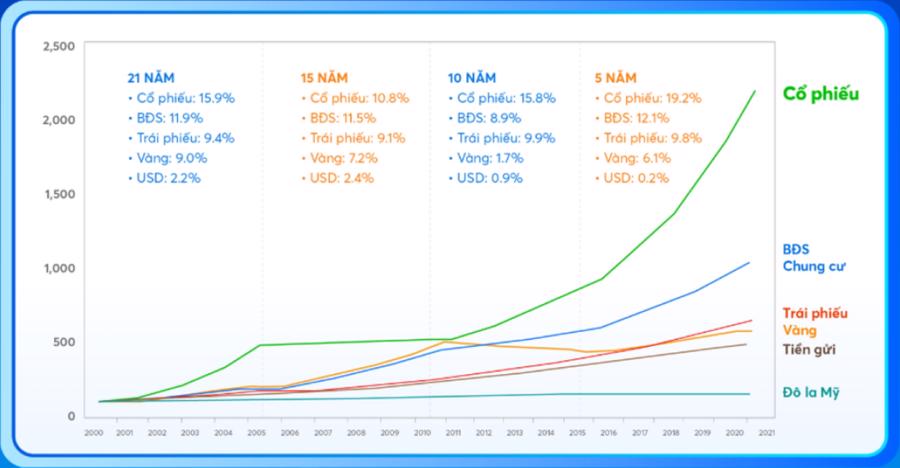

If you’re looking for a tool to continuously grow your assets, compound interest is the secret you need to grasp. Albert Einstein once likened compound interest to “the eighth wonder of the world.” This is because compound interest calculates interest on both the initial principal amount and the accumulated interest, creating a “snowball effect,” where your money grows exponentially over time.

The power of compound interest is especially evident when you have a long-term and consistent investment. It’s not just about “interest bearing interest,” but a smart investment strategy that requires patience and a long-term vision. This is also the philosophy that Yuanta Securities Vietnam wants to convey through YSsaving – a product designed to help investors maximize the benefits of compound interest.

DOLLAR-COST AVERAGING: THE “UNBEATABLE” INVESTMENT METHOD IN ALL MARKET CONDITIONS

In the context of the stock market, which always involves unpredictable fluctuations, choosing a suitable investment method is crucial. The Dollar-Cost Averaging (DCA) method stands out as an effective strategy, helping investors minimize risks and optimize long-term profits.

DCA is a strategy of investing a fixed amount of money in a specific asset (e.g., stocks, ETFs) at regular intervals, regardless of the asset’s price. Instead of trying to time the market by buying at lows and selling at highs, DCA eliminates emotional factors and guesswork. It enables investors to buy more shares when prices are low and fewer shares when prices are high, thus averaging out the cost over time.

YSsaving – a product of Yuanta Securities Vietnam – combines DCA with the power of compound interest, providing the key to building a robust investment portfolio and gradually achieving long-term financial goals.

YSSAVING – A SOLID FOUNDATION FOR SMART INVESTING

With a mission to accompany investors on their wealth accumulation journey, Yuanta Securities Vietnam has developed YSsaving. This is not just an ordinary savings account but a comprehensive financial solution, helping investors maximize compound interest and effectively apply the DCA method.

Especially, from June 1, 2025, to September 30, 2025, there is a promotional program “Open YSsaving – Receive VND 200,000 ting ting” for new customers investing in YSsaving. Accordingly, customers will have the opportunity to receive a bonus of up to VND 200,000 (as per the promotion program regulations) when they register and disburse investments according to the plan (matched order value >= VND 1,000,000/month) continuously for 3 months (recorded transactions until December 31, 2025).

Since its launch, “Open YSsaving – Receive VND 200,000 ting ting” has received great attention and participation from investors in the market. This is because it offers attractive and flexible interest rates, optimizing cash flow and asset management, and promises to accompany the development of Vietnam’s financial market and the prosperity of investors.

The implementation of YSsaving and this promotional program demonstrate Yuanta Vietnam’s vision in providing comprehensive financial solutions, helping customers build a solid financial foundation and confidently seize future investment opportunities. Yuanta Vietnam is not just a place for investors to trade but also a trusted companion on the journey of value creation.

Let’s join Yuanta Vietnam in turning small savings into significant capital and confidently conquering important financial milestones in the future.

Visit the website: uudai.yuanta.com.vn/mo-YSsaving-nhan-tingting-200k

Contact our hotline: (+84) 28 3622 6868.

“Stock Market Outlook: VN-Index Faces Adjustment Pressures for the Week of June 2-6, 2025”

The VN-Index witnessed a significant decline during the week’s final session, bringing an end to its four-week streak of consecutive gains. The index’s repeated tests of the old March 2025 peak (equivalent to the 1,320-1,340 range) indicate a crucial resistance level that the VN-Index must surpass to sustain its upward trajectory. Erratic trading volume fluctuations around the 20-day average reflect investors’ unstable sentiment. Moreover, consistent selling pressure from foreign investors has further intensified the burden on the VN-Index. Should this trend persist, the likelihood of a corrective phase looms large.

The Stock Market Capitalization of Vietnam Surges by Almost VND 1.5 Trillion from Tariff Bottom

The past two months have been a glorious period for the Vietnamese stock market, a period of prosperity not seen in many years.